Non-Performing Loans Are Not Accidents. How Weak Enforcement Is Strangling Nigeria’s Productive Economy

Non-performing loans in Nigeria reflect weak enforcement, poor credit discipline, and regulatory gaps. This analysis explains how lax recovery frameworks damage productivity, capital formation, and economic growth.

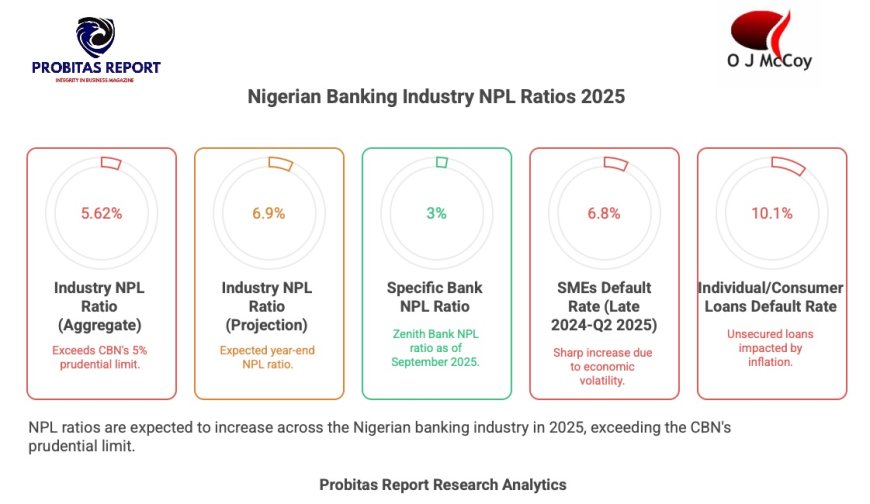

Nigeria's banking sector is bleeding. By 2025, bad loans were rising again, with Central Bank of Nigeria data pointing to growing repayment failures among small enterprises, major firms, and individual borrowers. Public debate quickly turned to inflation, currency pressure, and external disruptions as the usual explanations. But let's cut through the noise. These NPLs aren't random hits from the economy. They're the direct result of weak enforcement that lets borrowers game the system. When defaulters face no real consequences, they treat loans like free money. Honest businesses pay the price through sky-high interest rates and credit droughts. This isn't a finance crisis. It's an enforcement crisis strangling productivity. Today, we'll unpack why, with hard data from recent journals and CBN reports, and show how fixing enforcement could unleash Nigeria's growth engine.

Why Non-Performing Loans Persist Beyond Macroeconomic Shocks

You hear it everywhere: "High inflation and FX swings are killing repayments." Sure, 28% inflation bites. But Nigeria's NPL story runs deeper. A 2025 study in the European Journal of Accounting, Finance and Investment analyzed commercial bank data and found loan defaults explain 74% of profitability drops, even controlling for macro factors. Defaults hurt returns on assets (ROA) directly, regardless of headline inflation. Why? Weak enforcement.

