Corporate Governance as a Macroprudential Anchor: Protecting Assembly of Nigeria into the Global Value Chains amid Economic Reforms of 2026

How corporate governance strengthens Nigeria’s economic stability, protects banks, and supports integration into global value chains during the 2026 economic reforms.

By Dr Ohio O. Ojeagbase

Nigeria is poised to begin 2026 at a crucial moment in the country’s economic journey. According to Mastercard Economics Institute, GDP growth is set to surge by four percent, driven by fiscal consolidation, naira stability, and accelerate rollout of the African Continental Free Trade Area (AfCFTA). EnterpriseNGR reports impressive export achievements in the agriculture, fintechs, and renewable energy sectors. Despite these positive growth drivers, structural risks remain, and this brings forth a significant question for policymakers and regulators, and corporate leaders: Is the corporate sector equipped with the governance mechanisms required to promote deep integration of Nigeria in global value chains without exposing the economy to unwanted spillover risks?

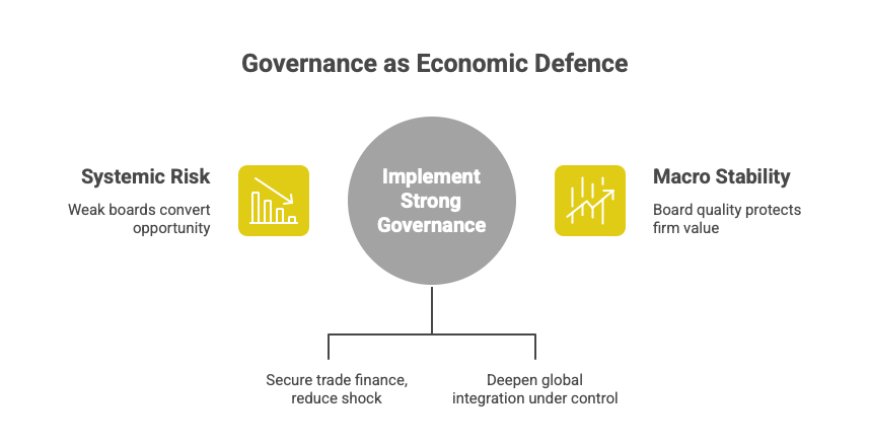

The Central Bank of Nigeria (CBN) employs a range of macroprudential measures, countercyclical buffers, liquidity coverage ratios, FX position limits, to put the financial system in bulletproof armour, from the top. Yet, these birds of a feather rarely come together at the firm level, where micro risks originate. Weak corporate entities become transmission channels that magnify shocks to the wider financial system. And it is at the corporate level where corporate governance turns from a mere compliance exercise to a macroprudential stabiliser. Strong, watchful boards can absorb and dampen shocks, but weak or passive boards amplify them. Ultimately, the quality of governance at the firm level determines the resilience of the entire financial system.

The Critical Link Between Governance and Economic Stability

Nigeria operates under the 2018 Nigeria Code of Corporate Governance, supported by sector rules. On paper, the structure looks solid. Boards hold responsibility for risk oversight. Independent directors strengthen controls. Audit committees enforce discipline. In practice, execution gaps weaken the system. PwC 2026 Economic Outlook connects revenue leakages and weak controls to lost reform gains. S and P Global points to hidden credit risks inside Basel II compliant banks. Banking strength mirrors corporate behavior. When firms fail on governance, banks absorb the shock.

Risk pressure shows up clearly in export sectors. Agricultural processors face cocoa price swings and EU deforestation rules. Oil and gas firms balance OPEC limits with energy transition demands. Fintech firms deal with cross-border data and licensing rules. Boards without FX risk rules, commodity stress tests, or supply chain checks expose lenders to avoidable losses. One major default triggers covenant breaches, weakens capital buffers, and increases pressure on the CBN.

From Micro Governance to Macro Stability

Governance affects stability through board actions. Treasury control offers a clear example. Boards that require structured FX hedging for trade finance and eurobond exposure build internal shock resistance. As Nigeria moves toward unified exchange rates, firms with clear risk limits absorb volatility internally. This reduces sudden pressure on reserves and supports FX market balance.

