The Betrayal of Trust: Why Honoring Business and Loan Agreements is Essential for Nigeria's Future

Examining how broken business and loan agreements undermine trust, weaken Nigeria’s economy, and why honoring contracts is vital for sustainable growth and financial stability.

Introduction

In the intricate web of economic interactions, trust serves as the invisible thread that binds parties together, enabling commerce to flourish and societies to prosper. Yet, when this thread frays through deliberate breaches of contracts or defaults on loans, it unravels not just individual deals but the very fabric of national development. In Nigeria, a nation brimming with entrepreneurial spirit and vast potential, the betrayal of agreements has emerged as an insidious form of economic sabotage, akin to a traitor undermining the ranks from within. This article argues that honoring business and loan agreements is non-negotiable, a moral and practical imperative that safeguards prosperity. Drawing on investigative insights and data, we explore how violations by individuals, corporations, and public institutions erode trust, stifle growth, and perpetuate cycles of instability.

Historical & Cultural Context

Nigeria's commercial landscape has deep roots in pre-colonial traditions where trust was paramount, woven into the social and economic tapestry of diverse ethnic groups. Traditional markets, such as those in ancient Yoruba kingdoms or Hausa trading networks, operated on oral agreements and communal enforcement, where a person's word was their bond, backed by cultural norms of honor and reciprocity. As noted in historical analyses, customary trust systems predated British colonialism, with communities relying on equitable obligations akin to modern trusts to manage property and trade (Adeyemo, 2021). The advent of colonialism introduced formal contracts under English law, blending with indigenous values to form a hybrid system. However, post-independence, rapid urbanization and globalization strained these foundations, yet the cultural ethos of "omoluabi" (integrity in Yoruba) or "mutunci" (honor in Hausa) underscores that betrayal was traditionally viewed as a grave transgression against community harmony.

The Present Crisis

Today, Nigeria grapples with a pervasive crisis of agreement breaches that permeates private enterprises, political elites, and government entities. High-profile cases illustrate this malaise: judicial bribery and procurement fraud remain rampant, with surveys revealing widespread perceptions of corruption in contract awards (Chatham House, 2024). For instance, the government's escalating debt profile, fueled by unchecked loans, has raised alarms about potential defaults, as seen in debates over federal borrowing sprees (Channels Television, 2025). In the private sector, loan defaults by elites often masked through complex schemes exacerbate banking woes. Non-performing loans (NPLs) in Nigerian banks hovered around 5-10% in recent years, but spikes during economic downturns highlight systemic issues (Central Bank of Nigeria, 2024). Public institutions, too, falter: delays in paying contractors for infrastructure projects have led to abandoned ventures, costing billions in naira and eroding investor confidence (Vanguard, 2024). These breaches, often involving political figures evading obligations, transform agreements into mere paper tigers, fostering a culture where impunity reigns.

The repercussions of defaulting on agreements are profound, manifesting as economic hemorrhaging, reputational scars, and social discord. Economically, loan defaults diminish bank profitability and capital adequacy, with studies showing that high NPLs reduce lending capacity by up to 20%, stifling small businesses and growth (Achebe et al., 2024). In Nigeria, where NPLs reached 13% in 2016 amid oil price crashes, the ripple effects included bank recapitalizations and slowed GDP growth (IMF, 2017). Reputationally, defaulters be they tycoons or officials, tarnish Nigeria's image, deterring foreign direct investment (FDI), which plummeted 45% in 2023 due to perceived risks (World Bank, 2024). Socially, these betrayals breed inequality; when elites default on loans meant for public benefit, it exacerbates poverty, with 87 million Nigerians below the poverty line (World Bank, 2024). Metaphorically, such violations are like termites gnawing at the foundation of a grand edifice unseen at first, but ultimately causing collapse.

