AMCON Achieves 87% Recovery, Repays N3.6 Trillion to Central Bank of Nigeria

AMCON has successfully recovered 87% of toxic bank assets and repaid N3.6 trillion to the Central Bank of Nigeria, strengthening depositor confidence and enhancing financial stability in Nigeria’s banking sector.

Asset Management Corporation of Nigeria (AMCON), the government-owned agency established in 2010 to stabilise and revitalize the Nigerian financial system, has repaid about N3.6 trillion to the Central Bank of Nigeria (CBN) since inception.

Gbenga Alade, Managing Director and CEO of the corporation, revealed at a press briefing in Lagos that although the company has spent N1.7 trillion to acquire banks’ toxic assets, it has successfully recovered around N3.6 trillion, with approximately N3 trillion still outstanding.

He explained that AMCON restructured affected banks by removing toxic assets from their balance sheets and injecting fresh capital, following corporate insolvency and restructuring principles.

Alade emphasized that this approach helps maintain depositor confidence, ensuring that banks can meet their obligations, while AMCON manages the acquired Eligible Bank Assets (EBAs) in preparation for eventual disposal.

He further noted that the law establishing AMCON gives it priority over other contractual rights and securities in disputes with bank debtors, effectively reversing the traditional hierarchy of claims on collateral and contracts.

The CEO also highlighted that, as part of their recovery strategy, AMCON has engaged international asset-tracing experts to locate assets that some obligors have hidden overseas.

Discussing the corporation’s financial performance since he took office, Alade reported that total revenue stood at N156.25 billion, with total operating expenses of N29.04 billion, reflecting an operating-to-revenue ratio of 19 percent.

He projected that for 2025, total revenue is expected to reach N215.15 billion, while operating expenses are estimated at N29.06 billion, bringing the operating-to-revenue ratio to approximately 13.5 percent.

Alade highlighted that the corporation has performed exceptionally well, particularly when benchmarked against other government-owned asset management entities globally. He noted that, based on purchase balances, AMCON has achieved over 87 percent in recoveries, surpassing similar institutions worldwide, despite the unique challenges of debt recovery in Nigeria.

READ MORE:

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

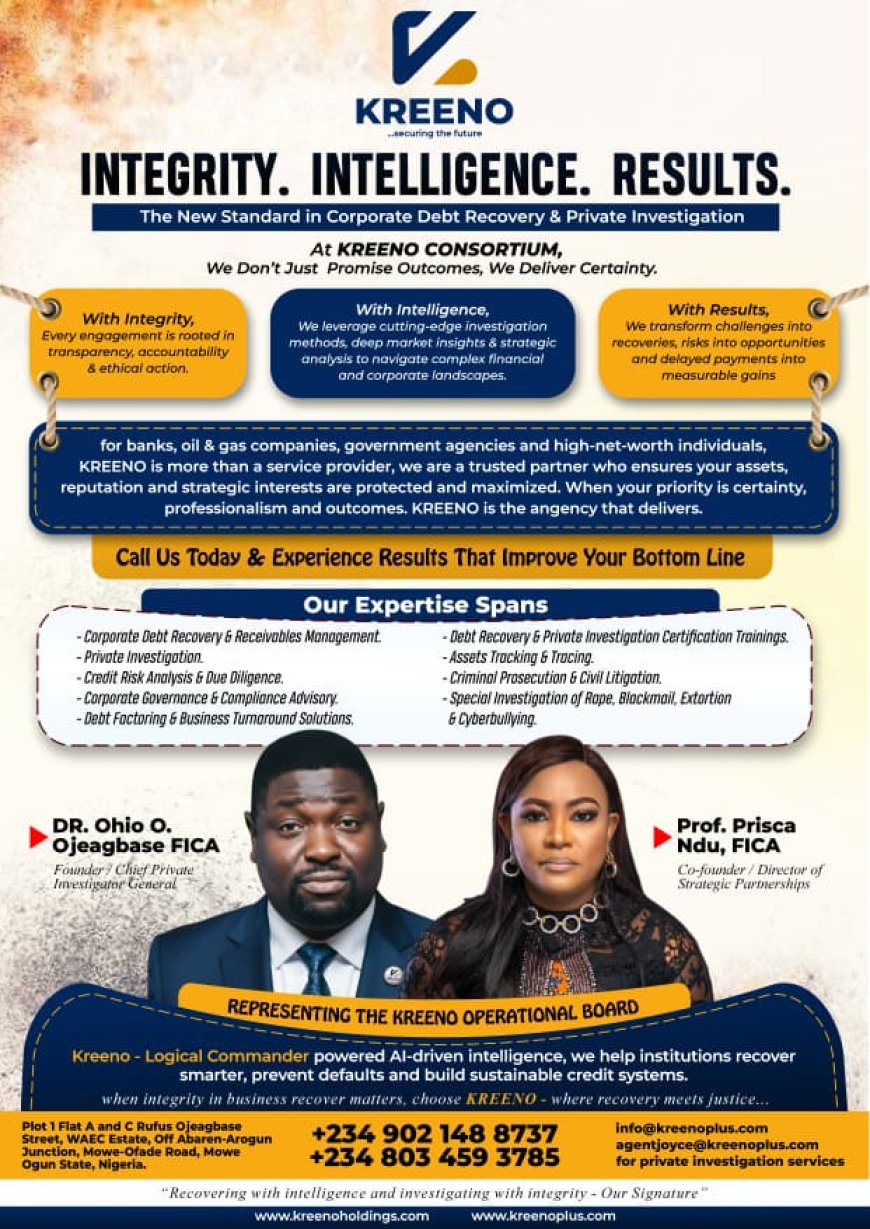

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

“The Malaysian Danaharta, widely regarded as one of the top-performing asset management corporations, recorded recoveries of only 58 percent. Similarly, the Chinese Asset Management Corporation, despite having more stringent regulations, achieved just 33 percent. Among comparable institutions, only South Korea’s KAMCO surpassed AMCON, attaining nearly 100 percent recovery, largely due to the aggressive measures employed in pursuing debtors.

“Although KAMCO has achieved impressive recovery rates, the agency continues to operate today with some adjustments to its mandate. Other notable asset management corporations that have evolved into permanent government institutions include China Asset Management Company, the U.S. Federal Deposit Insurance Corporation (FDIC), and KfW in Germany. Without being immodest, AMCON has performed admirably, and we remain committed to fully recovering all outstanding debts,” Alade stated.

He further noted that the corporation’s current Executive Committee has engaged experienced consultants to conduct a comprehensive audit of all AMCON cases across the Federal High Court, the Court of Appeal, and the Supreme Court. According to Alade, the leadership of the judiciary at all three levels understands the challenges posed by obligors and empathizes with AMCON’s mandate.

As a result, all courts have endorsed a New Practice Direction to facilitate AMCON’s debt recovery efforts, and the Federal High Court has established Insolvency Units to expedite pending AMCON cases across various courts.

The CEO also noted that the corporation’s recovery efforts have been strongly supported by President Bola Ahmed Tinubu-GCFR, the judiciary, the Central Bank of Nigeria, the Federal Ministry of Finance and the Attorney General of the Federation, and Minister of Justice, the Board of Directors of AMCON, the EFCC, the Police, the ICPC, the National Assembly, the Media and a host of other sister agencies of government.

He said the corporation, “will continue to go about its recovery mandate with the fear of God, love of country, and complete adherence to the rule of law. Let me also alert you that, as we are tightening the noose through the Courts on the obligors and deploying our strategies, most of the debtors would want to leverage the media to misinform the public.

“Please note that most of them took the loans with no intention whatsoever to repay the debt. So, I beg you, no matter the skewed narration they peddle in the newsrooms, kindly take it with a pinch of salt, and touch base with us because we have the accurate records, which is evident in some of the landmark cases that we have won against many of the obligors.

“Yes, the wheel of justice grinds slowly sometimes, but with patience and dedication, we have continued to make progress. Our cases have also contributed to the development of jurisprudence in the country with the publication of the first set of the AMCON Legal Compendium – a compilation of AMCON cases at both the Federal High Court and the Court of Appeal.”

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

ADVERTISEMENT:

What's Your Reaction?