More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria

Issuing a bounced cheque in Nigeria goes far beyond owing money. It can lead to criminal prosecution, reputational damage, and financial restrictions under the Dishonoured Cheques (Offences) Act. Learn the five hidden consequences every business owner and borrower should know.

“Beyond the Debt: Five Legal and Financial Fallout Risks of a Bounced Cheque in Nigeria”

You meant to pay. You thought the money would be there. But now, that cheque you issued has bounced. Your phone is ringing, and the embarrassment is real. You think, "No problem, I'll just pay the debt when I can." Right?

Wrong.

In Nigeria, a dishonoured cheque is so much more than an IOU. It's a legal tripwire that can set off a chain reaction, turning a simple financial hiccup into a life-altering crisis. While everyone focuses on the debt, the real dangers are the hidden consequences that can haunt you long after the money is repaid.

This isn't just about banking or lending; it's about your freedom, your reputation, and your future.

Why Bounced Cheques Are a Global Financial Crime

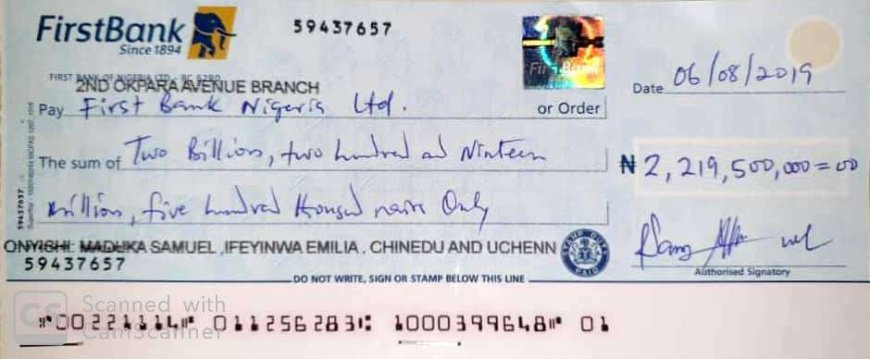

Do you think that bounced cheques only occur in Nigeria? Think again. Issuing a cheque you know will bounce is considered cheque fraud, a form of financial crime taken seriously worldwide. From the UAE to India, governments enact strict laws to maintain trust in the financial system. Nigeria's approach, governed by the Dishonoured Cheques (Offences) Act, is one of the most stringent, designed to be a powerful deterrent in a rapidly growing economy, that is now transitioning from a cash based economy into a credit-based economy and this article is a must read for everyone. A cheque is said to be ‘’Dud’’ when after being presented for payment, it is returned unpaid, on the grounds that there is insufficient funds standing to the credit of the drawer, meaning that the issuer of the cheque has not funded their account adequately to meet that obligation.

"In my decades of debt recovery, private investigation, nurturing entrepreneurs and turning around businesses in Nigeria, I have observed a critical, often fatal, mistake: the casual treatment of a cheque as a mere payment instrument rather than a binding covenant of one's personal integrity. Many businesspeople see a dishonoured cheque as a simple cash flow problem, but I see it as a catastrophic failure of corporate governance and personal brand management. The Dishonoured Cheques (Offences) Act is not a paper tiger; it is a legislative scalpel that dissects the facade of a business to reveal the character of its leaders. When a director is jailed, as we have seen in the Monsour v. FRN case, it is not just a legal penalty, it is the market's most brutal verdict on unreliability. The true cost is not the debt, but the irreversible erosion of trust with banks, church colleagues, partners, and the market itself. My counsel is non-negotiable: your reputation is your most valuable asset. Protect it with your life. Never issue a cheque unless the funds are cleared, certain, and committed solely for that purpose.

Honor loan agreement with your blood and secure the debts. In the architecture of a successful enterprise, financial discipline is the strongest pillar, and a clean cheque book is its most visible foundation."... Says Dr. Ohio O. Ojeagbase Founder / Chief Private Investigator General of KREENO CONSORTIUM

- OTL 2025: Oyebanji Says Deregulation Sparks Renewed Focus on Infrastructure and Long-Term Growth in Downstream Sector

- OTL Platform Has Played A Crucial Role In Shaping Agenda For Downstream Development Across Africa- Sanwo-Olu

- Tinubu Reaffirms Support for Dangote Refinery Expansion, Calls on Africa to Harness $120B Oil Market

- OTL 2025: Africa’s Downstream Energy Leaders Unite to Drive Market Innovation and Strategic Investment

- OTL Africa Downstream Energy Week 2025 in Lagos: Driving Africa’s Downstream Transformation

The 5 Hidden Consequences of Dud Cheques You Never Saw Coming

1. You Become a Criminal, Not Just a Debtor

This is the biggest shock for most people. That bounced cheque action between you and the payee is not a civil matter—it is a crime matter between you and the State. Cheques are legal tenders, and acceptable means of trade exchange for products and services, that is highly relevant in conducting business transactions for the payment of these products and services.

Under the Dishonoured Cheques (Offences) Act, you can face up to two years in prison, and the courts have shown they are not afraid to enforce this. In the landmark case of Abubakar v. FRN (2022), the Chief Executive Officer of a company saw his two-year prison sentence upheld by the Court of Appeal. There was no option for a fine. Just prison.

The myth that you can just talk your way out of it is a dangerous fantasy. The law is clear, and it is harsh. The issuance of dud cheques undermine trusts in the financial system. The legal consequences arising from this is to protect the integrity of financial transactions and guarantee users that the promise of payment which a cheque instrument carries, can be relied upon. Outside of these legal consequences, you also have the potential destruction of the reputation of both the directors of the company and the company itself, thus destroying long standing business relationships. Trust once lost, is much more difficult to regain.