Comparative Insight

Contrasted with nations boasting robust contract enforcement, Nigeria's challenges stand in stark relief. In Singapore, ranked first globally for enforcing contracts with resolutions in just 164 days and costs at 25.8% of claim value, adherence is cultural and legal, fueling its economic miracle (World Bank, 2020). The UK and US fare similarly, with enforcement times of 437 and 370 days respectively, supported by efficient judiciaries and low corruption indices (World Bank, 2020). Nigeria, however, lags with 510 days and 27.2% costs, ranking 92nd, hampered by judicial delays and enforcement gaps (World Bank, 2020). This disparity underscores how strong adherence correlates with FDI inflows: Singapore attracts billions annually, whilst Nigeria's laxity perpetuates a vicious cycle of distrust.

Bad Debts and Their Ripple Effects

Building on that, bad debts are the toxic aftermath of those NPLs. When loans go sour, banks' capital shrinks, forcing them to cut lending by up to 20%, as per IMF studies from past crises. In Nigeria, this ripple effect is brutal: SMEs, the backbone of our economy, struggle to access credit, leading to job losses and stalled innovation. Socially, it's even worse with 87 million Nigerians below the poverty line (World Bank, 2024 data still relevant amid ongoing challenges), bad debts exacerbate inequality by diverting funds from public services.

Picture bad debts like termites gnawing at a wooden house: silent at first, but eventually, the structure collapses. Recent data from ThisDay shows average NPLs hitting N2.59 trillion in mid-2025, despite "improved" quality, a paradox driven by aggressive lending in a volatile economy. The implication? We need tighter regulations to prevent this cycle, or risk a full-blown banking crunch.

Dealing with Loan Defaulters

So, what about the loan defaulters themselves? These folks, from big-shot elites to struggling businesses – are often the villains in our story. In the public eye, they're traitors to trust, evading obligations while the rest of us pay the price. Nairametrics reported in June 2025 that Nigeria's debt surged over 1,000% in naira terms in a decade, with sovereign default risks looming if defaulters aren't held accountable.

Dealing with them requires a mix of legal muscle and cultural shift. Under Nigeria's Contracts Act, breaches are punishable, but enforcement is weak – disputes take 510 days on average, per older World Bank metrics, though subnational improvements in places like Edo State show promise. We need to name and shame, strengthen KYC rules, and promote whistleblower protections to deter future betrayals. After all, letting defaulters off the hook is like rewarding the fox for raiding the henhouse.

Summary:

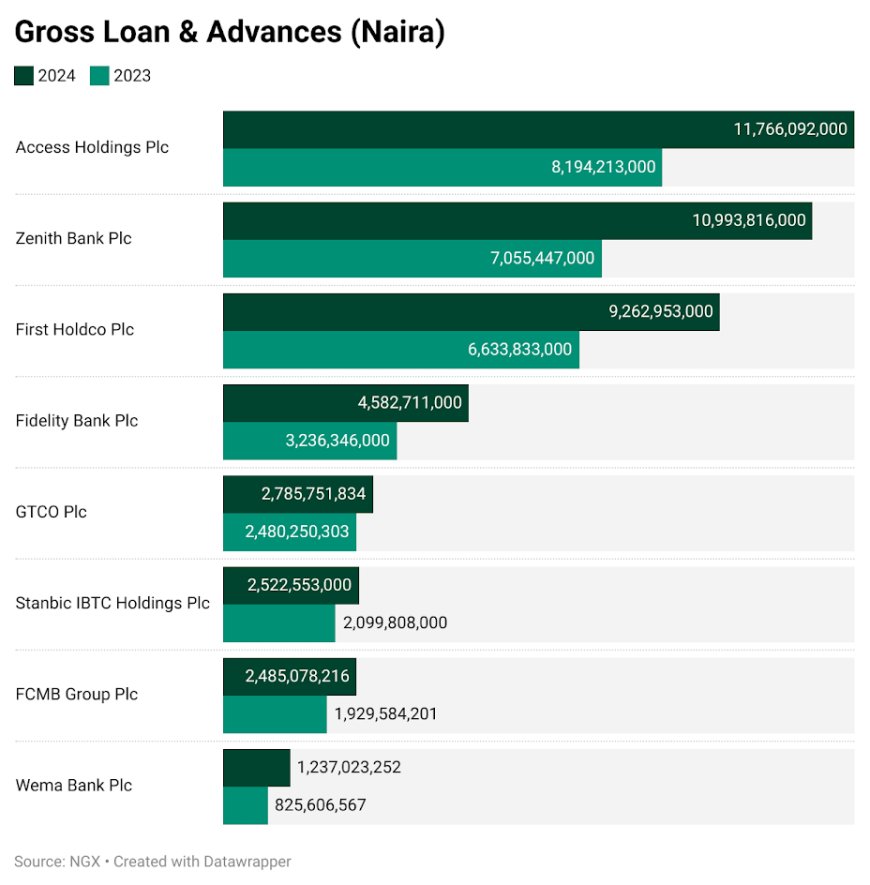

In 2024, Nigeria’s eight major banks recorded ₦2.59 trillion in non-performing loans (NPLs) against ₦45.64 trillion in gross loans, giving a ratio of about 5.7%. Sector-wide, NPL ratios stood at 4.2% in January 2025 and rose to 5.62% by April 2025, exceeding the CBN’s 5% prudential limit. This indicates a modest but notable deterioration in loan performance.

Moral & Legal Imperatives

Breaching agreements transcends legality; it embodies treachery against trust, community, and national ethos. Legally, Nigeria's Contracts Act and Evidence Act mandate enforcement, yet weak implementation allows "traitors" to evade justice. Morally, such acts violate the communal values of traditional Nigeria, where betrayal erodes social capital essential for development (Noma, 2022). Like Judas in biblical lore, defaulters sell out collective progress for personal gain, undermining the nation's quest for self-reliance. Reinstating honor in agreements is thus a patriotic duty, aligning with global norms where trust fuels innovation and stability.

Call to Action

To rebuild this fractured trust, Nigeria must enact bold reforms. Strengthen judicial independence to expedite contract enforcement, perhaps through specialized commercial courts as piloted in Lagos. Enhance banking regulations via stricter KYC and collateral requirements to curb defaults, building on CBN guidelines (Central Bank of Nigeria, 2024). Promote corporate governance via mandatory ethics training and whistleblower protections, drawing from anti-corruption frameworks (Chatham House, 2024). Citizens and leaders alike must champion a cultural shift: educate on the perils of betrayal and celebrate integrity-in-business champions of those who honnor loan contracts. Only through these steps can Nigeria transform from a land of broken promises to one of enduring prosperity.

KREENO Consortium is more than just a debt recovery agency, we are also a full-spectrum private investigative organization committed to upholding integrity-in-buisness culture across Nigeria’s private and public sectors. Kreeno Private Investigation Unit (KPIU) handles sensitive and complex cases, including: rape, blackmail, extortion, cyberbullying, internet fraud, investment scams, cryptocurrency scams, land scams, land grabbing, embezzlement, breach of contracts, missing assets, and employee evaluations. At the heart of our mission is a deep commitment to restoring trust, accountability, and justice in business and governance. We believe in partnering with well-meaning Nigerians who share our vision for national transformation: a vision rooted in creating equal opportunities, building a fair economy, and enabling every citizen to pursue their dreams without feeling the need to relocate or “japa” out of the country.

Kindly Contact KREENO Consortium Today: Turn losses into recoveries. Transform risks into resolutions. Convert obligations into outcomes.

Dr. Prisca Ndu

Director of Strategic Partnerships

KREENO Debt Recovery & Private Investigation Agency (Kreeno Consortium)Operational Office: The Kreeno Place

Plot 1, Rufus Ojeagbase Street, WAEC Estate, Off Abaren–Arogun Junction

Mowe–Ofada Road, Mowe, Ogun State, Nigeria

Phone: +234 803 459 3785

Email: info@kreenoholdings.com

Web: www.kreenoholdings.com | www.kreenoplus.com

What's Your Reaction?