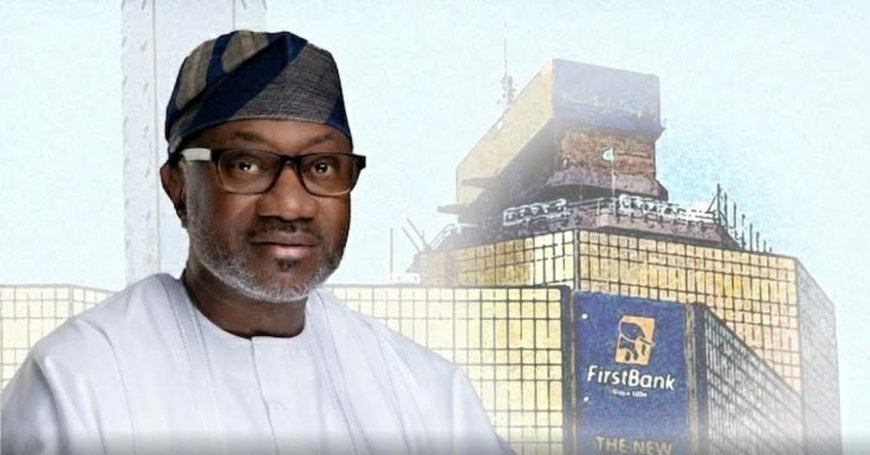

Nigeria Banking Recapitalisation: FirstBank’s ₦500bn Capital Raise and the Push Toward a $1 Trillion Economy

FirstBank has completed a ₦500bn capital raise as Nigeria’s banking sector adjusts to CBN reforms. Chairman Femi Otedola says banks must scale to ₦1tn capital to support a $1 trillion economy.

First Bank of Nigeria Limited has successfully completed a ₦500 billion capital raise, marking a significant milestone for the country’s oldest financial institution as it aligns with ongoing regulatory reforms introduced by the Central Bank of Nigeria (CBN).

The capital raise comes at a critical time for Nigeria’s banking sector, which is undergoing a broad recapitalisation and governance reset aimed at strengthening financial stability, improving risk management, and positioning banks to support long-term economic growth. Industry analysts view FirstBank’s move as both timely and strategic, given heightened regulatory scrutiny and evolving macroeconomic conditions.

According to sources familiar with the transaction, the capital raise was achieved through a mix of approved instruments in compliance with CBN guidelines, reinforcing the bank’s balance sheet and enhancing its capacity to absorb economic shocks. The fresh capital is expected to improve FirstBank’s capital adequacy ratio, expand lending capacity, and support investments in digital banking infrastructure, risk management, and operational resilience.

The CBN’s recent reforms have placed renewed emphasis on stronger capitalization, transparency, and sound corporate governance across the financial system. Banks are now expected to demonstrate resilience amid currency volatility, inflationary pressures, and tighter global financial conditions. FirstBank’s successful capital mobilisation positions it ahead of peers navigating the same regulatory environment.

Commenting on the broader implications of banking sector capitalization, Chairman of FirstHoldCo Plc, Mr. Femi Otedola, recently emphasized that Nigeria must think beyond the current benchmarks if it is serious about achieving a $1 trillion economy. According to him, while the ₦500 billion capital base represents an important step, Nigeria’s ambition requires banks to scale further, potentially doubling capital levels to ₦1 trillion to adequately finance large-scale infrastructure, industrial expansion, and economic transformation.

Market observers note that the capital raise sends a strong signal to investors, regulators, and depositors, particularly at a time when confidence in financial institutions is closely linked to capital strength and regulatory compliance. As a systemically important institution, FirstBank’s actions are seen as reinforcing stability within Nigeria’s banking ecosystem.

