Loan Default as Economic Sabotage: Why Nigeria Must Enforce Credit Discipline to Protect National Growth

Loan default in Nigeria has moved beyond isolated commercial disputes to become a systemic risk to economic stability and growth. This article explores how willful loan default and dishonoured cheques fuel non-performing loans, weaken banks, restrict credit to productive businesses, and undermine trust in commerce. It argues that weak enforcement and limited accountability have normalized financial indiscipline, transferring the cost of default to compliant borrowers and the wider economy. By reframing deliberate default as economic sabotage, the piece calls for stronger credit discipline, legal consequences, and coordinated regulatory action to protect Nigeria’s financial system and support sustainable national development.

-

Loan default threatens Nigeria’s economy, not just banks.

-

Most defaults are intentional, exploiting weak enforcement.

-

NPLs choke SMEs, inflate costs, and suppress job creation.

-

Accountability and investigative recovery are essential to restore trust.

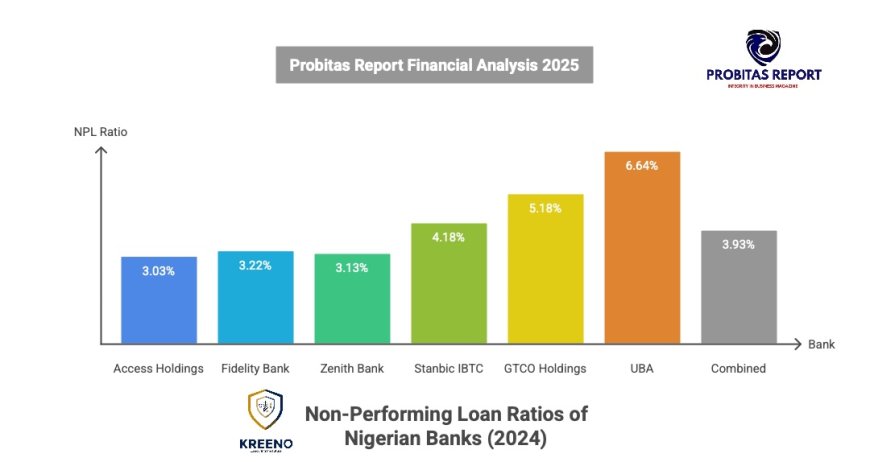

Let’s talk about a trillion-naira problem we’ve strangely learned to accept. It’s not about oil theft or cybercrime, but something that happens in polished offices, religious organizations, corporate SMEs, and through signed documents. We’re talking about the deliberate, willful refusal to pay back loans or tactical delay of paying back what is owed due to over familiarity with owners of financial institutions. As of Q3 of 2025, Nigeria is shouldering a staggering approximately ₦3.5trillion in non-performing loans (NPLs). That’s not just a number on a bank’s balance sheet; it’s capital stolen from our collective future.

For too long, we’ve treated loan default as a private mishap, a "business failure" between a lender and a borrower. This framing is not just lenient; it’s dangerously inaccurate. When an individual or corporation, with clear ability to pay, chooses instead to hide assets, issue dud cheques, or ghost their lenders, that’s not an accident of the market. It’s a calculated act. It’s economic sabotage.

This sabotage weakens the very pillars of our supposed renewed hope economy, distorts trust, and cripples national productivity. It’s time for a total paradigm shift in how Nigeria perceives, prosecutes, and punishes the intentional default. It's time to move from seeing this as a civil dispute to recognizing it as a crime against our collective economic integrity.

The Thin Line Between Business Failure and Intentional Default

First of, we must distinguish between misfortune and malice. No reasonable system punishes genuine business failure. A venture that collapses due to market shifts, unforeseen competition, or genuine operational challenges is a tragedy, not a crime. Our empathy should lie there.

But the data and daily realities point to a different, more insidious trend. A significant portion of our NPL crisis stems from intentional conduct. Think of the borrower who diverts a facility meant for machinery into luxury real estate or religious clergies paying heavy honorarium to spiritual fathers whilst owing huge chunks to their lenders. Consider the serial applicant who uses proxy BVNs to obtain multiple loans with no intention of repayment, a scheme often exposed by the EFCC and Kreeno Consortium. Recall the business owner who, on the eve of default, transfers assets to a spouse’s name or transfer liabilities to another sister company after which remove the spouse from the board.

These are not victims of economic shock; they are perpetrators of Behavioural Risk. They exploit a system with weak deterrence. A study on defaults in Nigerian commercial banks underscores that loan default rates significantly impact bank profitability, explaining a large variance in returns. This isn't about an unpredictable economy alone; it's about predictable human behaviour gaming a fragile system. The line is crossed when there is proof of intent when cash flows exist but are hidden, when assets are stripped, or when a dud cheque, a literal promise of funds, is issued knowing it will bounce.