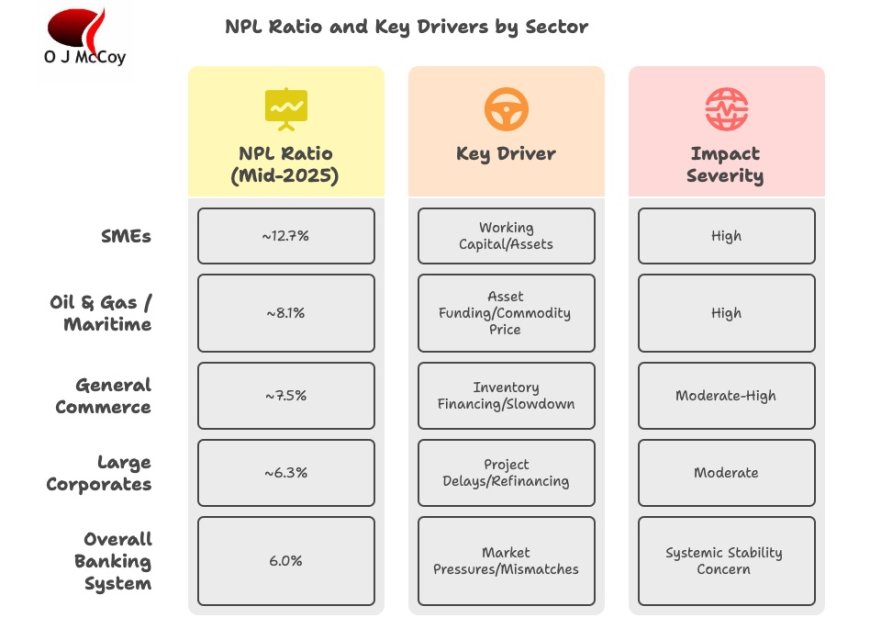

Consider the pattern. CBN's Q2 2025 Credit Conditions Survey shows small businesses topping defaulters, with default indices plunging from 0.5 to -7.2. Large firms and other financial corporations followed in Q1, posting -0.6 scores after prior gains. Lenders report worsening across secured and unsecured loans. Yet credit access improved. Borrowers aren't broke. They're choosing not to pay. Journals like NAU Journal of Commercial and Property Law highlight "unsafe loan practices" and "weak corporate governance" as root causes, not just macro shocks. Insider abuses such as directors grabbing unsecured loans beyond limits persist because prosecutions are rare and in most cases not reported. AMCON's struggles prove it: despite billions injected post-2009, legal disputes and lax laws let NPLs fester. Enforcement gaps, not economics alone, keep NPLs alive till date.

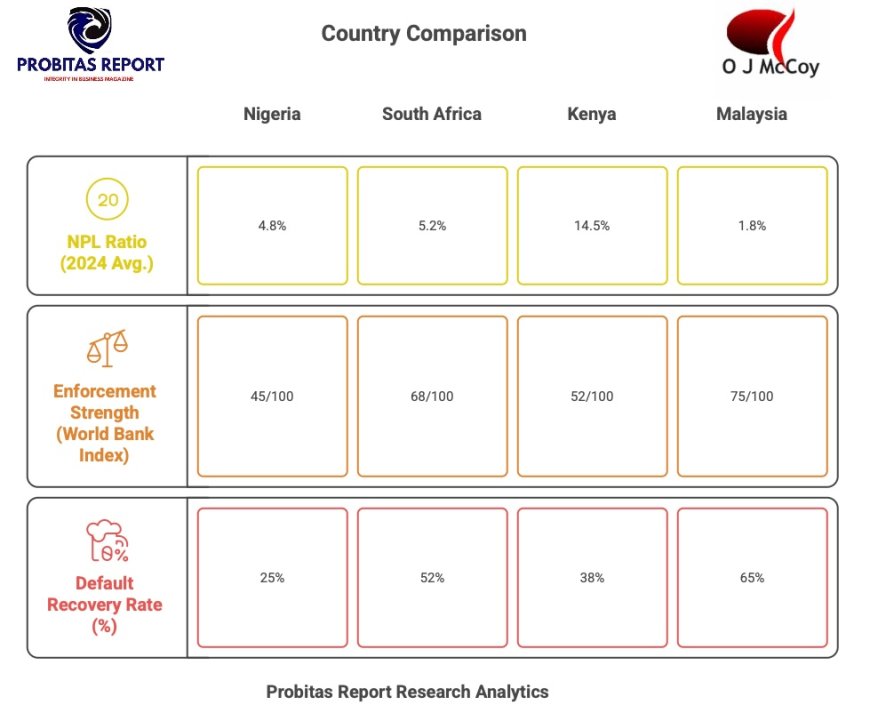

This table, drawn from World Bank Doing Business data and CBN stats, shows enforcement drives outcomes. Malaysia's tough laws cap NPLs low; Nigeria's leniency mirrors higher persistence. Weak rules signal: default with impunity.