Cross-border expansion under AfCFTA raises another issue. Related-party transaction control protects lenders from hidden contagion. Full NCCG disclosure blocks asset stripping and insider abuse. ESG oversight now links directly to trade finance access. EU carbon rules and global lender standards demand proof of compliance. Succession planning also matters. CBN 2025 guidance highlights leadership continuity. Firms with clear plans avoid disruption during global stress, keeping supply chains and credit lines intact.

READ MORE:

- Non-Performing Loans Are Not Accidents. How Weak Enforcement Is Strangling Nigeria’s Productive Economy

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

Evidence From the Nigerian Market

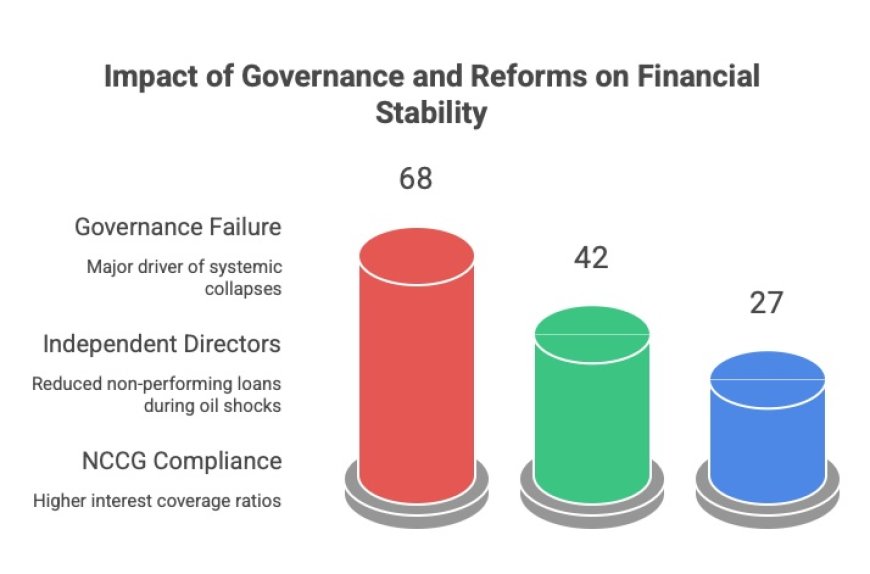

Data confirms the link. NDIC analysis after the 2009 crisis found governance failure in 68 percent of bank collapses. Macroeconomic shocks played a smaller role. Listed firms with majority independent boards showed 42 percent lower contribution to non-performing loans during the 2020 to 2023 oil price shocks. FRCN data shows firms with higher NCCG compliance achieved 27 percent stronger interest coverage. Better governance supports debt service and protects banks.

Global integration increases the cost of weak boards. AfCFTA Phase II brings deeper investor scrutiny. Foreign capital compares Nigeria with South Africa and Kenya. Poor governance signals unpriced country risk. Credit spreads widen beyond macro fundamentals. The cost falls on every firm. Capital becomes more expensive. Value chain integration slows.

Policy Direction

CBN reforms target resilience through recapitalization, digital finance, and payments. One gap stands out. Firm-level governance metrics sit outside stress testing. Governance functions as economic infrastructure.

Action steps matter.

- l Institutionalise governance metrics. Score board quality, audit committee independence, risk expertise, and director tenure. Feed results into CAMELS ratings and capital requirements.

- l Enforce transparency on key risks. Require board disclosure of unhedged FX exposure above 10 percent of revenue.

- l Build sector protocols. Work with BOI to align governance standards in agriculture and mining with CBN resilience goals.

- l Use technology for oversight. Apply AI tools to track related-party transactions and flag risks for CBN and FRCN review.

- l NESG 2026 Outlook calls for stabilisation consolidation. Consolidation starts inside firms. Macro tools handle external shocks. Internal failure begins in the boardroom. Governance absorbs internal shocks before they spread.

