The Collapse of Heritage Bank in Nigeria: A Lesson in Financial Mismanagement and Ethical Banking

The failure of Heritage Bank in Nigeria exposes critical issues of financial mismanagement, poor corporate governance, and the urgent need for ethical banking reforms. This article examines the lessons from its collapse and the impact on Nigeria’s financial sector.

By Dr Kreeno

History

The bank traces its roots to the late 1970s, when it was founded as Societe Generale Bank (Nigeria), by the late Dr. Olusola Saraki. In January 2006, the Central Bank closed down Societe Generale on account of failure to meet new minimum capital requirements of US$155 million (NGN:25 billion) for a National Bank. Societe Generale successfully challenged the closure in court. In December 2012, the Central Bank re-issued Societe Generale's banking license, but as a regional bank. Having acquired the banking license, the new ownership re-branded the bank as Heritage Banking Company Limited and opened for business under the new name on 4 March 2013.

In October 2014, Heritage Banking Company Ltd successfully met the requirements of the Asset Management Corporation of Nigeria (AMCON) and the Central Bank of Nigeria toward owning 100% shares in Enterprise Bank Ltd.

On 27 January 2015, AMCON officially transferred ownership of Enterprise Bank Ltd to Heritage Bank Plc.

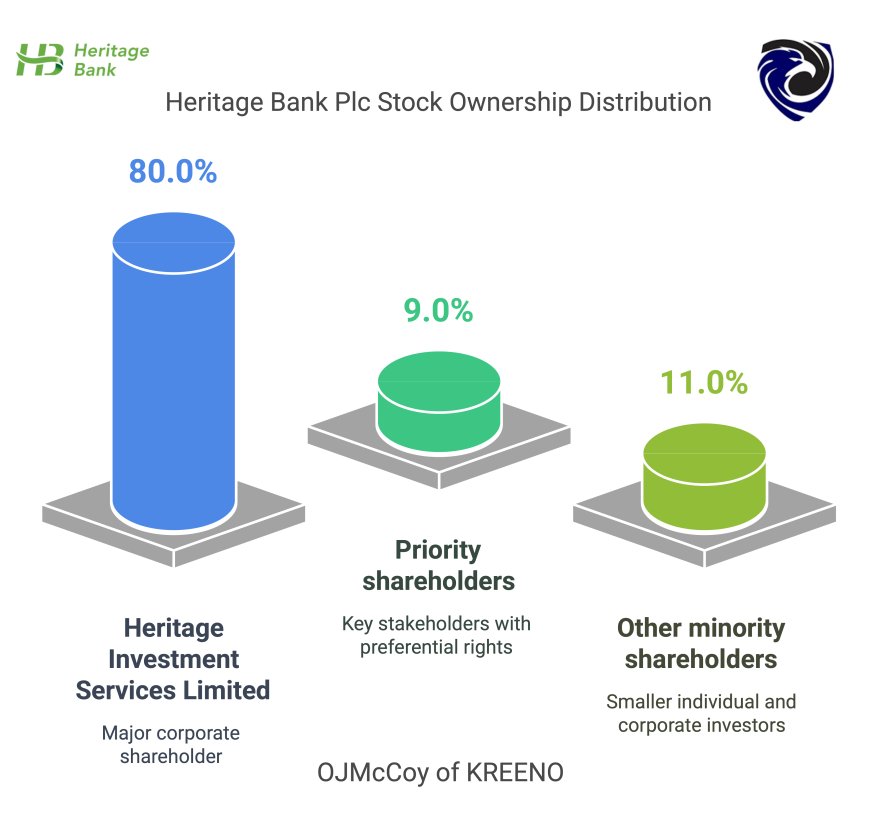

Ownership

As of September 2013, the bank's stock is publicly owned by the following corporate entities and individuals:

| Rank | Name of owner | Percentage ownership |

|---|---|---|

| 1 | Heritage Investment Services Limited | 80.0 |

| 2 | Priority shareholders | 9.0 |

| 3 | Other minority shareholders | 11.0 |

| Total | 100.00 |

Branch Network

Headquartered in Lagos, Nigeria, Heritage Bank Plc has 127 branches and 202 automated banking centers with over 350 ATMs in all states of the federation and the Federal Capital Territory.

