Nigeria’s Economic Sovereignty Test. How Institutions and Strategy Shape National Power

You explore why Nigeria must shift from dependency to economic power. You see policy actions, industrial growth paths, and financial sovereignty steps shaping Nigeria’s future.

Nigeria is too big, too young, too resource-rich, and too well-positioned to continue having a weak economy. Its ongoing vulnerability is not a mystery, nor is it the result of foreign conspiracy or fate. Power is planned, constructed, and protected; it does not just happen. Nigeria has suffered for decades not from a lack of potential but from the inability to turn that potential into long-term economic dominance. In the quickly changing global landscape of today, where a fragmented, multipolar system is replacing the previous unipolar order dominated by the West, nations that do not strategically organize their economies are no longer merely marginalized; they are managed. In Why Nations Fail, Daron Acemoglu and James Robinson argue that prosperity is not determined by geography or natural resources but rather by institutions that shape incentives, discipline leadership, and reward productivity. Nigeria's main issue now is not growing isolation but economic sovereignty.

Power Is Institutional, Not Just Economic

Nigeria has a sizable GDP by African standards, but without systems, size is powerless. In *The Rise and Decline of Nations*, Mancur Olson cautioned that societies deteriorate when institutions become exploitative, transient, and controlled by special interests. This description uncomfortably describes Nigeria. Investments cannot mature as quickly as policy regimes. On paper, regulations are strong, but their implementation is lax. Monetary and fiscal authorities frequently function independently, sending contradictory signals that damage credibility. An economy that responds more than it plans is the outcome. This shows up for businesses as a higher risk premium, sudden policy reversals, and regulatory uncertainty. The purpose of institutions, according to Nobel laureate Douglass North, is to lessen uncertainty in interpersonal relationships. Uncertainty about policy has turned into an unofficial "tax" on investment and productivity in Nigeria. Nigeria is discounted by investors due to its governance rather than a lack of opportunities.

READ MORE:

- Non-Performing Loans Are Not Accidents. How Weak Enforcement Is Strangling Nigeria’s Productive Economy

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

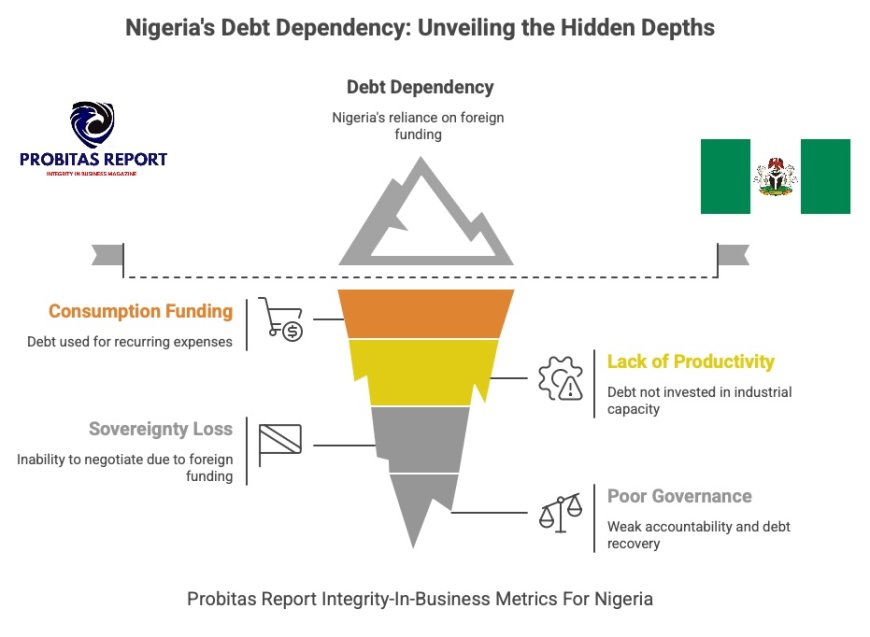

Debt: Instrument of Leverage or Dependency?

When paired with a well-thought-out plan, debt can be a transformative force. When misused, it turns into a dependency mechanism. In *Principles for Dealing with the Changing World Order*, Ray Dalio demonstrates how countries lose influence when they use debt to fund consumption rather than productivity. Nigeria's recent debt trajectory is consistent with this caution. Recurring expenses, fuel subsidies, and budget deficits have been funded by excessive borrowing rather than industrial capacity or infrastructure that would facilitate exports. This is a matter of sovereignty, not just financial difficulties. Countries that depend significantly on foreign funding gradually lose their ability to negotiate. Conditions, both overt and covert, start influencing domestic economic decisions. In *Globalization and Its Discontents*, Joseph Stiglitz points out that poor governance regarding the distribution and repayment of debt frequently results in debt "traps," rather than the act of borrowing. Weak project accountability, inadequate debt recovery, etc. in Nigeria.

It is evident to business executives and legislators that economic power necessitates both financial stability and control over the use and repayment of funding. Instead of just filling budget gaps, strategic debt should create resilient value chains, foreign exchange capacity, and productive assets.