Nigeria enters 2026 with strong opportunity. AfCFTA opens a multi-trillion dollar market. Demand for green minerals and raw materials keeps rising. Exposure rises with opportunity. Boards that treat governance as stability infrastructure secure cheaper finance, better terms, and operational resilience. Boards that ignore discipline turn opportunity into systemic risk and force regulatory intervention.

You shape outcomes in the boardroom. Corporate governance stands as the first line of economic defence. The quality of boards determines firm survival, financial system strength, and national credibility in a connected global economy.

Positioning Nigeria for Global Opportunity

As 2026 unfolds, Nigeria faces a narrow but crucial window to advance its economic agenda. The AfCFTA offers access to a continental market valued at $3.4 trillion. At the same time, global demand for green minerals is accelerating, and Europe and China are actively seeking critical raw materials. In this environment, boards that treat governance as more than a regulatory checkbox, seeing it instead as the backbone of operational stability, gain a decisive advantage. Firms with disciplined oversight secure better trade finance, shield themselves from tariff and commodity shocks, and build resilience that allows them to scale confidently across international markets.

The stakes are high. Boards that fail to enforce strong governance risk turning these opportunities into systemic vulnerabilities. Weak oversight not only exposes individual firms but also threatens the broader financial system, forcing regulators into the difficult position of balancing bailouts with containment of potential contagion. Stability starts at the top, in the boardroom, where every decision, every risk assessment, and every governance practice contributes directly to macroeconomic resilience. In 2026, the quality and vigilance of corporate boards will shape firm performance, financial system stability, and Nigeria’s credibility on the global stage.

Building Investor Confidence Through Governance

A key outcome of robust corporate governance is the ability to attract and retain both domestic and foreign investment. Investors increasingly prioritize transparency, risk management, and ethical oversight when deciding where to allocate capital. In Nigeria, firms with strong governance practices signal reliability and stability, reducing perceived country and corporate risk. This is particularly critical as global investors evaluate the country against regional peers such as South Africa and Kenya. Boards that enforce rigorous internal controls, audit independence, and compliance with NCCG reporting standards inspire confidence in lenders and stakeholders, opening doors to lower-cost capital and more favorable financing terms.

Effective governance also fosters resilience against sudden shocks. Investors are more likely to remain committed during periods of market turbulence when boards demonstrate proactive oversight. This stability not only protects firm value but also reinforces the broader financial system. By creating a culture of accountability and transparency, Nigerian companies can convert investor scrutiny into a competitive advantage, building long-term credibility and sustaining growth in global value chains.

Leveraging Technology and Innovation in Governance

Governance in the 21st century is inseparable from technology. Advanced monitoring tools, data analytics, and AI-driven dashboards allow boards to track risks in real time, manage related-party transactions, and ensure regulatory compliance efficiently. For Nigerian firms aiming to expand within AfCFTA and beyond, these technological capabilities are no longer optional—they are essential.

Integrating technology into governance frameworks improves decision-making speed and accuracy. Risk exposure, financial reporting, and compliance can be assessed continuously, reducing the likelihood of operational lapses that threaten both firm and systemic stability. Additionally, technology supports ESG compliance, enabling companies to meet international environmental and social standards, a critical factor for securing trade finance and participating in global supply chains.

Boards that embrace innovation in governance not only protect their firms but also enhance operational efficiency, minimize risk, and position themselves as leaders in regional and global markets. This proactive approach transforms governance from a reactive compliance function into a strategic driver of competitive advantage.

Conclusion: Governance as the Engine of Sustainable Integration

Nigeria’s ambition to integrate deeply into global value chains depends squarely on the strength and effectiveness of its corporate governance structures. Boards that uphold accountability, insist on transparency, and anticipate risks do more than protect their own firms, they safeguard the entire financial ecosystem and the broader national economy.

In today’s interconnected global economy, governance cannot be treated as mere compliance. It is the engine that drives growth, fosters investor confidence, and ensures long-term sustainability. Boards that internalize this reality transform challenges into opportunity, positioning their firms, and by extension Nigeria, to compete effectively on the world stage while reinforcing economic stability at home.

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

What's Your Reaction?