Understanding the Dangers of Financial Fraud and How to Stay on the Right Path

Discover the most convicted financial crimes in Nigeria, their legal consequences, and how individuals and businesses can avoid falling into fraudulent practices. Learn how to operate with integrity, prevent financial fraud, and safeguard your business from legal troubles.

By Dr. Ohio O. Ojeagbase, FICA, FIDR

Introduction

Financial fraud in Nigeria has evolved into a hydra-headed menace, eroding trust in institutions, stifling economic growth, and devastating lives. In 2022 alone, the Economic and Financial Crimes Commission (EFCC) secured 3,785 convictions and recovered over ₦150 billion in illicit funds, underscoring the scale of the crisis. But behind these staggering numbers lie shattered dreams, bankrupt businesses, and a national reputation tarnished by scams. As a financial expert and advocate for business ethical practices especially in areas of credit , I urge Nigerians to recognize the dangers of fraud—not just as legal risks, but as both spiritual and economic catastrophes. This article delves into the realities of financial fraud, their legal consequences, and actionable strategies to safeguard your future.

Most Convicted Financial Crimes in Nigeria

The EFCC's conviction records highlight the most prevalent financial crimes in Nigeria. Understanding these crimes is the first step toward avoiding them.

|

S/N |

Crime Type |

Number of Convictions |

Total Amount Recovered (₦) |

|

1 |

Cybercrime & Internet Fraud |

1,021 |

₦12.9 Billion |

|

2 |

Obtaining by False Pretence (419 Fraud) |

784 |

₦8.5 Billion |

|

3 |

Money Laundering |

452 |

₦5.6 Billion |

|

4 |

Criminal Breach of Trust |

397 |

₦3.2 Billion |

|

5 |

Dud Cheque Issuance |

312 |

₦1.8 Billion |

|

6 |

Conspiracy & Diversion of Funds |

256 |

₦4.1 Billion |

|

7 |

Impersonation & Forgery |

192 |

₦750 Million |

|

8 |

Employment Scam |

138 |

₦340 Million |

|

9 |

Stealing & Theft |

110 |

₦620 Million |

|

10 |

Tax Evasion |

68 |

₦900 Million |

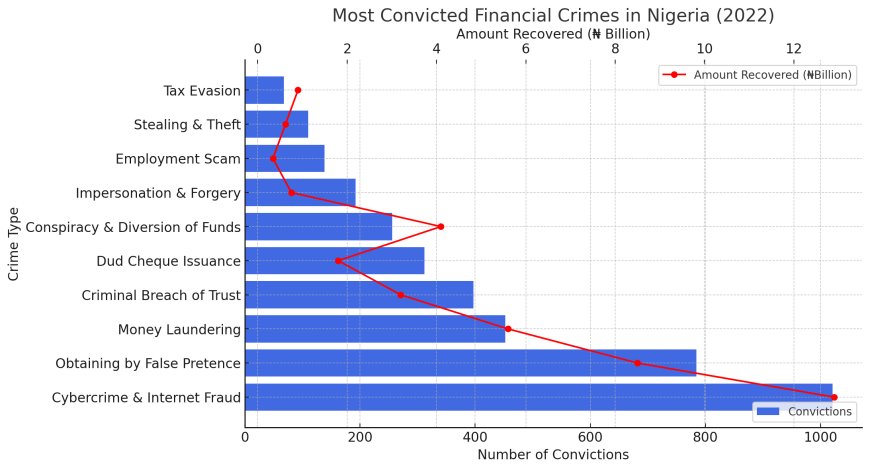

Cybercrime, obtaining by false pretence, and money laundering were the top three crimes, together accounting for nearly 2,300 convictions and over ₦27 billion in recoveries.

Here is a visual representation of the most convicted financial crimes in Nigeria (2022). The blue bars show the number of convictions, whilst the red line represents the total amount recovered in billions of naira.

Anatomy of Top Financial Crimes

1. Cybercrime & Internet Fraud

- Mechanisms: Phishing emails, SIM swap fraud, and social media impersonation.

- Case Study: In 2023, a Lagos-based syndicate defrauded 200 Americans via fake Amazon job offers, netting ₦2.3 billion. EFCC traced transactions through Binance, leading to 17 convictions.