The Productivity Cost of Weak Credit Enforcement

Banks tighten lending after defaults, pushing rates above 30 percent and demanding heavy collateral, which starves SMEs that employ 84 percent of workers and contribute 50 percent of GDP; CBN data shows private credit fell in Q1-Q2 2025, leaving a 3.5 trillion Naira gap as lenders favor secured corporate loans, while unsecured small business loans decline, and high policy rates plus risk aversion drive banks to buy Treasury Bills instead of funding productive loans. Defaults block growth, halt infrastructure, inflate costs to households, and force honest firms to subsidize defaulters, whilst less than 5 percent of SME loans reach intended recipients, creating cycles of scarcity and stagnation. Enforcement gaps make credit unpredictable, but strong rules and accountability could restore capital flow and resume growth.

How Serial Default Becomes a Business Strategy

Here's the ugly truth: serial default pays when consequences are soft. Borrowers spot the pattern then apply via proxies, divert funds, issue dud cheques, vanish. CBN data shows repeat offenders gaming BVN gaps pre-2015, now evolving to fintech laundering. NAU Journal calls out "reckless granting without security," but borrowers exploit it rationally. Why repay when restructuring offers haircuts?

Large PNFCs defaulted more in Q1 2025, per Channels TV. They roll bad loans via evergreening, hiding NPLs. Moral hazard thrives: indiscipline wins. A LinkedIn legal analysis flags dud cheque issuers facing civil suits but rare jail time. Enforcement leniency makes default a strategy and cheaper than repayment which s wickednes to the lenders. Youth sell BVNs for scam rings, per EFCC busts. This isn't accident. It's calculated, enabled by gaps.

READ MORE:

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

Dishonoured Cheques and the Collapse of Commercial Trust

Nigeria’s Dishonoured Cheques Act imposes up to two years imprisonment for issuing cheques without sufficient funds, with courts enforcing jail terms consistently as in Abubakar v. FRN (2022). The Central Bank of Nigeria’s November 2025 guidelines target serial offenders, triggering blacklisting, credit bans, and fines from 1 to 5 million naira, while banks report dishonours within 48 hours and retain copies for five years. Lawmakers’ repeal talks risk weakening deterrence, yet serial offenders still evade detection by opening new accounts and bypassing Credit Risk Management System checks.

The economic costs are severe: frozen accounts, blacklists, lawsuits, reputational damage, and EFCC probes. Cheque volumes reached 5.15 trillion naira in Q1 2025, rising 51 percent, showing trust erosion as suppliers demand cash, small traders close, and commercial discipline collapses. Dud cheques signal broader non-performing loan risks, highlighting enforcement gaps. Effective recovery requires upfront checks, application of the Act, CBN bans, fast-track courts, hourly reporting, and asset tracing, which together reduce volumes, rebuild trust, and restore credit circulation. Linking cheque dishonours to loan risk in the Credit Risk Management System ensures serial defaulters face investigation, enforcement, and accountability, strengthening Nigeria’s financial system.

Why Restructuring Without Accountability Fails

Restructuring sounds smart: extend terms, cut rates, forgive principal. But without teeth, it fails. AMCON's model, per NAU Journal, drowns in legal fights and lax laws. Malaysia succeeds via swift ADR and strict recovery—Nigeria lags. CBN's finance company guidelines cap NPLs at 10%, but breaches bring slaps, not hammers.

Post-2009 cleanup dropped NPLs to 5%, then they rebounded. Why? No personal accountability. Directors walk; banks eat losses. International Journal of Economics and Financial Issues notes weak risk frameworks undermine reforms. Restructuring rewards defaulters, teaching: delay pays. Without deterrence, cycles repeat