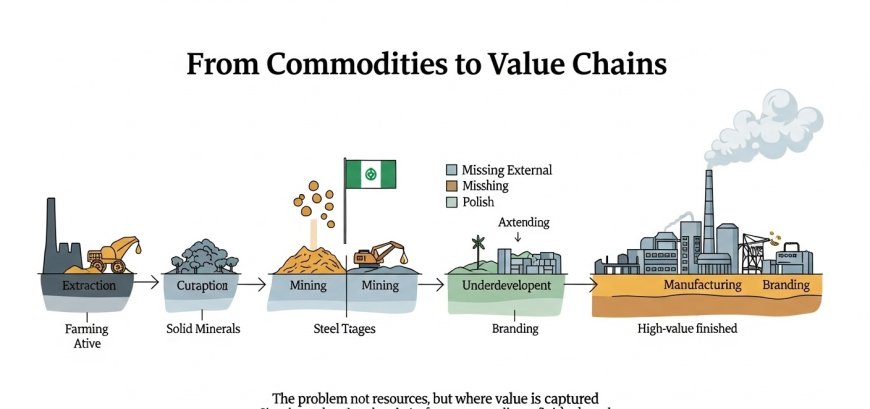

From Commodities to Value Chains

Nigeria remains trapped in a colonial economic pattern: exporting raw value and importing finished products. This structure hardwires dependency into the economy. Ha-Joon Chang, in *Kicking Away the Ladder*, shows how today’s rich countries protected and nurtured domestic industries before advocating for open markets. Nigeria, by contrast, liberalized early without first building globally competitive industrial capacity. Oil still dominates foreign exchange earnings, yet refined petroleum products are imported. Solid minerals leave the country with little or no processing. Agricultural products are exported raw and return as high-margin, branded imports. This is not a resource problem; it is a value chain problem.

MORE READ:

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

Currency, Capital, and Confidence

A weak currency is a governance signal as well as a macroeconomic statistic. In The Wealth of Nations, Adam Smith reminded us that the unseen basis of economic exchange is confidence. Deeper credibility issues, inconsistent policy, fiscal dominance of monetary policy, and a lack of export diversification are all contributing factors to Nigeria's persistent foreign exchange instability. Currency volatility lowers household wellbeing by impeding long-term investment, restricting industrial planning, and raising inflation. Furthermore, it limits policy authority when reserves fall, externalizing Nigeria's decision-making process. Paul Krugman's research on currency crises shows that expectations and plausibility can be just as significant as fundamentals. To stabilize the currency in a long-term way, Nigeria would require more than just temporary inflows or administrative actions. It calls for prudent budgeting, consistent policy, and a clear path to export-led growth.

Rule-Taker or Rule-Maker in a Multipolar Era?

Power struggles are becoming more intense in a multipolar world. The rules will be shaped by nations that are strategic, cohesive, and well-organized. Disorganized people will just adjust to them. Nigeria has the scale: a sizable market, a large population, a strategic location, and a strong entrepreneurial spirit. Coordinated economic statecraft, the purposeful alignment of trade policy, industrial policy, financial regulation, and diplomacy around specific national goals, are what it lacks. The Asian Tigers didn't wait for the international system's kindness. They enforced discipline, planned and implemented reforms, and safeguarded specific industries. Their success resulted from capable states collaborating with performance-driven private sectors, as Alice Amsden documented in *Asia’s Next Giant*. Nigeria needs to determine if it wants to be the economic leader of West Africa or just follow along. A once-in-a-generation opportunity is the AfCFTA. Nigeria may be positioned as a manufacturing and service hub.

The Management Problem Beneath the Economics

In the end, management is the fundamental cause of Nigeria's economic issues. The statement made by Peter Drucker that "plans are only good intentions unless they immediately degenerate into hard work" is directly relevant. Although Nigeria has created an impressive list of plans, including Vision 2020, ERGP, NDP, and others, over the years, execution has lagged. The accountability system is disjointed. The use of performance metrics is either inadequate or irregular. Rarely do policies remain the same. These are typical signs of both state and corporate organizational failure.

In Good to Great, Jim Collins makes the case that long-term success is fueled by disciplined leadership and a robust institutional culture. This also applies to nations. Economic sovereignty will remain a pipe dream until Nigeria starts to approach governance as a serious management discipline, complete with feedback loops, real consequences, hard metrics, and clear incentives. For the business community, this opens a crucial conversation: how can private-sector discipline, data, and execution culture be brought to the center of national economic management?

MORE NEWS:

- Be Careful Who You Allow Into Your Chamber. Biblical Wisdom on Access, Influence, and Destiny

- The Currency of Trust in Lagos Markets | Integrity & Business Ethics in Nigeria

- How Banks Create Money Through Lending, A Clear Guide to Credit Creation and Modern Financial Intermediation

From Potential to Power: A Call to Action

Nigeria stands at an inflection point. The global order is shifting. Old alliances are loosening. New power centers are emerging across Africa, Asia, and the Middle East. Countries that organize themselves will gain leverage; those that drift will be managed by others. Economic sovereignty is not isolationism. It is strategic autonomy with the capacity to engage the world on one’s own terms. For Nigeria, the path forward is demanding but clear:

- Build and protect credible economic institutions.

- Borrow strategically and enforce disciplined recovery and accountability.

- Move decisively up value chains, from commodities to finished goods and services.

- Stabilize the currency through trust, not controls alone.

- Treat governance as a management discipline, not a political slogan.

In Development as Freedom, Amartya Sen argues that development's true aim is expanding real choices. Economic sovereignty empowers nations to make decisions serving their long-term interests—not external dictates. Nigeria is too valuable and significant to remain structurally dependent; its potential is undeniable. The real question now is: who will help transform that potential into power, and on what terms? For investors, executives, and legislators, this is the moment to engage while Nigeria's new economic framework is still being shaped and the country moves toward greater independence and rule-making authority.

Send your information and contributions to The Writer to priscan@kreenoholdings.com and WhatsApp Only: +234 902 148 8737

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

What's Your Reaction?