Tinubu’s Direct Remittance Order: What It Means for Nigeria’s Oil and Gas Industry

Nigeria’s new directive mandating direct remittance of oil revenues signals sweeping reforms, tighter fiscal control, and a potential transformation of transparency, partnerships, and profitability in the petroleum sector.

By Dr Ohio O. Ojeagbase

President Bola Tinubu issued a directive requiring direct oil and gas revenue deposits into the Federation Account. This move stands as a major fiscal shift for Nigeria's petroleum industry. The order stops source deductions and demands retrospective audits of previous collections. It signifies a transition toward financial centralization and transparency. This industry has long dealt with opaque accounting and overlapping institutional roles. The new policy forces structural changes by challenging established revenue practices. Every agency and contractor must recognize government intent to monitor all hydrocarbon income. This action reshapes power dynamics and fiscal discipline within the country's main economic driver.

This policy demands strict compliance from bodies like the Nigerian National Petroleum Company Limited. Regulatory agencies such as the Upstream and Midstream commissions also lose their historical autonomy over revenue. The government now mandates full financial disclosure and weekly reporting to eliminate discretionary spending. This moves these organizations away from quasi-commercial independence toward sovereign control. Investors might view this centralization as a double edged sword. It could improve discipline by stopping leakages while potentially adding bureaucratic delays to operations. The state is clearly asserting its primary right to manage all petroleum cash flows directly.

MORE NEWS:

- President Bola Tinubu Orders Direct Oil Revenue Remittance to Federation Account. What It Means for Nigeria’s Economy and Businesses

- AfCFTA at a Crossroads, Renewed United States and Africa Trade Partnership in a Changing Global Economy

- The Gavel of Uncertainty: How a Broken Judiciary Drives Billions from Nigeria's Economy

- The Currency of Trust in Lagos Markets | Integrity & Business Ethics in Nigeria

The retrospective audit covering funds like gas flare penalties carries significant weight. These reviews examine how agencies applied provisions from the Petroleum Industry Act meant for modernization. The administration is looking at past financial actions to enforce current accountability standards. Discrepancies found during these audits could lead to restitution demands or institutional changes. This establishes a precedent where regulatory compliance covers both future and past activities. The stakes for international and local oil companies have increased because internal reporting must now survive backward looking scrutiny. Compliance is no longer just a goal for new projects.

A specific fiscal philosophy drives this centralized revenue pooling model. The Federation Account Allocation Committee acts as the primary authority for distributing all petroleum income. The government aims for a unified national pool instead of maintaining fragmented funds. Suspending direct deductions ensures oil money follows constitutional paths before being spent on operations. This approach increases legislative oversight and makes distribution to state governments more predictable. This model supports Nigeria's fiscal federalism by potentially reducing revenue disputes between tiers of government. Transparent accounting builds necessary trust among different stakeholders and political regions.

MORE NEWS:

- If You Are Not at the Table, You Are on the Menu, Africa’s Strategic Imperative in the Global Order

- Corporate Governance as a Macroprudential Anchor: Protecting Assembly of Nigeria into the Global Value Chains amid Economic Reforms of 2026