Governance

Jani Ibrahim FNSE, FAEng., OON, MNI, a non-executive director, serves as the acting chairman of the seven-person board of directors. The managing director and chief executive officer is Akinola George-Taylor.

Acquiring Enterprise Bank

In October 2014, Heritage Bank acquired 100% shareholding in Enterprise Bank Limited, a nationalized financial services provider with over 160 branches and US$1.6 billion in assets. Heritage paid AMCON US$340 million (NGN:56.1 billion), in cash, for the acquisition. Heritage Investment Services Limited, the investment arm of Heritage Banking Company Limited.

A Wake-Up Call for Nigeria’s Banking Sector

On June 3, 2024, Nigeria’s banking sector faced a seismic shock: Heritage Bank, once a mid-sized player with over 100 branches, was abruptly liquidated by the Central Bank of Nigeria (CBN). The collapse, triggered by years of bad loans, corporate governance failures, and regulatory non-compliance, sent ripples through the economy. For customers, it meant lost savings. For investors, it raised red flags. For the industry, it became a cautionary tale.

But beyond the headlines lies a deeper story. Heritage Bank’s downfall isn’t just about one bank’s missteps—it’s a mirror reflecting systemic flaws in Nigeria’s financial ecosystem. As we dissect this event, we’ll explore what it means for the future of banking in Africa’s largest economy.

Lessons from Failed Banks in Nigeria: Why Heritage Bank’s Story Matters

Nigeria has seen its fair share of bank failures, from the 2009 crisis that wiped out 14 institutions to the 2018 collapse of Skye Bank. But Heritage Bank’s case stands out. Unlike previous failures tied to macroeconomic shocks, this collapse was rooted in internal rot:

- Bad Loans Galore: A staggering 65% of Heritage’s loan portfolio was classified as non-performing (NPLs) by 2023, far above the CBN’s 5% threshold. Many were tied to politically connected borrowers who defaulted with impunity.

- The Keystone Debacle: The bank’s 2021 acquisition of Keystone Bank—a deal marred by allegations of inflated valuations and insider dealings—left it drowning in unsustainable debt. Let us break this down for our reading pubic: Yes, Heritage Bank threatened to take over Keystone Bank after the Isa Funtua/Emefiele group was unable to repay a loan used to acquire Keystone Bank.

- Heritage Bank provided a loan of N25 billion to the Isa Funtua/Emefiele group to acquire Keystone Bank.

- The loan was backed by the shareholders of Heritage Bank.

- After the acquisition, Keystone Bank returned N20 billion to Heritage Bank as placement.

- When the loan matured, Heritage Bank demanded repayment.

- The Isa Funtua/Emefiele group was unable to repay the loan.

- Heritage Bank threatened to take over Keystone Bank based on the shares pledged as security.

- Keystone Bank created internal loans to repay Heritage Bank, but the MD resigned before the loans were serviced.

- Regulatory Blind Spots: Despite repeated warnings, Heritage Bank failed to meet capital adequacy ratios, even after the CBN’s 2023 recapitalization push. This wasn’t just a failure of management—it was a failure of oversight.

READ More News:

- The Acting Group CEO of Access Holdings PLC

- Blackmail And Extortion In Nigeria And Consequences

- Tribute To Mrs Titilayo Osuntoki HCIB

- ABUAD Business School and KREENO Forged Strategic Partnership

How Does Lack of Integrity in Business Practices Affect Banking?

Let’s skip the buzzwords and get straight to the point: banking thrives on trust. When integrity crumbles, the ripple effect is devastating. This is precisely why Probitas Report (Integrity-In-Business Online Magazine) faces resistance from powerful interests—it dares to champion integrity in business, even among small and medium-sized enterprises where fraudulent intent often lurks. Too often, when it’s time to repay debts, excuses surface, and defaulters expect their victims to simply move on. That is fraud—plain and simple.