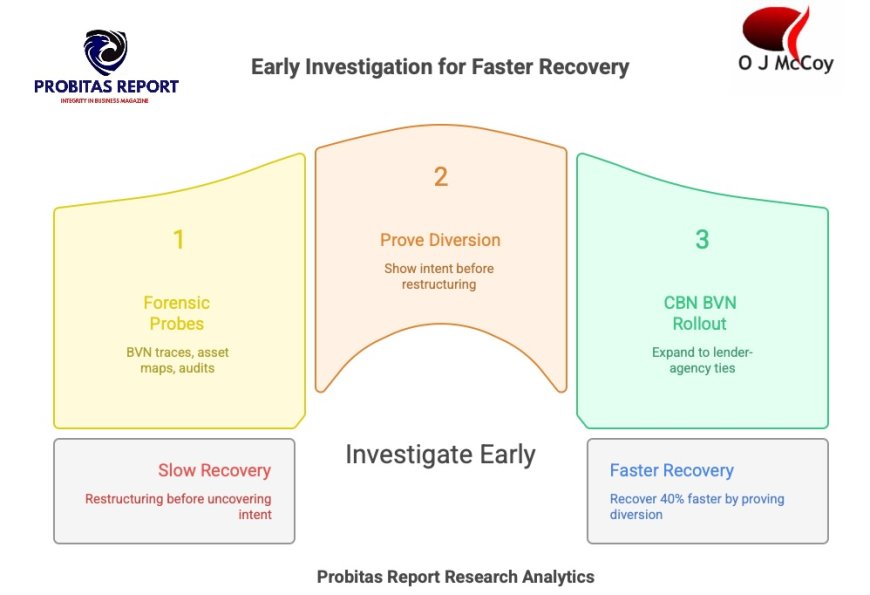

Early Investigation as a Superior Recovery Model

Flip the script: investigate early. Forensic probes - BVN traces, asset maps, cash flow audits to uncover intent before restructuring. KREENO-style agencies recover 40% faster by proving diversion. CBN's BVN rollout cut evasion; expand to mandatory lender-agency ties.

Journals advocate: EJAFI urges supervisor capacity-building over post-hoc fixes. Early action deters, recovers principal, restores capital faster. Malaysia's model blends investigation with ADR 90% resolution pre-court. Nigeria's EFCC-CBN links work for fraud; scale to willful defaults. Cost-benefit: ₦1 in probes yields ₦4+ recovered versus endless AMCON bailouts.

Closing the Enforcement Gap in Nigeria’s Credit System

Policy gaps scream reform. CBN regulates lending; criminal law lags deterrence. No unified willful default statute. BVN blacklists exist, but access is spotty. Compare Africa: Kenya's 38% recovery via credit bureaus; South Africa's 52% from swift courts which Nigeria can adopt moving forward due to the many dishonored cheques cases and unpaid debts piling up across EFCC and PSFU offices in Nigeria.

Nigeria needs: criminalize proven intent (diversion >₦50m: 5-10 years); public CRC records barring re-borrowing 7 years; lender-agency mandates. 2025 tax reforms tax defaults six years back. Align judiciary: fast-track dud cheque/NPL courts. CBN's cheque ban is a start but can be extended.

From Leniency to Accountability: Rebuilding Trust in Nigerian Finance

Nigeria's credit crisis ends with enforcement muscle. Serial defaulters thrive on leniency; kill it, and capital flows to producers. SMEs build factories. Manufacturers hire. Infrastructure rises. GDP accelerates past 3%.

Policymakers: embed accountability in CBN Act amendments. Lenders: partner investigators early. Leaders: champion integrity in business culture. Enforcement isn't punishment. It's liberation for the productive economy. Weak rules strangle growth. Strong ones unleash it. Time to choose and enact laws to defend the lenders.

Kreeno Consortium strengthens Nigeria’s financial system by combining credit discipline, forensic debt recovery, and asset tracing to prevent non-performing loans. It supports banks, MFIs, cooperatives, corporates, and institutional lenders facing serial defaults. Kreeno’s model emphasizes evidence-based, lawful enforcement and early intervention to restore trapped capital and protect commercial relationships. The firm also conducts credit integrity audits and borrower risk profiling. Its debt recovery playbook reduces lender losses whilst reinforcing market trust.

Organizations seeking structured debt recovery and private investigation services can contact Kreeno Consortium at 0902 148 8737 or Prof. Prisca Ndu at priscan@kreenoholdings.com

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

What's Your Reaction?