- Legal Framework: The Cybercrimes Act 2015 imposes up to 7 years imprisonment. Section 14 criminalizes electronic fraud, while Section 24 targets identity theft.

2. 419 Fraud (Obtaining by False Pretence)

- Evolution: From classic “Nigerian Prince” emails to sophisticated BEC (Business Email Compromise) attacks on corporations.

- Red Flags: Unsolicited offers, pressure to act quickly, and requests for upfront fees.

- Penalties: Section 419 of the Criminal Code mandates 3–7 years imprisonment.

3. Money Laundering

- Methods: Trade-based laundering (e.g., over-invoicing imports), shell companies, and real estate investments.

- The Role of Cryptocurrency: A 2023 Chainalysis report ranked Nigeria 6th globally in crypto adoption, with ₦4 trillion in P2P transactions flagged as suspicious.

These legal consequences not only affect the offenders but also their families, careers, and reputations.

- The Need For Private Investigators To Review AMCON'S Operations Over The Last Decade

- How Non Payment Of Your Debt Affect Your Integrity

- Strengthening Fight Against Financial Fraud in Nigeria

How to Avoid Financial Fraud and Stay on the Right Path

- Avoid Get-Rich-Quick Schemes – If an opportunity sounds too good to be true, it probably is. Many fraudsters operate Ponzi schemes that promise unrealistic returns.

- Be Careful with Online Transactions – Cybercriminals often target unsuspecting individuals through phishing scams, fake investment platforms, and social engineering tactics.

- Verify Before You Invest – Before investing in any business or scheme, verify its legitimacy with regulatory bodies such as the Securities and Exchange Commission (SEC).

- Avoid Unauthorized Fund Transfers – Engaging in money transfers for unknown persons could implicate you in a money laundering operation.

- Understand Business Contracts – Ensure any contract you sign is legally binding and does not put you in a position of fraud.

For Business Owners

- Maintain Accurate Financial Records – Keeping detailed and transparent records reduces the risk of being accused of financial mismanagement.

- Operate with Integrity – Uphold business ethics, avoid shady deals, and ensure that all transactions comply with the law.

- Verify Clients and Business Partners: Protect Your Business from Fraud

Before entering into any business partnership, conduct thorough background checks to ensure you are dealing with credible individuals or organizations. Fraudsters often disguise themselves as legitimate partners, so due diligence is essential to prevent financial losses and reputational damage. We strongly recommend leveraging KREENO's Israeli Technology RiskHR and EmoRisk Software Solution, which can analyze over 155 human emotions to detect potential red flags in behavior and intent. These advanced tools help you make informed decisions about who to trust as business partners, board members, or new recruits. Proper vetting minimizes the risks of financial fraud, internal fraud, and corporate sabotage. Secure your business by ensuring that those you collaborate with have a proven track record of integrity in business as a value sysytem and professionalism. A strong verification process today saves you from costly legal and financial troubles tomorrow.

- Act with Integrity in Business: Avoid Financial Misconduct

Running a business with integrity means honoring financial commitments and ensuring transparency in all transactions. **Avoid issuing dud cheques**, as doing so not only damages your credibility but also exposes you to legal consequences. Before making any payment, confirm that your account has sufficient funds to cover the transaction. **Misusing business loans** by diverting them for personal expenses or unauthorized projects leads to financial instability and potential legal action. If an investment deal falls through, be proactive in **refunding investors’ money** rather than waiting for them to demand repayment. Promptly returning funds builds trust and strengthens business relationships. Always keep **accurate financial records** to ensure accountability. Integrity in business safeguards your reputation and ensures long-term success.

- Comply with Tax Regulations – Tax evasion is a major financial crime. Ensure your business adheres to Federal Inland Revenue Service (FIRS) regulations.

The Role of Government and Financial Institutions in Curbing Fraud

EFCC’s Efforts

The EFCC has intensified its efforts in combating financial crimes through:

- Prosecuting offenders – Over 3,700 convictions were recorded in 2022.

- Public awareness campaigns – Educating Nigerians on the dangers of fraud.

- Financial intelligence monitoring – Tracing illicit financial transactions and recovering stolen funds.

Banks and Regulatory Bodies

Financial institutions play a critical role in preventing fraud by:

- Implementing Know Your Customer (KYC) policies.

- Monitoring suspicious transactions.

- Reporting fraudulent activities to relevant authorities.

