Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

Based on Dr. Ohio O. Ojeagbase’s groundbreaking book Navigating Modern Debt Collection in Nigeria, this guide empowers Debt Recovery Officers in Nigerian banks with global best practices, legal frameworks, and ethical standards. It explores how integrity, technology, and professionalism can transform debt recovery into a nation-building enterprise.

This training guide is based on the e-book titled “Navigating Modern Debt Collection in Nigeria: A Comprehensive Guide” by Dr. Ohio O. Ojeagbase (FICA, SFIDR). It is rewritten to educate Debt Recovery Officers in Nigerian banks, combining the book’s depth with global best practices, ethics, and regulatory context all positioned to strengthen the professionalism and strategic mindset of officers in the field.

1. Introduction: The Moral and Legal Mandate of Debt Recovery

Debt recovery is not merely a business operation. It is the moral backbone of financial stability, national integrity, and investor confidence. Dr. Ohio O. Ojeagbase, Africa’s foremost authority on debt recovery and corporate governance, defines it as “the ethical art of restoring trust between debtor and creditor in a manner that preserves dignity and upholds justice.”

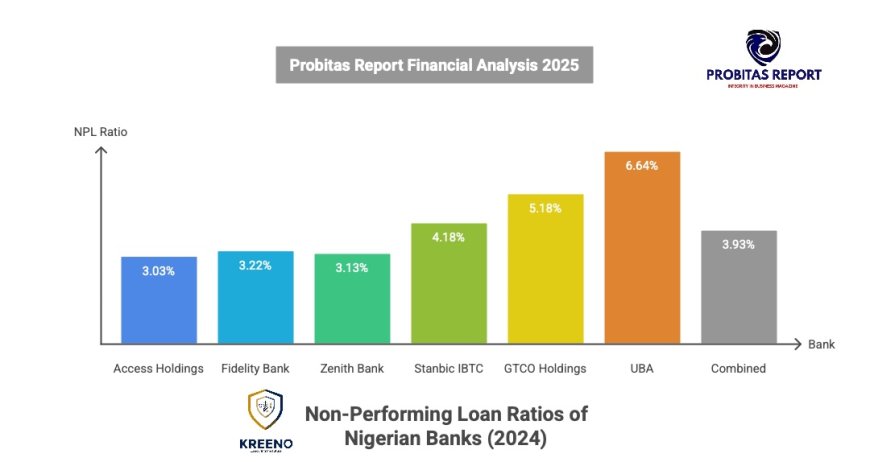

In the Nigerian banking system, where over ₦20 trillion in loans circulate through both commercial and microfinance institutions, debt recovery officers stand at the intersection of law, ethics, and economics. Their conduct determines whether Nigeria’s credit system strengthens or collapses under the weight of non-performing loans (NPLs).

This summary provides a professional learning framework drawn from Ojeagbase’s Navigating Modern Debt Collection in Nigeria and other global best practices. It is designed to equip Nigerian bank officers to recover debts ethically, lawfully, and intelligently while adapting to evolving technologies and consumer expectations.

Types of Debt in Nigeria

1. Secured Debt

This is backed by collateral or an asset. If the borrower defaults, the creditor can take possession or sell the asset (e.g., mortgage-backed loans, post-dated cheques, pledged property).

2. Unsecured Debt

This type of debt is not backed by collateral. It relies on the trust and creditworthiness of the debtor. It is common with service contracts or informal loans.

3. Guaranteed Debt

This involves a third party (guarantor) who agrees to repay the debt if the debtor defaults. In such cases, the creditor can sue the guarantor directly.

Note: A debt can also arise from a breach of contract, not just loans only. For instance, failure to pay for delivered goods or services also constitutes a recoverable debt.

When Does an Obligation Become a Debt?