Even as you read this, ask yourself: Are you part of the problem in Corporate Nigeria? Do you turn a blind eye when it benefits you? Do you justify financial fraud when you’re the perpetrator? Integrity in business isn’t selective. If we’re ever going to rebuild trust in Nigeria’s business ecosystem, accountability must start with each one of us." Dr Ohio O. Ojeagbase FICA, FIDR

Case in Point: Heritage Bank’s executives allegedly approved loans to shell companies linked to board members. When these loans defaulted, depositors’ funds evaporated. The result? A ₦700 billion hole in the bank’s balance sheet and a trail of ruined SMEs.

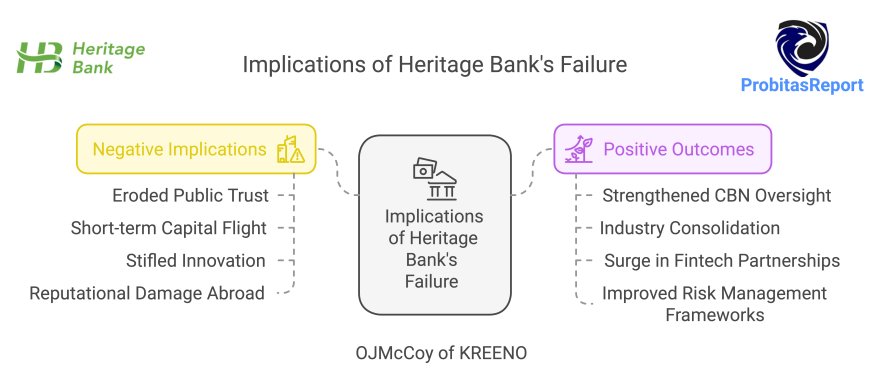

The Ripple Effects

- Customer Distrust: After the collapse, 43% of Nigerians surveyed by [Nairametrics](https://nairametrics.com/2024/06/04/unlike-emefiele-heritage-bank-closure-shows-cardosos-cbn-is-willing-to-let-banks-fail-2/) said they’d move funds to “safer” tier-1 banks.

- Investor Flight: Foreign direct investment in Nigeria’s banking sector dropped 18% in Q3 2024.

- Regulatory Panic: The CBN’s knee-jerk freeze on new banking licenses stalled fintech innovation.

Yet, there’s a silver lining. As [Proshare noted](https://proshare.co/articles/banking-insolvency-in-nigeria-liquidation-of-heritage-bank-as-case-study), the crisis forced surviving banks to adopt stricter due diligence—a win for transparency.

Is Corporate Governance Overrated in Banking?

Spoiler: No. But Heritage Bank’s board seemed to think otherwise.

The Governance Gap:

- Board Squabbles: Directors prioritized personal gains over risk management, leading to reckless lending.

- Auditor Complicity: External auditors allegedly turned a blind eye to red flags for years.

While some argue that Nigeria’s corporate governance codes are “too theoretical,” Heritage’s collapse proves otherwise. As [PwC’s 2025 Banking Report](https://www.pwc.com/ng/en/publications/the-future-shape-of-banking.html) warns: “Governance isn’t a checkbox—it’s the bedrock of survival.”

