Why Aggressive Loans and Short-Term Targets Hurt Banks and Borrowers

Aggressive lending and short-term targets fuel loan defaults, strain banks, and hurt borrowers. Discover the risks and solutions for a healthier banking system.

Introduction

Nigeria’s banking sector has weathered storms of change such as oil shocks, inflation, regulatory reforms, yet a lingering crisis remains: rising loan defaults. It’s not just only bad luck or weak borrowers with lack of integrity-in-business culture at play. Often, it is the banks themselves, driven by aggressive market push strategies, chasing short-term income and selling risky assets, who create mismatched financing: funding long-term assets like aircraft or vessels with short-term deposits. This misalignment hides in plain sight, sowing instability for banks and hardship for borrowers alike. In this research article, we explore what really drives defaults; not only blaming the borrowers, but shining the light on the banking system’s pressures.

Integrate recent CBN Statistics

The CBN’s Q2 2025 Credit Conditions Survey shows rising defaults across secured, unsecured, and corporate loans despite increased credit supply and approvals. Households faced higher repayment stress on mortgages, personal loans, and credit cards, while corporates of all sizes also saw elevated defaults. Widening loan spreads for households and weakening asset quality for corporates highlight growing credit risk in Nigeria’s banking sector.

This suggests that Nigeria’s banking sector in mid-2025 is facing a paradox of growth with fragility: whilst banks are expanding credit supply and granting more approvals, the quality of those loans is deteriorating as defaults rise. This means that economic pressures and borrower stress are outweighing lending expansion, pointing to heightened credit risk and potential systemic vulnerability if not managed properly

Nigerian Deposit Insurance Corporation (NDIC) Reports

Whilst NDIC has not published any loan default report publicly but acting on Central Bank of Nigeria Credit Coondition Survey, its role as liquidator looms large in recent watchdog actions. For instance, the CBN revoked Heritage Bank’s operating license in June 2024, citing compliance failures, with NDIC stepping in to manage resolution. That move signals how serious systemic risk from mismatched portfolios can become.

NDIC’s work in winding up distressed banks highlights the consequences when aggressive market push is driven by deposit targets and income-yield quests that collides with asset-liability fragility. As of 2024, NDIC had closed 651 failed banks, including 50 DMBs, 55 PMBs, and 546 MFBs.

IMF/World Bank Data

The IMF, through technical assistance to the CBN since 2009, has helped strengthen supervisory capacity, yet challenges persist, including weak validation of banks’ interbank and external asset/liability data.

Globally, asset-liability mismatch remains a potent risk: it’s when a bank’s assets and liabilities don’t align in currency, tenor, or interest rate terms. In Nigeria, the mix of high inflation, currency volatility, and short-dated deposit funding compounds this risk—making mismatches more dangerous.

Key Insights: What's fueling the crisis?

1. Market Push Over Customer Fit

Banks, motivated by fee income and volume, often push products without tailoring tenor to need. Long-term ventures like aviation require patient funding but depositors may only want short-dated products, forcing banks to stretch their liquidity.

2. Asset-Liability Gaps Breeding Instability

When banks fund long-term assets with short-term deposits, sudden withdrawals or interest rate hikes can trigger forced asset sales or expensive borrowing. Even strong banks like FCMB felt this strain, with their liquidity ratio rising to 40.6% by end-2024, up from 36.6% in 2023, as they tried to cushion against these mismatches.

3. Short-Term Income Targets & Risk Sell

Zenith Bank’s 2024 reports show growing pressure, with stage-2 (watch-list) loans rising to 37% of gross loans by September 2024, driven partly by currency devaluation that worsened defaults on foreign-currency obligations. The bank’s cost of risk also climbed to 7.3%, more than double the industry average of about 3%.

4. Economic Headwinds as Amplifiers

Inflation and the weakening Naira are not just internal missteps but added stress to borrowing. Nigeria's current headline inflation eased to 21.88% in July 2025, down from 22.22% in June, marking the fourth straight month of decline. Food inflation that is a critical contributor, rose to 22.74% year-on-year in July, slightly higher than June’s 21.97%.