For an obligation to qualify as a recoverable debt, it must meet the following:

-

Be liquidated and specific (i.e., a definite amount)

-

Have a due date that has passed

-

Arise from a contractual or legally recognised obligation

2. The Evolution of Debt Collection in Nigeria

Historically, debt collection in Nigeria was informal, largely reliant on social reputation and communal pressure. Dr. Ojeagbase documents how debt enforcement transitioned from traditional authority to regulated professionalism with the rise of modern banking laws and the Central Bank of Nigeria (CBN)’s regulatory framework.

The 1980s to 2000s witnessed crude recovery methods such as harassment, threats, and public shaming. These practices eroded public trust and exposed financial institutions to legal risks. With the emergence of the Consumer Protection Act (2019) and Bankrupty Act, the paradigm shifted toward professional ethics, structured negotiations, and consumer dignity.

Globally, debt recovery evolved similarly. The U.S. Fair Debt Collection Practices Act (1977) and UK Financial Conduct Authority (FCA) Code of Conduct outlawed intimidation and emphasized fairness, setting models for emerging economies. Today, Nigerian Debt Recovery Officers must align with these standards to sustain credibility and avoid regulatory sanctions.

3. The Legal Framework Guiding Debt Recovery in Nigeria

Every recovery officer must know the legal compass that guides their work. According to Dr. Ojeagbase, ignorance of the law is the first step to professional failure.

Key Legal Instruments:

-

Companies and Allied Matters Act (CAMA): If you are dealing with a corporate debtor, this law is your go-to. It outlines the rules for suing a company, appointing receivers or liquidators, and even winding up a business that is unable to pay its debts.

-

Banking and Other Financial Institutions Act (BOFIA): This one applies mostly to banks and licensed financial institutions. It protects creditors and regulates how financial institutions handle debt-related matters; especially when it comes to non-performing loans or insider lending.

-

Sheriff and Civil Processes Act: Ever wondered how the court enforces judgments? This is the Act that guides how you can go after a debtor’s assets once you’ve gotten a favorable ruling. It covers everything from writs of execution (like FIFA) to the attachment of assets.

-

Rules of Court (High Court, Federal High Court, etc.): Every court has its own procedural rules. Whether you are filing a case in the State High Court or Federal High Court, you need to follow their specific formats for filing claims, affidavits, motions, and enforcement processes.

-

Insolvency and Bankruptcy Laws: If your debtor has reached the point of no return, you can explore bankruptcy (for individuals) or liquidation (for companies). These laws provide a way to either recover your share of the remaining assets or get a court to wind up a company that is no longer viable.

A recovery officer must operate with threefold awareness: legal compliance, ethical integrity, and reputational caution. Each contact, phone call, or email is a potential legal record. Documentation, consent, and respectful tone are therefore not optional — they are risk shields.

4. The Ethics of Debt Recovery: Integrity as a Currency

Dr. Ojeagbase emphasizes that “debt recovery without ethics is extortion.” The core of ethical debt collection lies in empathy, transparency, and the protection of human dignity.

Ethical debt recovery means:

-

Never humiliating or intimidating debtors.

-

Providing accurate, verified information about the debt.

-

Allowing negotiation and restructuring where possible.

-

Maintaining confidentiality and privacy.

-

Recording all communications transparently.

Banks that institutionalize ethical recovery enjoy higher repayment rates and public trust. In contrast, unethical conduct can result in FCCPC sanctions, reputational loss, or civil litigation.

Global Context:

-

In Canada, collectors must give written notice before any contact.

-

In South Africa, the National Credit Regulator ensures collectors are licensed and subject to consumer rights audits.

-

In Nigeria, Dr. Ojeagbase’s KREENO Consortium introduced the Integrity-in-Business Recovery Model (IBRM), which trains officers to balance assertiveness with ethics.

5. Technology, Artificial Intelligence, and the Future of Debt Collection

The book highlights technology as the new frontier of recovery. Artificial Intelligence (AI) and data analytics allow lenders to predict debtor behavior, automate follow-ups, and reduce default risks.

Applications of AI in Recovery:

-

Predictive analytics to identify likely defaulters early.

-

Automated SMS/email reminders.

-

Chatbots for 24/7 payment support.