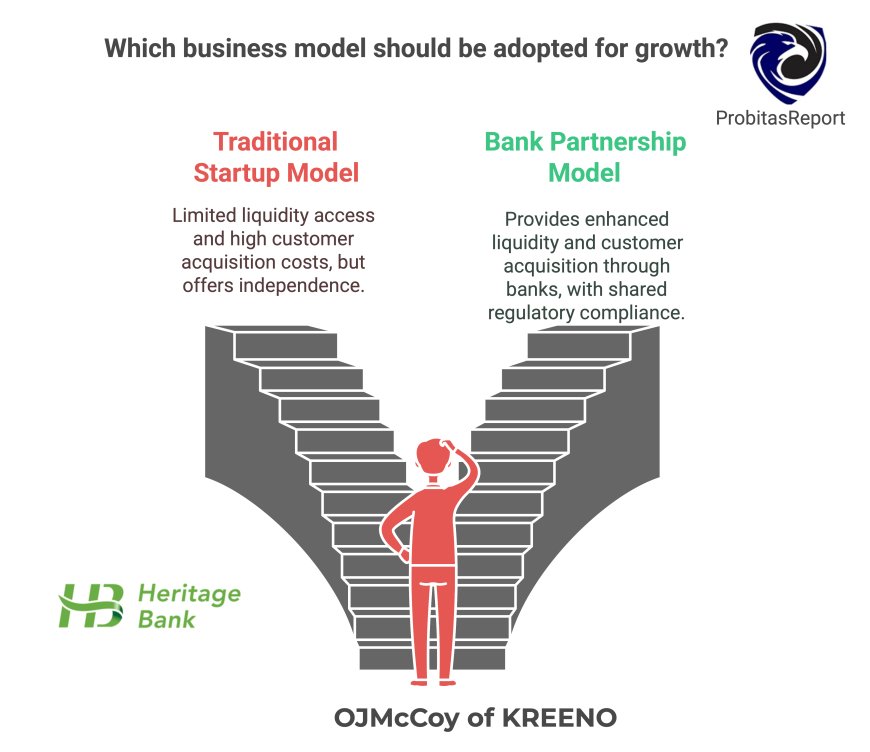

What Does the Implications of Heritage Bank’s Failure Portend for the Industry ? Let’s break this down with a comparison in the image:

The Road Ahead (2025–2030):

1. Digital Banking Boom: Expect tier-2 banks to partner with fintechs like Opay to cut costs and reach unbanked Nigerians.

2. The $1 Trillion Economy Dream: Banking stability is key to Nigeria’s 2030 GDP target. Heritage’s collapse may delay this by 2–3 years.

3. New Players, New Rules: The CBN could introduce “niche bank” licenses for agriculture and renewable energy sectors.

Should New Entrants Come into the Nigerian Banking Space?

Yes, but with caveats:

- Opportunities: 38% of Nigerians remain unbanked. Digital-first models (like Kuda Bank) could thrive.

- Risks: The CBN’s capital requirements may jump to ₦500 billion for commercial banks, per [ThisDay](https://www.thisdaylive.com/index.php/2024/11/19/liquidation-of-heritage-bank-plc-matters-arising-1/).

- How Non Payment Of Your Debt Affect Your Integrity

- Strengthening Fight Against Financial Fraud in Nigeria

- 1.3BN Fraud: Police To Arraign Obanikoro's Son On February 27

- An Abuja-Based Bishop Sentenced To 20 Years Imprisonment For Rape of A Minor

Strategic Advice for Nigerian Fintech Startups: Partnering for Liquidity & Targeting Underserved Sectors

Nigeria’s fintech ecosystem is booming, with startups raising over $1.5 billion in 2023 alone. Yet, the collapse of Heritage Bank underscores the risks of operating in a volatile financial landscape. For startups navigating this terrain, two strategies stand out: **partnering with established banks for liquidity** and **targeting underserved sectors like green energy loans**. Here’s why these approaches matter and how to execute them.

1. Partnering with Established Banks for Liquidity

Why It Matters:

Startups often lack the capital reserves of traditional banks, making liquidity management a constant challenge. Partnering with established institutions like Zenith Bank or Access Bank provides:

- Instant Liquidity: Access to interbank lending markets and CBN’s discount window.

- Regulatory Shield: Compliance support for licenses like the CBN’s Payment Service Bank (PSB).

- Customer Trust: 72% of Nigerians trust tier-1 banks more than standalone fintechs ([EFInA Survey, 2023](https://www.efina.org.ng/publications/)).

