The Gavel of Uncertainty: How a Broken Judiciary Drives Billions from Nigeria's Economy

Explore how Nigeria’s judicial inefficiencies and delayed rulings undermine economic growth, erode investor confidence, and drive billions out of the economy.

LAGOS, Nigeria – On the edges of Abuja, miles from the city center, an unfinished industrial zone stretches across land - empty, silent, untouched by progress. This shell of a project does not reflect lost ambition; it reflects breached words between parties. A global group once behind its funding now tangled in courtrooms, arguing their money pledged to fair terms was instead met with deliberate disregard. Five years since work stopped, still: rulings delayed, verdicts unclear. A source close to the venture - asking not to be named - puts it directly: “No more money will go into Nigeria, plain and simple.” Courts, they say, are where money vanishes without trace.

There is one story that weaves its way through the fabric of an economy that is stagnant, and a judicial system in disarray. The headlines scream about the rampant theft and violence in the country, but below it all, there is another crisis brewing - a judiciary that has no accountability for their actions. The decisions are intentionally stretched to the limit, manipulated by those wearing black robes, while strong men disregard decisions made with full transparency and openness before the public eye. Fairness becomes unbalanced and speculative, rather than based on certainty. A move like this pulls money out quietly out of Nigeria, sends a clear message to would-be investors, then slows down the country's economy, root and all.

The Anatomy of Impunity

In Nigeria, judges often act without consequences. One way this shows up is through endless waiting. Court cases meant to be about money matters sometimes drag on ten years. This happens on purpose, just to wear people down. Sometimes it's about squeezing compromises from opponents. Time gets used like leverage. One reason ties to claims of "cash-and-carry" justice - decisions swayed less by law, more by bribes. Public anger flares when big fights between companies or politicians play out in what feels like biased rulings. Then comes the deeper issue: courts being ignored. Officials acting under orders, strong figures - they treat judicial mandates like suggestions. That kind of defiance chips away at trust faster than any scandal. Should the government ignore court rulings, it shows rules feel more like advice than mandates.

Barrister Ebele Okoli, a legal expert based in Lagos, puts it this way: “When a court order gets ignored by a public body, someone who invests money might wonder - why protect my agreement if yours isn’t respected too? Trust in business rules rests on consistency. Yet here, in Nigeria, that consistency exists only in talks and not in reality.”

A tale of global concern wraps around the P&ID affair. Starting as a simple business disagreement, it grew - swelling costs by billions for Nigeria. Allegations of secret payments added fuel; so did gaps in how laws protected the country early on. Even after officials moved to reverse the ruling, cracks remained visible: weak agreements, twisted court processes.

MORE NEWS:

- Be Careful Who You Allow Into Your Chamber. Biblical Wisdom on Access, Influence, and Destiny

- The Currency of Trust in Lagos Markets | Integrity & Business Ethics in Nigeria

- How Banks Create Money Through Lending, A Clear Guide to Credit Creation and Modern Financial Intermediation

The Direct Economic Cost: FDI in Free Fall

It’s very obvious that what the data are telling us is that despite good expectations for growth, Nigeria is drawing a lot less foreign direct investment (FDI) than comparable countries. The World Bank has been tracking the FDI gap as well as other indicators such as the ease of doing business rankings for many years, and Nigeria has consistently ranked low on both fronts. Among the specific issues with enforcement of contracts was the need to enforce contracts. Investors have complained about a lack of protections for investors, as well as the lack of transparency in regulatory affairs.

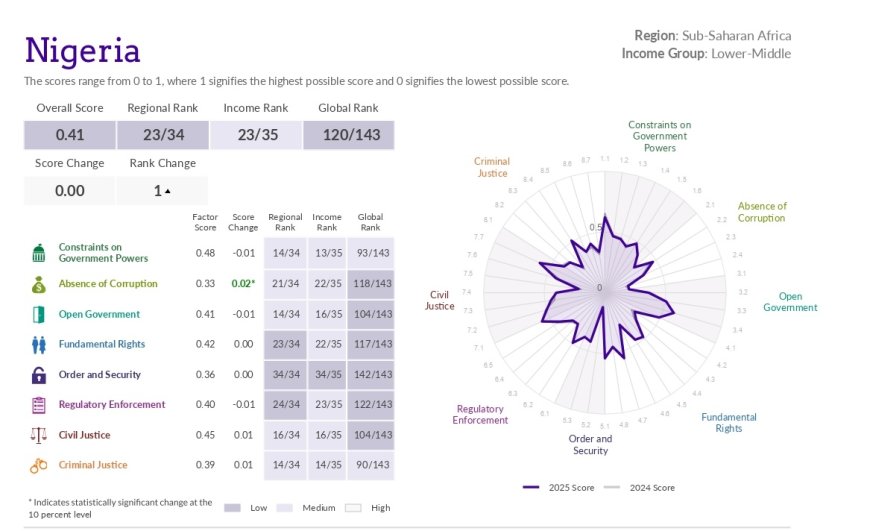

In 2025, Nigeria ranked 120th of 143 countries in the World Justice Project's rule of law index. Nigeria rated much lower than most all of its peers regarding access to civil justice and regulation.

