If You Are Not at the Table, You Are on the Menu, Africa’s Strategic Imperative in the Global Order

You learn why Africa must shape global rules on trade, finance, labor, and resources to drive economic growth, protect sovereignty, and secure power in the emerging global order.

By Dr Ohio O. Ojeagbase

Mark Carney, the former governor of the Bank of England and Bank of Canada, distilled a harsh truth of international relations into an incisive metaphor: “If you are not at the table, you are on the menu.” Uttered in contexts of global finance and climate governance, this phrase captures the zero-sum dynamics of decision-making in multilateral forums, where the powerful dictate terms, whether fiscal austerity through IMF programs, trade rules via the WTO, or climate finance allocations at COP summits and the excluded absorb the fallout in the form of debt burdens, market access barriers, or stranded assets. In global finance, it evokes the 2008 crisis, where G7 central banks coordinated liquidity injections, leaving emerging markets to manage capital flight. Geopolitically, it recalls how Bretton Woods institutions were designed by wartime victors, embedding Western dominance. For economic governance, it underscores how rule-setting in bodies like the Financial Stability Board privileges incumbents, turning outsiders into passive recipients of externally imposed standards. Carney’s warning is not mere rhetoric; it is a call to agency in a system where influence is asymmetrical and exclusion is structural.

Today’s global power is exercised through a triad of rule-setting, enforcement, and consequence-bearing. The United States, European Union, and China dominate agenda-setting in institutions like the IMF (where voting shares reflect outdated GDP weights) and the World Bank, enforcing compliance via conditional lending and sanctions. Tech giants and sovereign wealth funds shape capital flows, while commodity prices are benchmarked in London or New York. Those at the periphery often developing nations, bear the consequences: volatility from dollar cycles, technology chokepoints, and climate impacts without commensurate reparations. This asymmetry persists despite formal multilateralism, as evidenced by Africa’s mere 6% share of global trade despite 18% of the world’s population.

READ MORE:

- Non-Performing Loans Are Not Accidents. How Weak Enforcement Is Strangling Nigeria’s Productive Economy

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

Africa’s historical position exemplifies this exclusion. Post-colonial integration locked the continent into commodity export dependency, with structural adjustment programs in the 1980s–90s enforcing liberalization that dismantled nascent industries without building alternatives. Dependency theory, from dependency on raw material exports to aid conditionality, has manifested in missed opportunities: the 1970s oil boom enriched elites but not institutions; the 2000s commodity super cycle funded consumption, not transformation. Multilateral debt relief like HIPC provided breathing room but tied reforms to Washington Consensus prescriptions, sidelining local priorities. The result: growth upticks averaging 5% annually since 2000, yet persistent poverty and fragility, as population growth outpaces per capita gains.