READ MORE:

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

How Loan Default Translates Into National Economic Loss

The impact of this sabotage radiates far beyond the bank’s ledger or the money lender’s books. It’s a toxin that seeps into every layer of our economy. Let’s trace the poison.

1. Credit Starvation for SMEs: Banks and Money Lenders are not charities; they are risk managers. When willful defaults spike, they tighten lending for everyone. Interest rates skyrocket, sometimes above 30%, to cover potential losses. Who bears the brunt? The honest, collateral-poor genuine Small and Medium Enterprise (SME). SMEs, which employ about 80% of Nigeria’s workforce, are left gasping for capital. A Babcock University study confirmed this, finding that loan defaults have a direct and significant negative effect on the growth of cooperative societies, a vital SME funding channel.

2. The Inflation and FX Connection: Unrecovered loans represent idle, frozen capital. That’s money that should be circulating—building factories, hiring staff, creating goods. Instead, banks, burned by defaults, often park more funds in risk-free government securities. This crowds out the private sector and can distort yields. Furthermore, defaulters often divert dollar-denominated loans, worsening FX scarcity and pressuring the Naira. The capital flight isn't offshore; it's in the deliberate non-rotation of credit within our economy.

3. The Jobs That Never Were: Every loan not repaid is a business expansion halted, a new hire not made, an innovation not funded. It directly stifles industrial growth and job creation. Our ambition to build a $1 trillion economy is a pipe dream if the capital meant to fuel it is constantly being siphoned off by bad actors.

The table below contrasts the two paths: our current reality of normalized default versus a future of credit discipline and their starkly different outcomes for our national economic health.

|

Aspect of Economy |

The Cost of Normalized Default (Current Path) |

The Benefit of Credit Discipline (Desired Future) |

|

Credit Access |

Shrinking, expensive, defensive. Banks lend only to the ultra-secure. |

Expanded, more affordable. Risk-based pricing rewards trustworthy borrowers. |

|

SME Growth |

Stifled. SMEs cannot refinance or scale, leading to stagnation. |

Unleashed. Capital flows to viable ideas, driving innovation and expansion. |

|

Job Creation |

Low. Productive sectors are starved of investment. |

High. Growing businesses create sustainable employment. |

|

Institutional Trust |

Eroded. The system is seen as exploitable and unfair. |

Strengthened. Contracts are respected, encouraging more transactions. |

|

National GDP Growth |

Constrained, stuck in low single digits. |

Accelerated, as capital efficiency improves across the board. |

Non-Performing Loans as a Crisis of Enforcement, Not Finance

We have a profound Failure of Deterrence. Our legal and regulatory frameworks treat aggravated willful default with kid gloves. The process is slow, costly, and often ends in a civil settlement that allows the defaulter to walk away, assets intact, ready to repeat the offence.

Consider the Dishonoured Cheques Act. It provides for criminal liability for up to two years imprisonment for issuing a cheque without sufficient funds. This law recognizes a dud cheque as more than a broken promise; it’s a tool of fraud. Yet, enforcement is sporadic, and there’s even talk of repealing the act for being "too harsh." This is the heart of the problem: we are weakening the very mechanisms meant to uphold trust. As noted in an analysis on the legal consequences of dud cheques, the instrument is foundational to modern commerce; treating its abuse lightly undermines the entire system.

The Central Bank of Nigeria (CBN) and other regulators have tools, but the enforcement ecosystem is fragmented and lacks the teeth for criminal intent. Serial defaulters operate with impunity, moving from one bank to another or from one micro money lenders to nano money lenders, because there is no swift, certain, and severe consequence. This isn't a finance crisis; it's an enforcement crisis and there is need for a dedicated financial crime courts from these criminal proceedings as against the delay tactics of serial dud cheques issuers filing fundamental human rights to delay criminal investigation.

The Cost of Normalising Dishonoured Cheques in Commerce

A dishonoured cheque is the perfect metaphor for our national malaise. It’s a broken contract in its most tangible form. When we normalize “the cheque will clear… eventually,” or the notion that stopping a cheque is a simple business tactic, we erode the bedrock of commercial trust.

The consequences are hidden but severe. It increases transaction costs for everyone (more verification, more security). It strains business relationships and kills partnerships. It forces a regression to cash-based transactions, which is anti-growth in a digital age. A Probitas Report analysis outlines how bounced cheques create a cascade of operational, legal, and reputational damages that go far beyond the debt itself. By tolerating this, we are actively choosing a less efficient, more suspicious, and slower-growing economy.

Why Civil Remedies Alone Can No Longer Protect the Credit System

Relying solely on civil lawsuits for recovery is like using a watering can to put out a forest fire. It’s inadequate by design. Civil cases can take years. They allow defaulters to hide assets through complex legal manoeuvres. The penalty, even if the lender wins, is often just the repayment of the original sum, with little punitive cost for the years of sabotage conducted.