READ MORE:

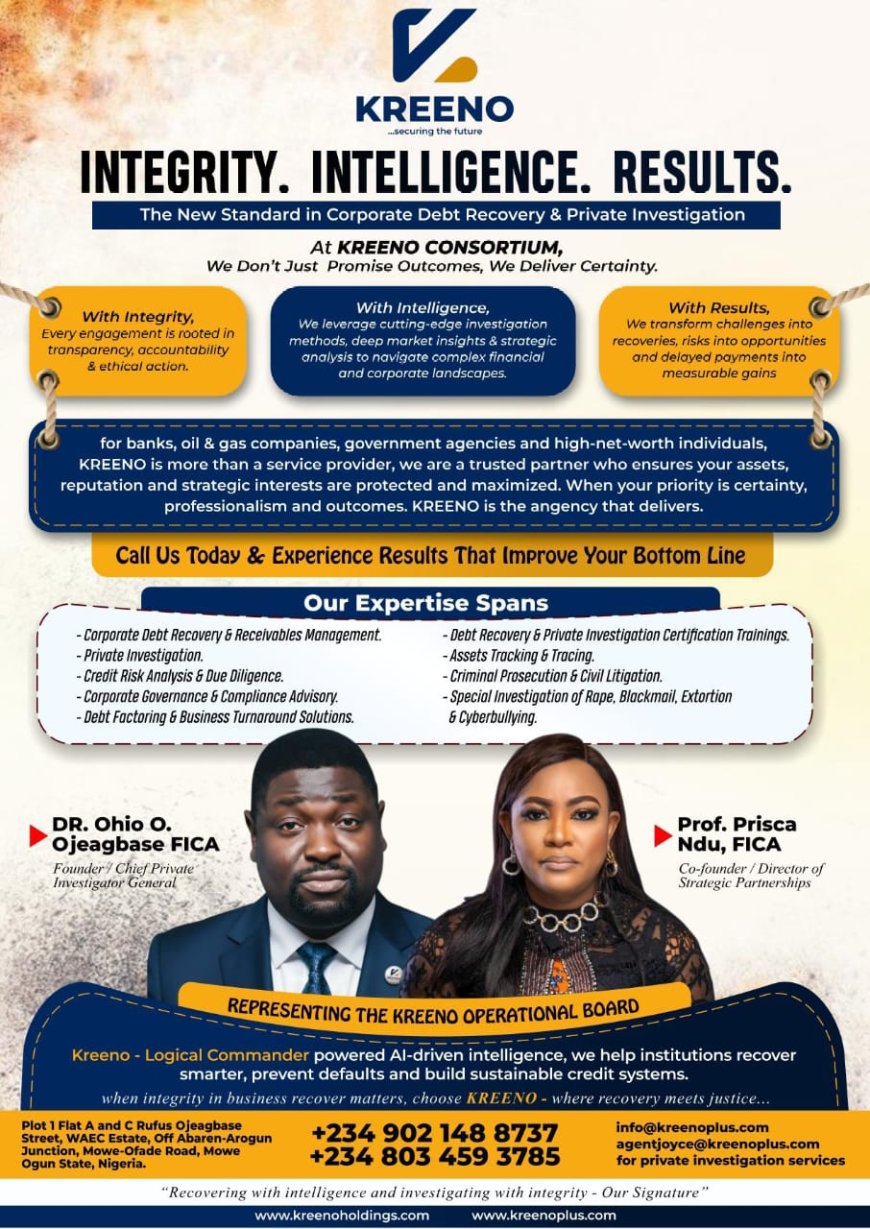

- Non-Performing Loans Are Not Accidents. How Weak Enforcement Is Strangling Nigeria’s Productive Economy

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

In a wider context, the transaction reflects growing alignment between Nigeria’s tier-one banks and the CBN’s vision of a more robust, well-capitalised financial sector capable of supporting ambitious national development goals. Analysts expect additional capital-raising efforts across the industry as regulatory deadlines draw closer and economic aspirations expand.

With the ₦500 billion raise concluded, attention will now turn to how effectively FirstBank deploys the funds to drive sustainable growth, manage risk, and support Nigeria’s long-term economic objectives—particularly in the context of the country’s push toward trillion-dollar economic status.

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

What's Your Reaction?