Nigeria’s Renewed Fiscal Focus: Reducing Borrowing and Growing Domestic Investment

Nigeria shifts fiscal policy toward lower public borrowing and stronger domestic investment. Learn how debt control, local capital growth, and policy reforms shape economic stability.

Navigating Global Uncertainties and Strengthening Nigeria's Economic Resilience

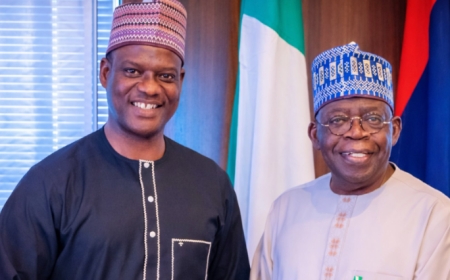

In the face of a rapidly evolving global landscape, Nigeria's Finance Minister, Wale Edun, has outlined a strategic vision to steer the country's economy towards greater self-reliance and sustainable growth. Amidst the backdrop of trade tensions, geopolitical shifts, and the lingering effects of the pandemic, Nigeria is determined to chart a course that reduces its reliance on borrowing and instead focuses on bolstering domestic investment and resource mobilization.

Edun's remarks at the World Economic Forum's annual meeting in Davos, Switzerland, provide a glimpse into Nigeria's renewed economic agenda. As the country grapples with a widening budget deficit and a high debt-to-revenue ratio, the government is taking proactive steps to address these challenges and position Nigeria as an attractive investment destination.

MORE NEWS:

- Be Careful Who You Allow Into Your Chamber. Biblical Wisdom on Access, Influence, and Destiny

- The Currency of Trust in Lagos Markets | Integrity & Business Ethics in Nigeria

- How Banks Create Money Through Lending, A Clear Guide to Credit Creation and Modern Financial Intermediation

Embracing Domestic Resource Mobilization and Reducing Reliance on Debt

One of the key priorities for the Nigerian government, as outlined by Edun, is to shift its focus towards domestic resource mobilization. The minister emphasized the need to "focus on revenue, focus on domestic resource mobilization" as a means to reduce the country's dependence on borrowing.

To achieve this, the government has introduced a series of tax reforms, including the implementation of four new tax acts that are designed to be "pro-poor" and help increase the country's tax-to-GDP ratio from the current 13% to a targeted 18% in the near future. Additionally, the government is leveraging technology and automation to enhance tax collection, block leakages, and improve overall fiscal efficiency.

Edun also highlighted the government's efforts to engage the private sector more actively, recognizing that the private sector accounts for 90% of Nigeria's GDP. By offering improved incentives and creating a more conducive investment environment, the government aims to encourage Nigerians, including the diaspora, as well as foreign investors, to increase their savings and direct their investments into the Nigerian economy.

Diversifying Funding Sources and Exploring Regional Partnerships

While the government's primary focus is on reducing its reliance on borrowing, Edun acknowledged that Nigeria maintains the latitude to access international bond markets if necessary. However, he emphasized that the government's preference is to explore alternative funding sources, particularly through regional partnerships and the African Continental Free Trade Area (AfCFTA).

One such partnership that the Nigerian government has recently signed is a Comprehensive Economic Partnership Agreement (CEPA) with the United Arab Emirates. This agreement is expected to facilitate increased trade and investment flows between the two countries, providing Nigeria with additional avenues to secure funding and attract foreign direct investment.

Edun also expressed optimism about the potential of the regional Ecowas (Economic Community of West African States) market and the continental AfCFTA to serve as alternative sources of funding and investment opportunities for Nigeria. By leveraging these regional economic blocs, the government aims to reduce its dependence on traditional multilateral institutions, such as the International Monetary Fund (IMF), which Edun noted are "always there" but may not align with Nigeria's current priorities.

Maintaining Macroeconomic Stability and Investor Confidence

Alongside its efforts to reduce borrowing and mobilize domestic resources, the Nigerian government has also made significant strides in stabilizing the country's macroeconomic environment. Edun highlighted several key indicators that have improved under the leadership of President Bola Ahmed Tinubu, including:

- Increased foreign exchange reserves

- Reduced inflation rate

- Stable exchange rate

- Improved economic growth, with the GDP projected to grow by 4.23% in 2025

These achievements have helped to restore investor confidence in Nigeria, making the country a more attractive destination for both domestic and foreign investment. Edun emphasized that the government's focus is on maintaining this positive trajectory and further enhancing the country's investment climate.

Navigating Global Uncertainties and Strengthening Multilateralism

The global economic landscape has been marked by increasing uncertainty and a shift away from multilateralism, with the Trump administration's policies on trade and Greenland being cited as examples. Edun acknowledged that this environment poses challenges for countries like Nigeria, as it can lead to reduced trade, less growth, and fewer investment opportunities.

However, the Nigerian government remains optimistic and is determined to navigate these uncertainties by strengthening its engagement with the international community. Edun expressed the hope that there will be a "pull back from fragmentation" and a return to more predictability, certainty, and multilateralism in the global economic order.

To this end, the Nigerian delegation in Davos is actively engaging with investors and partners from around the world, including the United States. Edun emphasized that Nigeria is well-positioned to offer value-added opportunities, such as its growing capacity to refine and process its natural resources, rather than just exporting raw materials.

By diversifying its funding sources, strengthening regional partnerships, and maintaining a stable macroeconomic environment, Nigeria aims to weather the global uncertainties and position itself as an attractive investment destination. The government's commitment to reducing borrowing and relying more on domestic resources is a key part of this strategy, as it seeks to build a more resilient and self-reliant economy.

READ MORE:

- Non-Performing Loans Are Not Accidents. How Weak Enforcement Is Strangling Nigeria’s Productive Economy

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

Conclusion: Charting a Sustainable Path Forward

Nigeria's Finance Minister, Wale Edun, has outlined a comprehensive strategy to steer the country's economy towards greater self-reliance and sustainable growth. By focusing on domestic resource mobilization, reducing reliance on borrowing, and diversifying funding sources, the Nigerian government is taking proactive steps to address the country's fiscal challenges and position it as an attractive investment destination.

The government's efforts to maintain macroeconomic stability, strengthen regional partnerships, and navigate the global uncertainties demonstrate its commitment to building a more resilient and prosperous economy. As Nigeria continues to implement its "Renewed Hope" agenda under the leadership of President Bola Ahmed Tinubu, the country's journey towards economic transformation and poverty alleviation holds promise for the future.

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

What's Your Reaction?