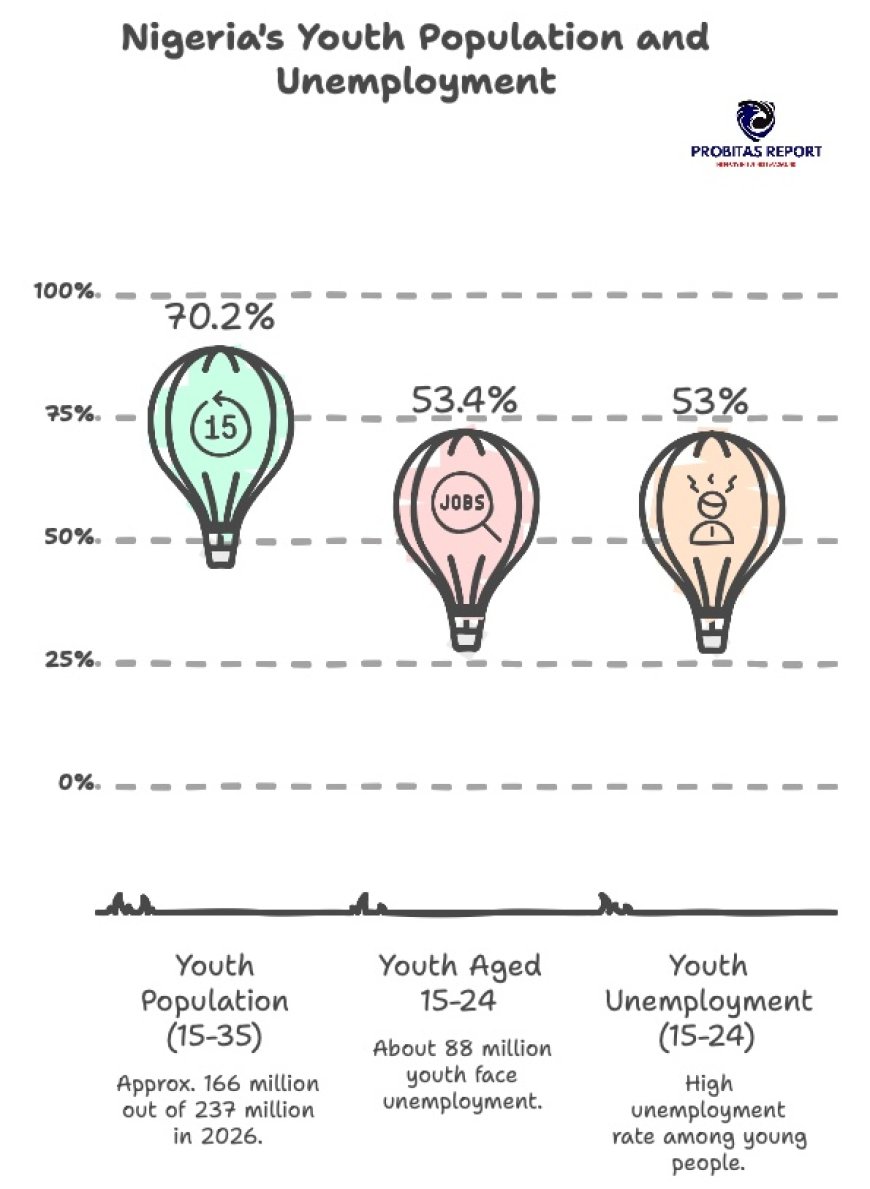

Yet the current global transition, geopolitical fragmentation post-Ukraine war, the energy transition from fossil fuels, demographic youth bulges in the Global South, AI-driven technological leaps, and capital reallocation toward resilient assets creates a rare inflection point. Fragmentation erodes U.S.-led unipolarity, opening space for multipolarity where non-traditional powers negotiate bilaterally. The energy transition demands African critical minerals (cobalt, lithium, graphite and more) for batteries, positioning the continent as the major supplier and potential processor. In terms of demographics which favor Africa: by 2050, it will house 25% of humanity, with a working-age population swelling whilst Europe and China age shrink. Technology, via accelerating generation in fintech and renewables, outstrips industrial-era infrastructure. Capital, fleeing volatility in the North, seeks yield in emerging markets with reform momentum like Nigeria. This convergence offers Africa leverage if seized now.

Nigeria stands as Africa’s pivotal case study, embodying untapped potential across multiple pillars. Demographically, its 230 million people (projected to hit 400 million by 2050) form West Africa’s consumer market core, with a median age of 18.1 fueling labor abundance amidst global shortages. Strategically, its geography overlapping the Gulf of Guinea, close to Europe and the Americas, anchors maritime trade routes, positioning Lagos and environs as a logistics hub rivaling Dubai. In energy and commodities, Nigeria holds Africa’s largest proven oil and gas reserves (we are a gas-rich country that has oil), but the transition elevates its gas (for blue hydrogen) and solid minerals (rare earths, bauxite, critical metals). Rather than stranded assets, these can fuel value chains: gas-to-power for industrialization, minerals processing under AfCFTA rules of origin. Financially, the naira’s float and CBN reforms signal credibility, with capital markets growing via NGX listings and pension fund assets topping $40 billion. Diplomatically, Nigeria’s ECOWAS leadership, AU peacekeeping roles, and non-aligned stance (e.g., BRICS interest) confer regional heft, as seen in its mediation in Sahel conflicts.