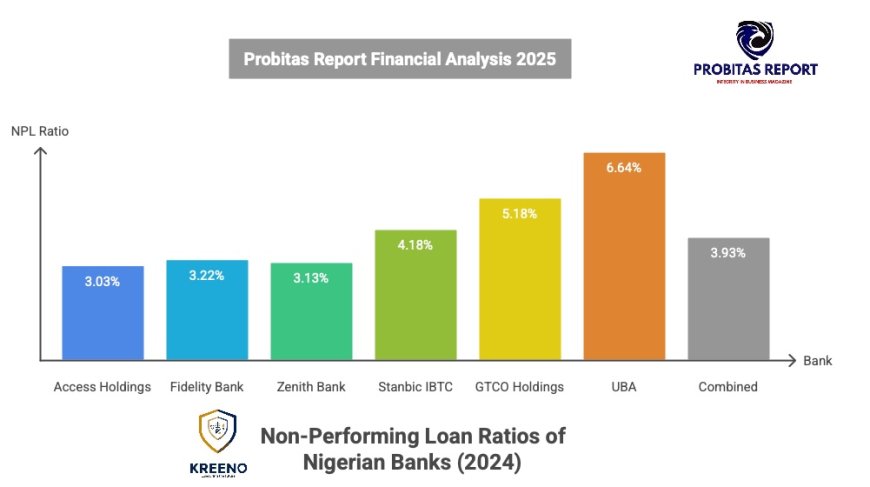

Table: Snapshot of Key Metrics in 2024

By the end of 2024, the Central Bank of Nigeria reported that banks’ non-performing loan (NPL) ratio stood at 4.5%, slightly lower than 4.58% in September, and still within the safe regulatory threshold of 5%. Earlier in May, the ratio had dropped to 3.81% from 4.79% in April, showing a clear mid-year improvement. Overall, data suggests that in 2024 the industry’s NPL ratio averaged about 3.9%, a much better level compared to previous years.

image:

Interpretation

In 2024, Nigeria’s banking sector kept its non-performing loan (NPL) ratio at a moderate level, ranging between 3.8% and 4.5%, which was within regulatory limits though slightly higher by year-end. Most major banks such as Access, Fidelity, Zenith, and Stanbic IBTC performed well, keeping their NPLs between 3% and 4%. However, GTCO crossed the regulatory limit with an NPL above 5%, while UBA recorded a worrying 6.64% in stage-3 (credit-impaired) loans, showing clear signs of weakening credit quality. Taken together, this means that while the sector appears stable overall, stress in a few large banks could spill over and affect the wider financial system if not carefully managed.

Consequences for Borrowers and Banks

- Borrowers get mis-matched loans: Imagine a vessel owner financing a 15-year asset with a 6-month loan must keep renewing, and each renewal is risky with rate hikes that can destroy viability..

- Banks strain reserves and liquidity: As stage-2 loans balloon and provisions escalate, capital drains. Zenith's high provisioning tells that story, banks bleed whilst chasing income, then scramble when defaults spike.

- Systemic fragility mounts: Heritage Bank’s collapse reminds us: pockets of misalignment can infect confidence, trigger license revokes, and plunge institutions toward NDIC resolution.

- Macro-stress compounds micro fragility: Loose matching in inflationary, FX-volatile Nigeria is reckless. Borrowers default; banks scramble; the cycle deepens.

Conclusion: Healing the Mismatch

We’ve mapped how Nigeria’s loan default crisis isn’t just only about the weak borrowers lack of integrity in business culture, or poor governance, it’s rooted in how banks push sales and chase income, building mismatched portfolios that crack under macro pressure.

Next steps, rooted in tradition and proven safeguards:

- Ensure long-term assets are financed with longer-tenor funding, properly matching assets to liabilities.

- Strengthen liquidity buffers and stress tests, guided by CBN and IMF-backed supervision .

- Incentivize client-centric lending, not just volume targets; design products that align with projects’ lifecycles.

- Leverage NDIC and CBN data to detect mismatch risks early by closely tracking stage-2 loans, provisioning ratios, and asset-liability gaps.

“Let’s see tradition not as rigidity but as wisdom, where banks provide funding wisely, borrowers receive support that matches their needs, and both stability and prosperity grow together.”