This system protects the saboteur and not the lender. It turns a criminal act of economic destruction into a leisurely civil negotiation. When the cost of getting caught is merely being asked to pay what you owed anyway (often with a discounted settlement), crime pays. We must escalate the toolkit for aggravated, willful default cases proven with evidence of diverted funds, fraudulent documentation, or serial history into the criminal realm.

Investigative Debt Recovery as Economic Infrastructure

This is where the narrative needs to flip. Professional, investigative debt recovery is not a hostile act against business; it is a pillar of economic order. Agencies like KREENO Debt Recovery & Private Investigation Agency exemplify this shift. This isn’t about thuggery or harassment. It’s about asset tracking, forensic accounting, loan contracts documentary Evidence, BVN tracing, asset mapping, and intelligence-led operations to locate diverted funds and hidden assets in strategical partnerships with law enforcement agents.

Such work restores circulative fairness. It returns trapped capital to the system so it can be re-lent to genuine entrepreneurs who exhibit the integrity-in-business behaviour. It acts as a powerful deterrent: when defaulters know skilled investigators will pursue them, the calculus changes. Positioning this sector as a critical part of our economic infrastructure is essential. It’s the immune system responding to an infection.

What Policymakers Must Rethink About Credit Discipline in Nigeria

The call to action is clear and targeted. Our lawmakers, the CBN, and enforcement agencies need a new playbook.

1. Legislative Redefinition: A new law or amendment must classify Aggravated Willful Loan Default and Fraudulent Cheque Dishonour as acts of Economic Sabotage. Criteria must include intent, proven through diversion of funds, asset stripping, or a pattern of serial defaults or serial dud cheques issuing.

2. Criminal Liability: For defaults above a specific threshold (e.g., ₦2 million) with proven intent, mandatory criminal penalties of 5-10 years imprisonment should apply, alongside full restitution with present time value of the loan as per loan contract agreement.

3. Supercharge the Credit Registry: The CBN’s Credit Risk Reporting Management System must be made more robust, public, and punitive. Serial defaulters should have their names, BVNs, NIN, Digital Social Media Handles, and photographs published and be barred from accessing any form of credit in Nigeria for 7-10 years. Sunshine is the best disinfectant.

4. Empower Investigative Recovery: Give agencies like the EFCC, PSFU, and professional recovery firms like Kreeno Debt Recovery and Private Investigative Agency a clear mandate and streamlined process to investigate and asset-trace in complex default cases, treating them like the financial crimes they are without sentiments. What is a criminal case must be handled by those empowered by law to prosecute such whilst those for civil must have fast track attention so as to redeem the value of the loan borrowed.

From Leniency to Accountability: Rebuilding Trust in Nigerian Finance

The path forward is from Leniency to Accountability. We’ve seen this work before. The post-2009 banking crisis cleanup, spearheaded by AMCON, showed that aggressive recovery and systemic enforcement can slash NPLs from catastrophic levels to under 5%. We now need a much more rigor applied to the wider market introducing the emerging private investigative industry based on the New Police Act of 2020 so as to strengthen the professional debt recovery process being private sector driven in partnership with law enforcement.

The 2025 Tax Reform Laws, which allow for six-year retrospective assessments for willful defaulters, show a shifting mindset, a recognition that this is a fiscal crime. We must build on this.

Rebuilding trust is not just a feel-good slogan; it’s an economic imperative. When trust in the credit system is high, capital is cheaper with risk fairly priced, and more abundant. Transactions happen faster. The economy grows. By refusing to tolerate the saboteurs and "business rapists" as Dr Ohio O. Ojeagbase calls them, we protect the dreams of the honest entrepreneurs, the workers waiting for a job, and the nation’s journey to prosperity and thriving economy for all.

Nigeria stands at a crossroads. We can continue to allow a culture of impunity to drain our economic lifeblood, or we can choose to defend it now as the level of insecurity is getting higher so is the level of loan defaulters who are committing business genocides are on the increase, so a state of emergency is needed to be declared over financial crime and non performing loans in Nigeria. Redefining willful loan default as economic sabotage isn’t about being punitive; it’s about being protective. It’s about declaring that the collective economic well-being of over 210 million people is more important than the illicit gain of a few. It’s time to make that choice.

Those who repeatedly issue dishonoured cheques and evade repayment are not merely negligent actors. They destabilise trust, cripple lenders, and undermine the very foundations of commerce. Addressing this menace decisively, beginning now, would send a clear signal that the era of consequence-free default is over. If the first term of the President Bola Ahmed Tinubu’s administration is to leave a lasting economic legacy, restoring credit discipline and enforcing accountability must be among its earliest and boldest acts. The dishonored cheques issuers and loan defauters are actual “economic terrorists” that we need to wage war against.

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

© 2025 Probitas Report – All Rights Reserved. Reproduction or redistribution requires explicit permission.

What's Your Reaction?