-

Machine learning algorithms for personalized negotiation (KREENO RiskHR and E-Commander are readily available)

However, Ojeagbase cautions that technology must be used with restraint and ethical oversight. Data misuse, algorithmic bias, or lack of human empathy can destroy consumer trust.

Global Insight:

-

In the U.S., AI tools like TrueAccord use behavioral science to enhance cooperation.

-

In the UK, Experian’s Debt Analytics Platform uses AI to segment debtor profiles.

-

KREENO’s innovation in Nigeria mirrors these by integrating Human-AI collaboration, ensuring digital efficiency does not erode personal accountability.

6. Understanding Consumer Rights

Modern recovery officers must act as educators, not enforcers. Debtors have rights — and respecting them enhances compliance.

Core Consumer Rights:

-

Right to accurate information.

-

Right to dispute errors.

-

Right to privacy and data protection.

-

Right to fair treatment and non-harassment.

Dr. Ojeagbase notes that many recovery officers lose cases because they violate these principles unintentionally. Each recovery must therefore be framed as a dialogue, not a threat except if the customers stray from his.

Educating debtors builds financial literacy, reduces resistance, and encourages voluntary repayment the most sustainable form of recovery.

7. The Role of Social Media in Debt Collection

Social media has become both a powerful communication tool and a reputational minefield. Dr. Ojeagbase warns against using public platforms to shame debtors, calling it “a violation of financial ethics and a misuse of technology.”

Instead, banks should use social media for:

-

Financial education campaigns.

-

Digital dispute resolution portals.

-

Positive brand communication that fosters trust.

Case Study:

In 2023, a Nigerian microfinance bank faced FCCPC sanctions for publishing debtor photos on Instagram. This incident reinforced the principle that digital ethics are public ethics.

8. Cross-Border and Corporate Debt Recovery

With the growth of Pan-African trade and international credit lines, cross-border recovery now defines the next frontier of banking operations.

Challenges include:

-

Differing legal systems.

-

Currency exchange risks.

-

Cultural communication barriers.

Ojeagbase advises institutions to build strategic partnerships with foreign recovery firms, lawyers, and regulatory agencies. KREENO Consortium’s success in handling multinational recovery cases is attributed to its cross-border compliance structure, mirroring European Union standards for international debt enforcement.

Global Authorities Referenced:

-

Hague Convention on the Service Abroad of Judicial Documents

-

UNCITRAL Model Law on Cross-Border Insolvency

These frameworks enable Nigerian banks to pursue recovery legally in foreign jurisdictions.

9. Training, Certification, and Professionalization of Recovery Officers

Dr. Ojeagbase calls for a “new breed of recovery officers who are financially intelligent, legally sound, and emotionally disciplined.”

To this end, training and certification are vital. Officers must be versed in:

-

Legal procedures for recovery.

-

Negotiation and mediation skills.

-

Digital communication ethics.

-

Forensic investigation of fraudulent defaults.

Institutions like KREENO Debt Recovery and Private Investigation Agency and the Institute of Debt Recovery Practitioners of Nigeria (IDRPN) are leading this transformation by setting global benchmarks for certification and professional conduct.

Globally, organizations like the Credit Services Association (UK) and the American Collectors Association (ACA International) have set similar models. Nigerian banks are encouraged to align their internal training with these standards.

- Innocent Ike Appointed as Access Holdings’ Group CEO

- Blackmail and Extortion in Nigeria and The Punishment in The Law

- Moral Minefield or Smart Move? The Silent Epidemic of Strategic Defaulters in Nigeria’s Lending System

