Kingdom Debt Management in Africa: Biblical Principles and Practical Strategies for Individuals, Businesses, and Faith-Based Organizations

Explore how individuals, SMEs, and faith-based organizations can use debt responsibly in a Kingdom economy. Dr. Ohio O. Ojeagbase outlines biblical principles, corporate governance, and strategic repayment to build dominion, integrity, and financial growth in Nigeria and across the continent of Africa.

MASTERING DEBT IN A KINGDOM ECONOMY

Integrity, Leverage, and the Path to Dominion

By Dr. Ohio O. Ojeagbase FICA, SFIDR

Introduction

Debt has shaped nations, markets, and households. It has lifted economies and challenged families. Many African societies hold extreme views on borrowing, with some seeing debt as a symbol of wealth and others as a threat. Scripture offers a balanced perspective. Debt becomes safe when disciplined stewardship guides its use, turning borrowing into a tool for growth, while misuse leads to financial bondage. This article provides a framework for leaders who seek to borrow responsibly and operate with integrity.

Historical and Biblical Foundations of Debt

Understanding debt begins with a historical and biblical perspective, as ancient economies in Egypt, Babylon, Greece, Rome, and Israel used borrowing to finance trade, agriculture, and household survival. Rulers periodically issued clean-slate decrees to prevent families from permanent servitude, with Mesopotamian tablets recording these resets and Israel’s legal system establishing boundaries, such as the ban on charging interest among Israelites (Deuteronomy 23), the six-year limit on bond service (Exodus 21), protection of dignity during debt collection (Deuteronomy 24), and the Jubilee cycle (Leviticus 25) that released long-term debt and restored family land. These rules encouraged fairness and economic stability without forbidding lending.

A Kingdom view of borrowing and lending is shaped by scripture: Proverbs 22 warns that borrowers may become servants to lenders; Romans 13 urges believers to settle obligations; Luke 14 emphasizes careful planning before commitments; and 1 Corinthians 4 calls for faithful stewardship. Scripture encourages responsible borrowing and productive use of credit, correcting poor habits while affirming diligence and integrity.

READ MORE:

- The rise of modern day witchcraft and the hidden influence of manipulation and selective targeting across institutions

- Meet The King Of Ethical And Professional Debt Recovery In Africa 2024 By IDRPN

- More Than Just Debt: 5 Hidden Legal and Financial Consequences of a Bounced Cheque in Nigeria by Prof. Prisca Ndu

- Navigating Modern Debt Collection in Nigeria: Ethical Recovery and Financial Integrity by Dr. Ohio O. Ojeagbase

- Nigeria Financial Security: Dr. Ohio O. Ojeagbase Leads Financial Integrity Initiatives During International Fraud Awareness Week

Debt in Modern Economic Thought

Modern finance views debt as a catalyst for growth. Disciplined borrowing increases productive capacity, supports capital investment, technology upgrades, supply chain stability, and market expansion, while interest deductibility strengthens company earnings. Poor decision-making, not debt itself, is the true threat. In Africa, low savings rates, weak credit literacy, and inconsistent enforcement contribute to misuse and default. A Kingdom economy begins with disciplined, purposeful, and accountable borrowing.

Individual Debt: Tools for Personal Dominion

Individuals borrow for emergencies, education, business start-ups, LPO financing, asset acquisition, and family obligations. Productive borrowing builds future value, while consumption-driven borrowing creates pressure and reduces financial stability. A Kingdom lifestyle relies on four biblical and ethical guardrails: clarity of purpose for long-term value, integrity in honoring agreements, a clearly defined repayment plan, and disciplined restraint against borrowing for appearances. When repayment challenges arise, individuals should approach lenders with humility and transparency to encourage cooperative solutions rather than conflict.

Corporate Debt: Building Kingdom Enterprises With Discipline

Corporate debt enables strategic growth when handled responsibly. Kingdom-minded organizations use debt to support scale, innovation, and long-term expansion. Faith-driven institutions have leveraged well-managed borrowing to strengthen influence across generations, aligning debt with governance, risk assessment, and accountability. Every loan must undergo board review, cash flows must be monitored, financial reporting must be transparent, and loan covenants honored consistently. Integrity in borrowing reflects both legal and ethical responsibility.