Being “at the table” demands more than presence; it requires shaping outcomes. For Nigeria, policy coherence is foundational: aligning fiscal-monetary stances for debt sustainability (public debt at 40% of GDP), whilst legislating and enforcing investors’ capital protections and judicial independence for enforcement of financial fraud in the markeplaces to attract FDI. You build institutional credibility by streamlining bureaucracy through digital single windows, following Rwanda’s model, to improve Ease of Doing Business rankings and by launching an Integrity in Business Culture Index to create a trusted environment where entrepreneurs collaborate without fear of fraud or broken trust. Strategic alliances amplify voice: deepening China ties for infrastructure without sovereignty erosion; partnering EU on green minerals via CBAM exemptions; leading AfCFTA implementation to forge intra-African rules preempting global ones. Economic statecraft means deploying sovereign wealth (from NNPC dividends) into strategic funds, similar to Norway’s, for tech and human capital.

Private sector leadership is equally important. Nigerian firms like Dangote Cement and Flutterwave demonstrate global competitiveness such as Dangote’s $20 billion refinery challenges Middle East dominance, whilst fintech unicorns process remittances rivaling GDP slices. Scaling requires policy enablers: tax incentives for R&D, export credits, and skills pacts with India or Germany. Intellectual capital seals the deal: Nigeria must control its narrative through think tanks, Davos panels, and UN agenda contributions, countering “fragile state” stereotypes with data on 7% non-oil growth potential.

Risks loom large. Governance failures such as corruption scandals and subsidy relapse erode trust, as 2023 fuel subsidy removal exposed elite capture. Internal fragmentation along ethnic lines or between oil States and others hampers unity, whilst elite myopic thinking favors consumption over investment or production. Globally, resistance persists: Western protectionism in green tech, China’s debt-trap optics, and indifference to AfCFTA until it threatens supply chains. Climate shocks and jihadist spillovers in the Sahel compound vulnerabilities to this implementation.

Nevertheless, Nigeria and Africa can indeed transition from menu item to menu architect through deliberate choices now. Prioritize credible institutions to convert demographics into dividends; leverage commodities for processing sovereignty amid energy shifts and NOT extract for export; wield AfCFTA and BRICS for multipolar bargaining; empower private pioneers to globalize Nigerian brands using Nigerian names as labels. Historical precedents abound: South Korea parlayed exclusion into export discipline; the UAE turned oil into hubs. In 2026’s fracturing order, Nigeria’s scale positions it as Africa’s fulcrum that is capable of demanding seats at G20 climate tables, IMF quota reforms, and WTO plurilaterals. Carney’s metaphor warns of peril but illuminates possibility: arrive at the table not as a beggar or petitioner, but as indispensable partner, or risk being carved up by circumstance. The window is open; the choice is strategic.

MORE NEWS:

- Be Careful Who You Allow Into Your Chamber. Biblical Wisdom on Access, Influence, and Destiny

- The Currency of Trust in Lagos Markets | Integrity & Business Ethics in Nigeria

- How Banks Create Money Through Lending, A Clear Guide to Credit Creation and Modern Financial Intermediation

Probitas Report Publisher’s Admonition:

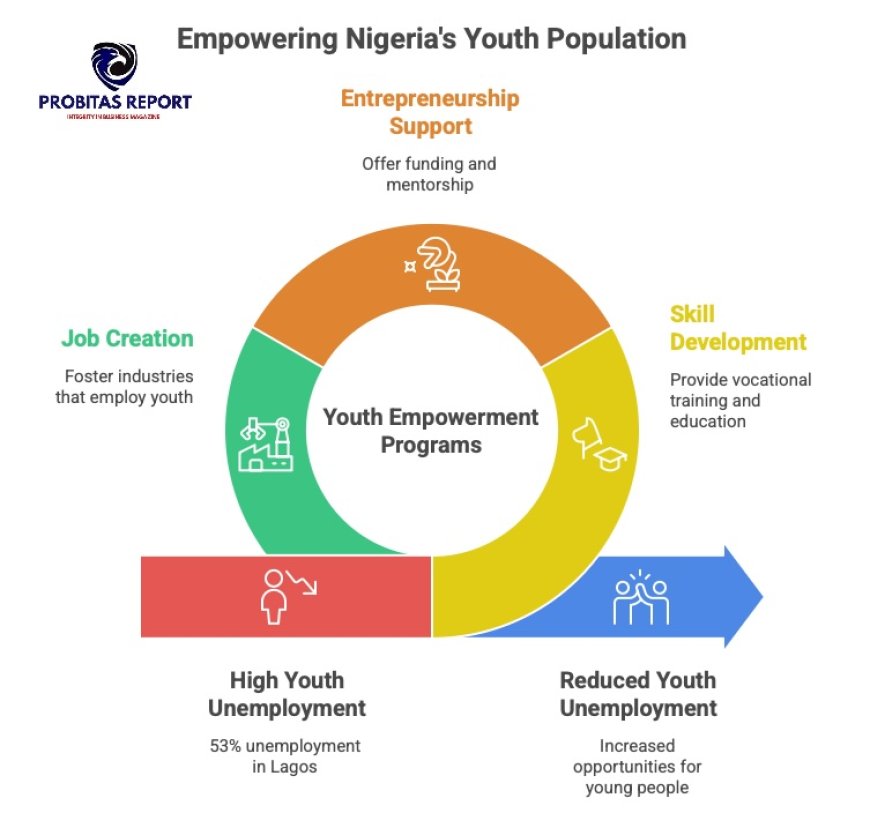

To harness Nigeria’s median age of 18 as a decisive bargaining chip in global forums, President Tinubu must pursue a bold, multi-pronged workforce strategy that converts demographic abundance into structured leverage.

1. Launch a National Youth Productivity Compact targeting 10 million high-skill jobs within five years across digital services, green manufacturing, and agro-processing, funded through pension reallocations and AfCFTA-linked incentives, enforced through mandatory apprenticeships combining vocational training and firm-based upskilling, with a national performance target of 70 percent employability within 18 months.

2. Establish Workforce Export Zones in Lagos, Kano, and Port Harcourt modeled after Singapore’s training hubs, attract international firms to co-invest in AI, renewable energy, and logistics academies, negotiate visa-free labor mobility pacts with Europe and the GCC (Middle Eastern Bloc), export 500,000 skilled workers annually, and apply structured labor leverage at ILO and G20 platforms to force quota reforms.

3. Integrate youth workforce development into economic diplomacy by conditioning mineral and gas agreements, including India LNG deals and EU critical raw materials partnerships, on binding youth skills transfer clauses, positioning Nigeria as a supplier of both strategic resources and skilled labor in response to projected global shortages exceeding 100 million workers by 2030.

4. Fortify domestic foundations through a Digital Youth ID system linking verified education credentials to global talent platforms, while reducing tertiary education costs through public private scholarships tied to national service in strategic industries and enforcing quality benchmarks aligned with leading global technical workforces.

5. Brand the agenda aggressively at Davos 2027 and the United Nations General Assembly using public data dashboards tracking “Nigeria’s 100 Million Jobs by 2040,” reframing Nigeria’s youth population as strategic economic leverage tied to IMF surveillance reform, WTO services trade negotiations, and climate finance structures.

6. Execute through direct political coordination by issuing executive orders to bypass bureaucratic bottlenecks, securing state governor implementation compacts, synchronizing ministries and private sector operators, and converting Nigeria’s youth population from job seekers into global bargaining assets.

About The Author:

Dr Ohio O. Ojeagbase is a leading expert in debt recovery, private investigation, financial security strategy, and corporate governance in Africa and Nigeria. He holds advanced academic training and deep professional experience, making him a respected authority in integrity in business culture, debt recovery, and sustainable enterprise. Dr Ojeagbase combines strategic insight with practical frameworks to strengthen financial systems, protect assets, and promote ethical standards in corporate and public sectors. He is known for shaping systems that enhance trust, accountability, and resilience across financial and governance ecosystems. He sits on the board of KREENO and INDECO.

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

What's Your Reaction?