2. Your Freedom to Travel Can Vanish Overnight

A criminal charge doesn't just mean court appearances. It can mean being placed on a watchlist with the police or the EFCC. Suddenly, that business trip to Ghana, United States of America, or Maldives family vacation you planned is impossible. You could be stopped at the airport, turned back, and find your mobility severely restricted, all as a result of a single cheque instrument, issued, probably not in bad faith, as it may be in expectation of inflows that ended up not coming in or is delayed. This collateral damage begins long before any conviction of crime is established, thus, turning your life upside down and bringing your personality to disrepute.

3. The Company Shield Won't Protect You

"If the company issued the cheque, the company is liable, not me." This is perhaps the most costly misconception for business owners.

The law explicitly allows for "piercing the corporate veil." This means that directors, managers, and officers who authorized or knew about the cheque can be personally prosecuted. In Nahel Bernard Monsour v. FRN (2025), the CEO was sentenced to two years in prison personally, for cheques issued by his company. Your incorporation certificate is not a get-out-of-jail-free card. That is why most directors go the extra mile to insure themselves against actions taken by the corporation, where they are not directly involved. So for all those who are quick to accept positions on boards, ensure that you are insured against actions taken by the corporate body, as this has saved a few people from consequences of actions taken by the company, which they knew nothing about or were not directly involved in.

4. You Face Two Legal Wars at Once

Imagine being sued in civil court to recover the debt and simultaneously fighting for your freedom in criminal court. This is the reality for issuers of dishonoured cheques. It is your responsibility as the cheque issuer, to ensure that your account is adequately funded on that date the cheque instrument is to be drawn. A lot of people take this for granted, as they make up lame excuses to justify why the cheque returned unpaid.

The payee is entitled to pursue both paths of justice at the same time. So, while a judge is ordering the seizure of your assets to pay the debt, another judge could be sending you to prison for issuing the cheque in the first place. It's a legal double-whammy that drains your finances and your spirit, at the same time destroying your reputation and credibility, and preventing you from being able to run a bank account for many years.

5. Your Financial Reputation Is Permanently Scarred

This is the silent, long-term consequence of dud cheque issuance. Even if you avoid prison, you may never escape the stain on your financial reputation.

● Banking Blacklist: Banks share information. You could find yourself unable to get a loan, a mortgage, or even open a simple current account for years.

● Credit Catastrophe: With the rise of credit bureaus in Nigeria, a record of financial misconduct can decimate your credit score, making you a pariah in the formal financial system.

● Business Isolation: Who wants to do business with someone known for issuing "dud cheques"? Rebuilding a damaged reputation is far more difficult as history does not forget.

From Business Setback to Legal Nightmare: How a Simple Cheque Can Ruin Your Reputation

It starts as a tool for convenience. It ends as an instrument of reputational destruction. The journey from a trusted businessperson to a named defendant in a criminal case is a swift and brutal fall. In a business culture built on relationships and trust, being known as someone who issues bad cheques is a "reputational death penalty." It closes more doors than any single debt ever could.

The Cost of Ignoring Financial Laws in Emerging Markets

Nigeria's strict approach isn't arbitrary. In a dynamic emerging market, robust financial laws are the bedrock of economic growth and foreign investment. The Dishonoured Cheques (Offences) Act sends a clear message: Nigeria takes financial commitments seriously. For the system to function, there must be consequences for those who undermine its integrity. Ignoring these laws isn't just a personal risk; it's a gamble with a system designed to punish non-compliance severely.

Beyond Punishment: How to Restore Financial Credibility after a Bounced Cheque

If you are facing this situation, all hope is not lost. The path to recovery is steep but navigable.

1. Face It Immediately: Do not ignore the demand letter or court summons. Procrastination is your worst enemy.

2. Seek Expert Legal Counsel: This is not a Do it Yourself, “DIY” situation. You need a lawyer experienced in both commercial and criminal law to guide you.

3. Communicate and Negotiate: Often, the best way to stop the criminal process is to immediately settle the debt with the payee and seek a withdrawal of the complaint.

4. Rebuild Diligently: After the immediate crisis has passed, focus on transparent financial dealings. Rebuilding trust takes time and consistent, honourable action.

The Professional Response: How Recovery Agencies Change the Game

In the complex landscape of financial disputes, specialized firms have emerged to navigate the intricacies of recovery on behalf of creditors. Agencies like KREENO Debt Recovery and Private Investigation Agency represents this professionalized response. They operate at the intersection of finance, law, and investigation, assisting businesses and individuals not only in tracing debtors and recovering funds but also in methodically gathering the necessary evidence such as proof of transaction and deliberate intent that is crucial for building a robust case under the Dishonoured Cheques (Offences) Act. Their involvement often signals to the debtor the seriousness of the creditor's intent to pursue all available legal avenues, both civil and criminal.

Engaging a specialized agency can fundamentally alter the dynamics of a bounced cheque scenario. For the creditor, it provides a structured path to recovery, mitigating the emotional and time-consuming burden of direct pursuit. For the debtor, the involvement of a firm like KREENO Debt Recovery and Private Investigation Agency serves as a stark, real-world wake-up call, moving the situation beyond mere threatening letters into the realm of actionable consequences. This often becomes the critical juncture that prompts the debtor to seek immediate settlement or legal counsel, as it makes the abstract threat of "legal action" a tangible and imminent reality, thereby potentially accelerating resolution before a matter escalates to full-blown prosecution and its attendant, life-altering repercussions.

A cheque in Nigeria is more than paper. It's a promise backed by the full force of the law. The consequences of breaking that promise extend far beyond your bank balance, reaching into your freedom, your career, and your good name. Before you write that next cheque, be absolutely certain. Because the hidden cost of a bounce is a price you never intended to pay.

ADVERTISEMENT

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?