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

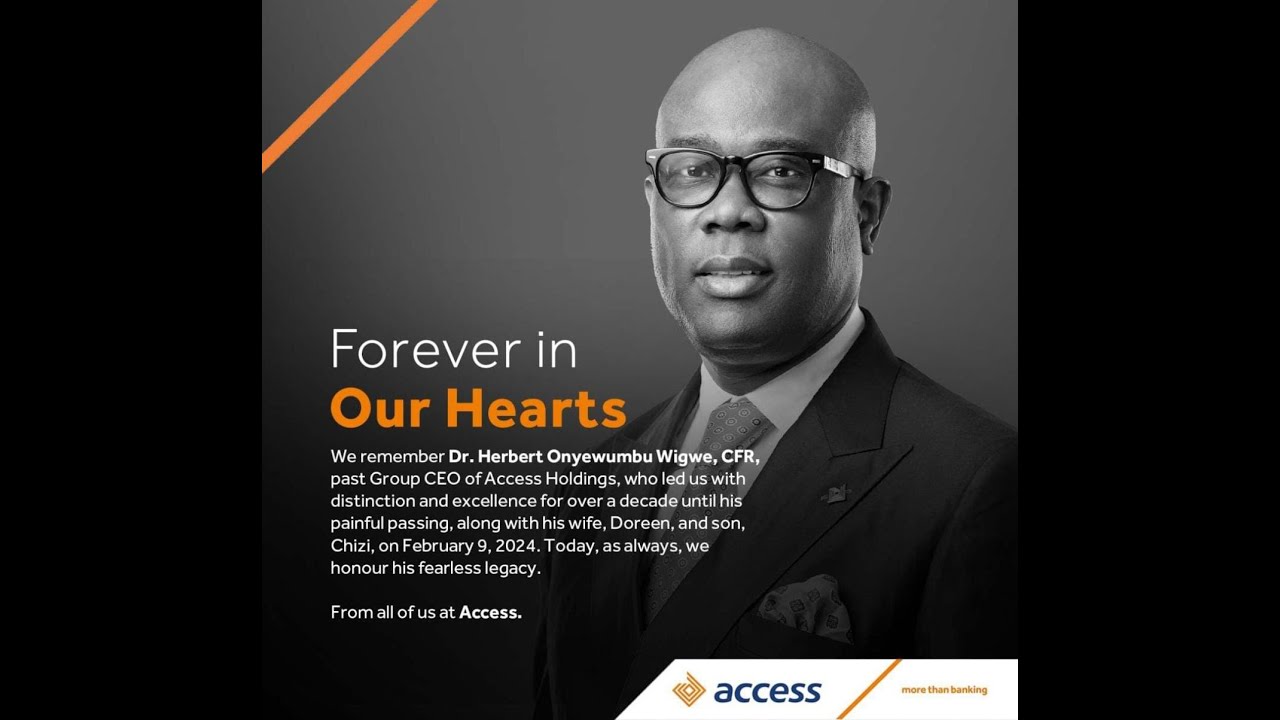

Another major dimension of the news is the renewed strategic alliance between the state oil company and the Dangote Refinery, led by industrialist Aliko Dangote. This partnership signals a complementary trend alongside the government’s tightening fiscal controls: while revenue governance becomes more centralized, commercial operations are becoming more collaborative. The refinery’s 650,000-barrel-per-day capacity positions Nigeria to reduce dependence on imported refined products, potentially transforming it into a regional downstream hub. A stronger partnership could unlock synergies in crude supply agreements, logistics, and trading networks. For the industry, this indicates that regulatory tightening does not necessarily equate to commercial restriction; rather, it may coexist with strategic alliances aimed at maximizing domestic value addition.

National economic experts see this rule shifting fiscal health across Nigeria. Hydrocarbon profits fund most government operations while providing foreign currency. Massive holes and hidden cuts prevent these resources from helping people. Putting funds into specific accounts makes all money visible before anyone spends it. Clear records help pay back debt while making local markets more stable. International observers and lenders prioritize these open accounting methods to judge local leadership quality. Decisions about oil will affect borrowing rates and global business partnerships soon.

New rules create distinct hurdles requiring specific management strategies over time. Strict enforcement remains vital because weak audits and manual tracking allow corruption. Institutions usually holding their own cash will struggle with money flows under new budget cycles. Results depend on how well leaders mix rigid monitoring with smooth internal processes. Successful reform changes the way national petroleum groups handle their primary assets. Bad planning leads to paperwork delays and heavy pushback from state employees. Our current situation marks a massive shift for domestic energy production standards. Students and researchers should notice how transparency defines these new commercial relationships. Leaders decide if they secure the wealth held within these natural resources today. Consistent oversight transforms future budget plans while removing messy spending habits. Direct action fixes broken systems when administrators follow clear financial guidelines without fail. Success shows global investors your commitment to building stronger public institutions through open and honest resource management.

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2026 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?