Case Study: Kuda Bank’s partnership with Access Bank (2022) allowed it to offer interest-bearing savings accounts, leveraging Access Bank’s liquidity pool whilst retaining its digital-first brand.

How to Execute:

- Revenue-Sharing Models: Negotiate partnerships where banks provide liquidity in exchange for a % of transaction fees (e.g., 15–20%).

- APIs for Real-Time Settlements: Use open banking APIs like [Stripe for Africa](https://stripe.com/en-ng) to automate liquidity flows.

- Collateral Backstops: Offer equity stakes or future receivables as collateral for credit lines.

Challenges:

- Loss of Autonomy: Banks may demand board seats or veto rights on product launches.

- Regulatory Hurdles: CBN’s 2024 guidelines require banks to conduct due diligence on fintech partners, delaying launches by 3–6 months.

2. Targeting Underserved Sectors: Green Energy Loans

The Opportunity:

Nigeria has a 26 GW energy deficit, with 45% of businesses relying on diesel generators. Yet, green energy financing remains untapped:

- Only ₦120 billion ($150M) of the $20 billion needed for renewable projects by 2030 has been mobilized ([BNEF, 2024](https://about.bnef.com/blog/)).

- Solar startups like Daystar Power and Arnergy have shown 30% annual growth but lack tailored debt financing.

Why Fintechs Can Win:

- Data-Driven Lending: Use IoT sensors to monitor solar panel performance, reducing default risks.

- Microloans for SMEs: Offer ₦500,000–₦5M loans for solar installations, repaid via energy savings.

Execution Blueprint:

1. Partner with Energy Providers: Bundle loans with equipment from firms like Lumos or Greenlight Planet.

2. Leverage Carbon Credits: Monetize emissions reductions via platforms like [ACX] (https://acx.net) to subsidize interest rates.

3. Government Incentives: Tap into the CBN’s ₦15 billion Renewable Energy Fund (2024) for low-cost capital.

Success Story: Spark.NG, a Lagos-based fintech, raised ₦2 billion in 2023 by specializing in solar loans for rural hospitals, achieving a 98% repayment rate.

Risks:

- Currency Volatility: Solar equipment imports are priced in dollars, exposing lenders to FX risks.

- Regulatory Uncertainty: Nigeria’s Energy Transition Plan (NETP) lacks clear tax incentives for green loans.

Comparative Analysis: Traditional vs. Partnership-Driven Models

The Road Ahead: 3 Steps for Startups

1. Start Small, Prove Concepts: Pilot green energy loans in one state (e.g., Lagos) before scaling.

2. Diversify Bank Partnerships: Work with 2–3 banks to avoid over-reliance on one institution.

3. Advocate for Policy Changes: Lobby for CBN incentives like reduced cash reserve ratios (CRR) for green loans.

Survival Through Synergy

In a post-Heritage Bank Nigeria, fintech startups can’t afford to go it alone. Partnering with banks bridges liquidity gaps, while green energy lending taps into a $3 billion market. As [PwC’s 2024 Fintech Report](https://www.pwc.com/ng/en/publications.html) notes: *“The future belongs to hybrids—digital agility paired with institutional stability.” For startups, that future starts now.

Conclusion: A Crossroads for Nigerian Banking

Heritage Bank’s collapse is a tragedy, but it’s also a catalyst. For regulators, it’s a call to enforce rules without favoritism. For banks, it’s a reminder that ethics matter. For customers, it’s a lesson in vigilance.

As Nigeria’s banking sector marches toward 2030, one thing is clear: institutions that prioritize integrity over quick profits will survive—and thrive. The rest? They’ll join Heritage Bank in the history books.

Further Reading:

- [CBN’s 2024 Banking Stability Report](https://www.cbn.gov.ng/Out/2024/FPRD/Financial_Stability_Report_2024.pdf)

- [How Fintechs Are Reshaping African Banking](https://www.bloomberg.com/africa-fintech)

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?