Ten Banks Record N1.99tn in Loan Impairment Charges as CBN Forbearance Winds Down

Nigerian banks reported N1.99 trillion in loan impairment charges in the first nine months of 2025 as the Central Bank of Nigeria phases out its forbearance regime. The rise reflects tougher provisioning requirements, inflation pressures, and foreign exchange volatility across key markets.

Ten Nigerian banks collectively reported N1.99 trillion in loan impairment charges in the first nine months of 2025, reflecting the strain of tighter regulatory requirements and a challenging macro-economic environment. This represents a 44.5 percent rise from the N1.37 trillion recorded in the same period of 2024.

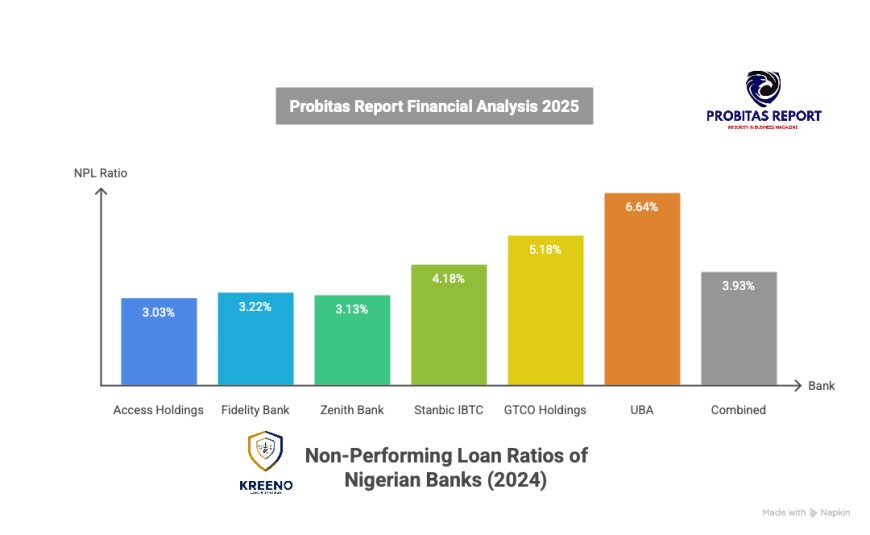

The institutions involved include Access Holdings Plc, Guaranty Trust Holding Company (GTCO), FBN Holdings, Zenith Bank Plc, United Bank for Africa Plc (UBA), Ecobank Transnational Incorporated, Wema Bank Plc, Fidelity Bank Plc, Stanbic IBTC Holdings Plc, and Sterling Financial Holdings Company Plc.

Why Impairment Charges Jumped

A major driver of the surge was the industry-wide unwinding of the Central Bank of Nigeria’s (CBN) forbearance framework, which had previously given banks temporary relief on loan restructuring and classification. With the phase-out now in motion, lenders were compelled to make deeper provisions to reflect the true quality of their loan books.

Loan impairment charges represent funds set aside to cover potential defaults and losses from deteriorating credit exposures. Rising inflation, weakened consumer and business liquidity, currency depreciation, and tight monetary conditions amplified the overall risk environment, increasing the cost of credit.

Profitability Despite the Drag

Despite heavier provisioning, the ten banks posted a combined N5.5 trillion in profit before tax, a marginal increase of 3.2 percent compared with N5.3 trillion in the corresponding period of 2024.

READ MORE:

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

Breakdown of the Big Movers

Zenith Bank, Ecobank, and Access Holdings were the three institutions with the steepest increases in impairment charges.

-

Zenith Bank recorded N781.5 billion in provisions for the period, a 64 percent jump from N477.77 billion in 2024.

Group Managing Director/CEO Dr. Adaora Umeoji stated that although the bank made substantial one-off provisions tied to the forbearance exit, its balance sheet remained strong, liquid, and well positioned for new opportunities.

Zenith’s total loan provisioning for the period stood at more than N830 billion, but recoveries helped reduce the final figure. -

Ecobank Transnational Incorporated posted impairment charges of N393.68 billion, up 47.4 percent from N267.13 billion in 2024.

The bulk of the pressure came from volatile conditions in its major markets—particularly Ghana and Nigeria, where FX instability and inflation weakened asset quality.

Although total provisions reached N530.3 billion, recoveries of N185.6 billion brought down the net figure. -

Access Holdings declared N349.99 billion in impairment charges, rising 141.5 percent from N144.95 billion in 2024.

About N255 billion of the impaired loans were tied to corporate accounts, with the remainder attributed to individual borrowers.

The bank’s third-quarter numbers indicate roughly N100 billion in additional provisioning, reflecting aggressive cleanup ahead of CBN’s forbearance deadline.

The group noted that inflation, regulatory adjustments, and broader economic headwinds hampered its Nigerian operations.

Regulatory Pressure and Industry Compliance

Analysts believe the spike in provisions was largely unavoidable, as banks moved to comply with the CBN’s forbearance exit timetable.

The apex bank had earlier clarified that the phasing out of pandemic-era regulatory reliefs was intended to strengthen the system’s long-term stability. By June 13, 2025, it issued a circular restricting banks under forbearance from paying dividends, issuing bonuses, or making certain foreign investments until they met required standards.

Ahead of the full unwind expected in March 2026, the CBN confirmed that at least eight banks had already met the key benchmarks.

Zenith Bank publicly acknowledged its compliance preparations, confirming that it had exceeded the N500 billion regulatory capital requirement and had made significant progress toward clearing exposures related to the Single Obligor Limit (SOL) and other credit facilities.

Capital Market Perspective

Investment analysts noted that some lenders increased their provisioning strategically so they could resume interim dividend payments once cleanup was completed. Others spread their provisions and opted not to declare interim dividends due to the heavy regulatory burden.

Renaissance Capital Africa estimated that six Nigerian banks collectively hold around $3.52 billion in forbearance-related exposures. Its report, “Nigerian Banks: Cash is King,” highlighted individual figures of $304 million, $887 million, $282 million, and $1.6 billion for Access Corporation, FBN Holdings, UBA, and Zenith Bank respectively.

Stockbroker Tajudeen Olayinka told THISDAY that several banks had accelerated their cleanup to meet the June 2025 deadline and position themselves for dividend payouts. According to him:

“The large impairment charges reflect the CBN’s forbearance countdown. Banks that delayed provisioning will have to spread their charges and may not be able to pay interim dividends. Those that provisioned early can reward shareholders sooner.”

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com

© 2025 Probitas Report – All Rights Reserved. Reproduction or redistribution requires explicit permission.

What's Your Reaction?