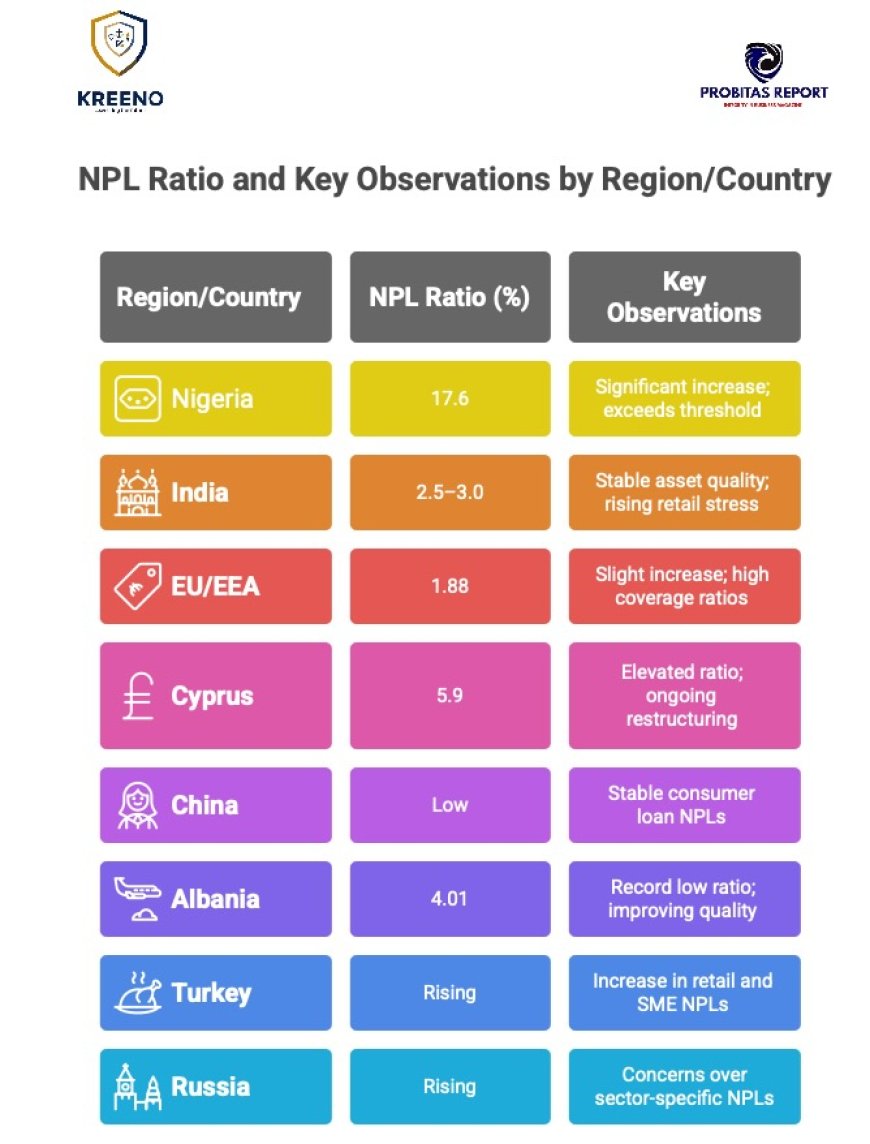

Nigeria’s Non-Performing Loans (NPL) Position – June 2025

The Gross NPL ratio in Nigeria’s banking sector jumped to 17.6% in June 2025, raising serious concerns about asset quality. This level is far above the Central Bank of Nigeria’s prudential threshold of 5%, signaling urgent need for corrective measures. The sharp rise is linked to wider economic pressures as well as sector-specific challenges that continue to weigh on borrowers and banks.

image:

Strategic Implications & Recommendations

Stronger Regulation: Since NPLs are far above the safe threshold, regulators must tighten oversight and step in quickly when risks appear.

Better Loan Management: Banks need to improve how they manage loan quality to stop defaults from worsening.

Sector-Specific Support: Industries under particular stress should get targeted help to bring down theits high NPL levels.

Stronger Capital Buffers: Banks must build enough capital reserves to withstand shocks that come with rising bad loans.

Partnerships with Credible Debt Recovery Agencies: Banks should work with trusted debt recovery professionals like Kreeno Debt Recovery & Private Investigation Agency to improve collections, recover non-performing assets, and protect balance sheets.

Author

Dr. Prisca Ndu

Global Director of Strategic Partnerships

KREENO DEBT RECOVERY & PRIVATE INVESTIGATION AGENCY

KREENO CONSORTIUM

Kreeno Place: Plot 1, Rufus Ojeagbase Street, WAEC Estate, Arogun Junction,

Mowe-Ofada Rd, Mowe, Ogun State, Nigeria

Tel: +234 809 867 7827 | WhatsApp: +234 902 128 8737

Email: info@kreenoholdings.com | info@kreenoplus.com

Web: www.kreenoholdings.com | www.kreenoplus.com

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?