- Celebrating The Birthday Of The King Of Debt Recovery In Nigeria 2024

- Rape In Nigeria Law: Penalties, Legal Complexities Explained

10. Global Comparisons: How Nigeria Measures Up

Comparative Debt Recovery Benchmarks (2025) prepared by Probitas Report

|

Country |

Avg. Non-Performing Loan (NPL) Ratio |

Regulatory Strength |

Ethical Enforcement Level |

Use of AI & Data |

|

Nigeria |

5.1% (CBN, 2025) |

Moderate |

Growing |

Emerging |

|

South Africa |

3.2% |

High |

High |

Advanced |

|

Kenya |

12.7% |

Strong |

Moderate |

Moderate |

|

Ghana |

15.5% |

Weak |

Developing |

Low |

|

Egypt |

4.3% |

Strong |

High |

Moderate |

|

Angola |

18.6% |

Weak |

Developing |

Low |

|

USA |

1.5% |

Very Strong |

Mature |

Advanced |

|

UK |

1.2% |

Very Strong |

Mature |

Advanced |

|

Canada |

1.3% |

Very Strong |

Mature |

Advanced |

The table shows that whilst Nigeria’s financial recovery system is improving, its ethical and technological frameworks still lag behind mature economies. Ojeagbase’s advocacy centers on bridging that integrity-in-business gap through structured ethics, continuous training, and data-driven modernization.

11. Compliance and Best Practices for Bank Officers

Core Best Practices from Dr. Ojeagbase’s Framework:

-

Verify Before You Engage – Always confirm debt validity, account ownership, and amount accuracy.

-

Document Everything – Every call, message, or meeting should be recorded in line with CBN compliance standards.

-

Engage, Don’t Intimidate – Emotional intelligence is more persuasive than aggression.

-

Negotiate with Dignity – Explore restructuring, refinancing, or settlement where appropriate.

-

Leverage Technology – Use AI and CRM systems for accuracy and timely follow-ups.

-

Stay Legal and Ethical – Always align actions with the FCCPC, NDIC, and CBN codes.

-

Protect the Brand – Remember: every recovery manager represents the bank’s reputation.

12. The Future of Debt Recovery: Intelligence, Not Intimidation

The global shift is clear: debt recovery is no longer about force, but forensics, empathy, and digital intelligence. Dr. Ojeagbase envisions a future where recovery officers are data scientists as much as negotiators, using predictive analytics to prevent defaults rather than chase them.

He argues that Nigeria’s economic recovery depends not on more lending, but on more ethical repayment systems. The sustainability of the banking sector will rest on whether recovery officers evolve into strategic value protectors, not mere collectors.

13. Key Takeaways for Debt Recovery Managers

-

Debt recovery is governance in action by enforcing accountability and restoring trust.

-

Knowledge of the law is your greatest asset; ignorance is your biggest liability.

-

Ethics is profitability. Integrity-driven recovery yields better long-term repayment and customer retention.

-

Technology is your ally so master it, but let it serve people, not replace humanity.

-

Communication is strategy. Respectful dialogue recovers more debt than threats ever can.

-

Global learning is essential. Adapt best practices from mature markets to Nigeria’s reality.

-

Dr. Ohio O. Ojeagbase’s principle: “Debt recovery done with conscience transforms institutions into custodians of national integrity.”

14. Conclusion: Building an Integrity-Driven Financial System

As Nigeria strives to strengthen its economic foundation under the Renewed Hope Agenda of President Bola Tinubu, the ethical reformation of debt recovery remains a non-negotiable pillar. The lessons from Navigating Modern Debt Collection in Nigeria call for a new era of debt collectors well trained, licensed, emotionally intelligent, and globally aware.

Dr. Ojeagbase’s philosophy, grounded in both business integrity and divine accountability, offers Nigeria a roadmap toward financial justice. His framework transforms debt recovery from a reactive process into a strategic, moral, and nation-building enterprise.

In essence:

The modern Debt Recovery Officer must think like a lawyer, act like a diplomat, and lead like a reformer because integrity in business, not intimidation, is the new frontier of financial power.

Contact Us: Chidera Paul of Kreeno Debt Recovery And Private Investigation Agency (KREENO CONSORTIUM) Email: agentjoyce@kreenoplus.com WhatsApp: 0902 148 8737 and visit www.probitasreport.com to read more around debt recovery and integrity in business.

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?