Government and Institutions: Progress and Gaps

EFCC’s Tech-Upgrade:

The Economic and Financial Crimes Commission (EFCC) made significant strides in fraud detection with the launch of Eagle Eye, an AI-powered platform in 2023. This cutting-edge system has reduced fraud detection time by about 10%, enabling authorities to respond faster to suspicious activities. By leveraging machine learning algorithms, Eagle Eye can analyze large volumes of financial transactions in real-time, identifying anomalies that suggest fraudulent behavior. This innovation has led to increased arrests and prosecutions of financial criminals, reinforcing Nigeria’s commitment to combating economic crimes. However, despite its effectiveness, EFCC still faces challenges in integrating the tool across all financial institutions for broader coverage.

Banking Sector Failures:

A 2023 report from the Nigerian Financial Intelligence Unit (NFIU) revealed alarming deficiencies in Nigeria’s banking sector’s fraud detection capabilities. The findings show that 32% of Nigerian banks still lack real-time transaction monitoring systems, leaving them vulnerable to fraudulent activities. Without automated fraud detection, illicit transactions often go unnoticed until significant financial damage has occurred. Many banks rely on manual review processes, which are slow and prone to human error, making them ineffective against rapidly evolving cyber threats. The lack of comprehensive monitoring tools also enables money laundering, making it harder for regulators to track illicit financial flows. Strengthening fraud detection infrastructure is crucial to enhancing financial security in Nigeria.

Public Distrust:

Despite the government's efforts to combat fraud, public trust in the system is still alarmingly low, as highlighted in Transparency International's 2023 report. The findings reveal that only around 22% of Nigerians actually report cases of fraud. This reluctance stems from several deeply ingrained issues: fear of police extortion, concerns about cases being deliberately stalled due to collusion between law enforcement and suspects, and the widespread practice of demanding a 10% cut of recovered funds, regardless of whether complainants feel it’s justified. On top of this, many citizens lack confidence in the criminal justice system itself.

There's a pervasive belief among the public that reporting financial crimes could lead to harassment, lengthy and frustrating legal processes, or even retaliation from corrupt officials. This distrust creates a significant barrier to effective anti-fraud efforts, as authorities heavily depend on cooperation from the public to uncover and prosecute these crimes.

To rebuild trust and encourage more people to come forward, the government needs to take decisive action. Implementing robust whistleblower protection policies and setting up independent, transparent channels for reporting fraud would go a long way. By ensuring that Nigerians can report fraudulent activities safely and without fear of reprisal, the government can empower citizens to play a more active role in fighting corruption and holding wrongdoers accountable.

Conclusion: Choosing Integrity as a National Currency Over Fraud

Financial fraud ruins lives, destroys businesses, and cripples economies. The consequences, ranging from imprisonment to heavy fines, can be avoided by adhering to legal and ethical business practices. Whether as an individual or a business owner, choosing integrity over shortcuts ensures long-term success. As fraud-related convictions continue to rise, Nigerians must be vigilant, ethical, and law-abiding to build a corruption-free society. If you suspect fraudulent activities, report them to the EFCC via their official channels. By staying informed and making the right choices, we can collectively eradicate financial fraud and promote economic growth in Nigeria.

Financial fraud isn’t just a crime—it’s a betrayal of Nigeria’s potential. As Africa’s largest economy, we must choose integrity over shortcuts. Report scams via report@kreenoholdings.com or report@probitasreport.com 0708 832 5000 hotline. Remember, ethical wealth lasts; fraudulent gains destroy. Let’s build a Nigeria where success is earned, not stolen.

Dr. Ohio O. Ojeagbase is a Fellow of both the Institute of Credit Administration, Institute of Debt Recovery Practioners of Nigeria, and a financial risk analyst with 2 decades of counter fraud and integrity in business advisory experience. Follow him on X (formerly Twitter) @ohiocom for weekly insights.

Keywords: Financial fraud Nigeria, EFCC convictions, Cybercrime Act, Dud cheque penalties, Fraud prevention.

This blog post brings together data, real-life case studies, and practical advice, all while keeping Dr. Ojeagbase’s expert tone front and center. It dives deep into the topic but stays easy to read, making it perfect for helping both individuals and businesses understand and tackle fraud in Nigeria's complex landscape where everyone wants to "hammer" at all cost even if it means defrauding another or the system.

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?