Repaying Debt With Speed: The Kingdom Blueprint

Repayment begins with correcting poor financial habits and full transparency, acknowledging all debts, interest rates, due dates, and conditions. Cash flow should be reengineered to increase income and reduce unnecessary spending, directing surpluses toward repayment. Negotiation and restructuring safeguard stability, while timely repayment and clear communication uphold character and credibility. Covenant support and faithful stewardship align leadership with divine guidance.

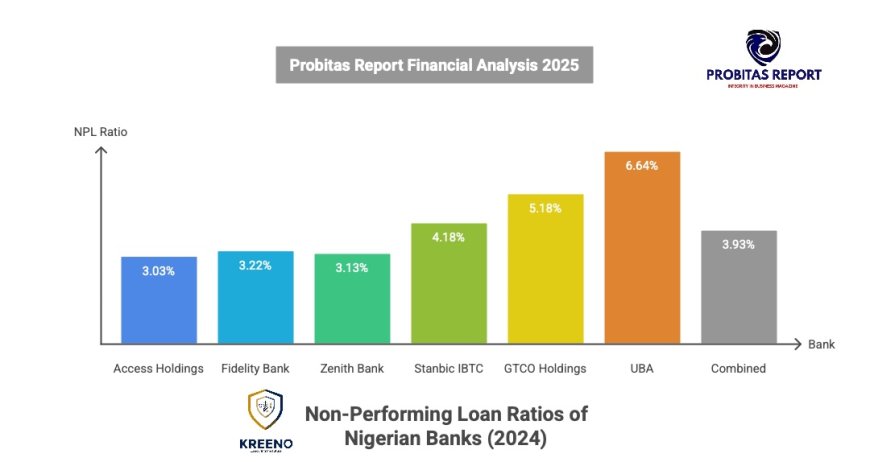

Integrity in Business: The True Currency

Integrity builds trust with lenders, customers, investors, and partners, reduces borrowing costs, protects corporate reputation, and attracts favor. The true risk lies in owing without intention to repay. Across Africa, SMEs and faith-driven institutions have grown through structured, purpose-driven borrowing, while failures occurred when debt was misapplied. Structure, clarity, and discipline remain the critical factors.

Faith Communities and Debt Responsibility

Faith-based organizations wield significant social influence, and financial responsibility is part of that witness. Churches and religious institutions should honor loans and verbal agreements promptly, demonstrating stewardship, covenant faithfulness, and integrity. Using spiritual language to justify financial neglect undermines trust and credibility. Leaders are called to model ethical borrowing, demonstrating that faith complements disciplined financial conduct.

Key Lessons

1. Debt Thrives on Discipline, Not Denial: Borrowing is a neutral tool that supports growth when aligned with productive purpose.

2. Integrity in Business: Honoring debts promptly is both legal and moral, building trust and credibility.

3. Transparency and Repentance Fuel Recovery: Address obligations openly, restructure thoughtfully, and manage cash flow effectively.

4. Faith Communities Lead by Example: Churches and organizations must demonstrate ethical borrowing to maintain their prophetic and social influence.

5. Kingdom Borrowing Builds Lasting Dominion: Structured, purpose-aligned borrowing supports innovation, expansion, and sustainable prosperity.

... More loaded contents in the book coming out soon on majoy online bookstores.

About The Author:

Dr. Ohio O. Ojeagbase is a leading authority in debt recovery, private investigation, corporate governance, and financial integrity in Africa. As founder of KREENO CONSORTIUM and publisher of Probitas Report, he champions ethical business practices, accountability, and disciplined stewardship across personal, corporate, and faith-based finance. Dr. Ojeagbase holds doctoral qualifications in private investigation and is a Fellow of the National Institute of Credit Administration and Senior Fellow of the Institute of Debt Recovery Practitioners of Nigeria.

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com WhatsApp Only: +234 902 148 8737

© 2025 Probitas Report – All Rights Reserved. Reproduction or redistribution requires explicit permission.

What's Your Reaction?