“Risk has one main connection to why there isn’t more money invested in Nigeria,” Dr. Ohio O, Ojeagbase the Chief Private Investigator General of Kreeno Consortium said. "Where money goes is shaped by the degree of perceived risk." When judges ignore the law, it creates fear of the law being ignored for reasons unrelated to politics or money problems. All of these fears add to the overall uncertainty that affects the country, including safety and fluctuations in the value of the currency and therefore make managing everything seem impossible. It can take a clearly defined business risk and turn it into a vague risk that cannot be quantified.

The more you take a look at an industry by industry basis the better it will be to see where the big problems are in terms of spending and how those will affect your ability to grow. The industries that need large amounts of capital to operate (and thus have long term contracts) and that require stable market conditions (such as transportation, energy, telecommunications and other "high-tech" manufacturing areas) are the ones that will be impacted the most. Because these businesses depend on long-term contracts and/or agreements with customers or suppliers, there is more opportunity for litigation. On the flip side, many other types of trading continue to occur on a daily basis at very high volumes, but do not create sustainable change or generate long-term jobs.

That time in 2015, MTN faced a huge penalty of $5.2 billion from Nigerian authorities. Shocking, really. What began as a single decision snowballed into legal confusion. Eventually cleared, yet the damage was done. Investors everywhere took notice, not just because of the amount, but because it felt like rule book chaos. To some, it wasn’t about one case alone. More like proof of how uneven the process could be, where power tilted too far toward enforcement.

READ MORE:

- Non-Performing Loans Are Not Accidents. How Weak Enforcement Is Strangling Nigeria’s Productive Economy

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

The Rot Within: Governance of the Bench

What lasts is shaped less by external pressures than by how power operates inside courts themselves. Appointments often draw blame for being unclear, tangled in politics, which casts doubt right away on real autonomy. Worse still, the system meant to punish misconduct being handled by the National Judicial Council moves too slowly, acts too cautiously, whilst reserving harsh penalties only when scandals force its hand.

What stands out is how deeply this kind of immunity cuts into fairness itself. As lawyer Ibrahim Bello puts it - with two and a half decades under his belt, the machinery shields its members while commerce suffers. Case in point: if a jurist gets away scot-free after holding up court for five full years, the whole idea of fairness bends beyond recognition. What happens inside often gets worse because courts keep getting ignored. When money for judges stays far too low, pay drops, making them more open to dishonest deals - at the same time, basic systems, both online and offline, start to collapse. So, cutting back on funding does not merely slow things down - it pushes corruption even further underground.

Could this lead somewhere?

Fixing the system requires different pieces working together. Start by upgrading tech across court operations such as using online submissions and tight deadlines that must be followed - in dedicated business jurisdictions. Another path: open up court decisions so people can see them online, while also sharing how well courts perform. Beyond that, what matters most is building up the National Judicial Commission not just independent but actually capable of acting fast when judges break the rules. It needs both authority and real determination to probe misconduct without delay and make consequences known to everyone involved.

Dr Ohio O. Ojeagbase makes it boldly clear: "This isn’t about adding new court buildings or brand new official vehicles," he says. "What matters is building an iron clad integrity-in-business mentality and strong will to deliver timely justice and follow up with immediate execution of court judgments." One clear example being a judge fired and punished for bribery would help investors more than all those talk events combined.

Floating above the ground are empty docks, silent mills. Attention fixes on crude and stocks, yet something graver plays out behind closed doors: delayed rulings, blocked claims, rulings whispered to winners. Where rules weaken, money vanishes fast. Only when a decision means something beyond speech will Nigeria’s progress move forward. The price tagged to court immunity shows up in broken incomes, vanished hopes, and a stalled collective future.

If court failure drains value from Nigeria’s economy, you need a partner built to protect transactions before disputes turn toxic. KREENO works ahead before deals break down and evidence gets buried. You gain structured debt recovery, private investigation, and governance controls designed for high-risk environments. You receive traceable recovery actions, asset location, contract enforcement support, and integrity audits tied to board oversight. You reduce exposure to stalled judgments through early-stage risk screening, dispute intelligence, and compliance systems aligned with business law practice. When uncertainty threatens capital, you move with KREENO to secure obligations, document facts, and enforce accountability through disciplined financial performance security reviews.

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

What's Your Reaction?