Debt Repayment and Business Ethics: Why Debt Repayment is the Backbone of a Thriving Business Ecosystem

Debt repayment is not just about settling balances—it defines a business's integrity, credibility, and long-term success. Companies that honor their financial obligations foster trust with investors, suppliers, and financial institutions, ultimately securing more opportunities for expansion and sustainability. Conversely, defaulting on debts leads to reputational damage, legal risks, and financial instability. This article explores the crucial role of ethical debt repayment in maintaining a healthy business ecosystem and why it is the backbone of economic growth.

By Dr Kreeno

Today being the beginning of a brand new month, with all humility and everyvsense of responsibility write to thought leaders and visionaries in both the workplaces and marketplaces in Nigeria, I want to delve into a topic that lies at the very heart of our business ecosystem: the integrity of debtors in repaying loans to banks, other financial institutions and lending companies. This issue transcends mere numbers on a balance sheet; it speaks to the trust, ethos, and responsibility that underpin sustainable commerce. In the world of finance, the relationship between lenders and borrowers is sacred. It is built on mutual respect and trust—a handshake agreement that promises growth for both parties. But when that trust is broken, the ripple effects are profound, shaking not just individual businesses, families, generations, but entire economies.

Integrity: The Bedrock of Sustainable Commerce

Integrity isn’t merely an ideal—it’s a necessity. As Dr. Ohio O. Ojeagbase so aptly puts it, "Integrity ensures that businesses honor their commitments, navigate challenges ethically, and contribute positively to the larger economic ecosystem." When applied to debt repayment, integrity becomes the linchpin that holds together the intricate web of modern business finance. When a business borrows money, it enters into a dual contract: one financial, the other moral. Failing to honor this commitment through non-payment or misuse of funds is more than a fiscal misstep—it’s a betrayal of trust. And in today's interconnected global economy, such breaches can have far-reaching consequences.

Consider the story of a mid-sized manufacturing firm (name withheld) that faced financial turmoil during the 2018 global recession. Instead of defaulting, its CEO demonstrated extraordinary integrity by engaging in transparent communication with creditors, proposing realistic repayment plans, and even making personal sacrifices to prioritize debt obligations. This approach didn’t just salvage the company’s reputation—it strengthened it, earning the trust of stakeholders and setting the stage for future success.

The Cost of Broken Trust

Unfortunately, not every business follows this path. For those who neglect their financial responsibilities, the repercussions are severe—and multifaceted.

First, there’s the immediate financial toll. According to recent data, non-bank lenders lost 7% of their revenue due to fraud alone in 2022. These losses reverberate throughout the economy, prompting lenders to tighten credit conditions and stifle economic growth. But the damage extends beyond Naira and kobo. A business that defaults on its debts risks irreparable harm to its reputation. In an era where information travels faster than ever, a single act of dishonesty can tarnish a brand’s image, eroding trust amongst investors, suppliers, and customers alike. This reputational blow often proves far more crippling than the original debt itself. In Nigeria’s competitive market, maintaining financial integrity isn’t just good practice—it’s essential for long-term survival and growth.

Even worse, some cases spiral into legal battles and financial ruin. In Nigeria, the misuse of government-backed loans, such as those from the Central Bank of Nigeria (CBN) intervention funds, Bank of Industry (BOI), or Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL) as well as Banks and Other Financial and Non Financial Institutions, can lead to criminal charges. Whether it’s issuance of dishonered cheques, collecting investors or shareholders funds and deliberately crippling the business, obtaining money by false pretense, cybercrime, diverting funds for personal luxury, falsifying business intentions, breach of business contract duly executed, or attempting to evade debt repayment through bankruptcy claims or religious emotional blackmails and "withcraft", these actions amount to financial fraud—carrying severe consequences, including criminal prosecution, asset forfeiture, and blacklisting from future financial assistance.

READ More News:

- The Acting Group CEO of Access Holdings PLC

- Blackmail And Extortion In Nigeria And Consequences

- Tribute To Mrs Titilayo Osuntoki HCIB

- ABUAD Business School and KREENO Forged Strategic Partnership

Fostering a Culture of Integrity In Business

So, how do we cultivate a culture where integrity reigns supreme? The answer lies in shared responsibility—between borrowers, lenders, and regulators.

For Borrowers:

Business owners must recognize that prudent debt management is essential for long-term success. This means:

- Timely Repayment: Meeting obligations as agreed upon builds credibility and fosters stronger relationships with lenders.

- Responsible Borrowing: Carefully assess your capacity to repay before taking on new debt. A healthy debt-to-equity ratio (typically 1:1.5) serves as a guideline, though this may vary by industry.

- Purposeful Use of Funds: Diverting loan proceeds to unintended purposes not only violates loan terms but also jeopardizes the business’s stability.

For Lenders:

Lenders play a critical role in mitigating risks and fostering transparency. Strategies include:

- Thorough Vetting: Conduct rigorous due diligence on loan applications to ensure borrowers’ financial health and intentions align with stated goals.

- Regular Monitoring: Stay informed about borrowers’ financial performance and intervene early if red flags arise.

Strengthening Collateral Control in Lending: Safeguarding Against Defaults

1. Leveraging Collateral Control Through Structured Financing

One of the most effective ways to mitigate default risks in lending is through collateral-backed financing structures such as loan warehousing and special purpose vehicles (SPVs). These structures provide an added layer of security, ensuring that lenders have direct control over the assets linked to the loan facility.

- Loan Warehousing: This model involves **pooling multiple loans into a centralized fund** before they are securitized or sold to investors. It ensures that lenders retain oversight and control over the loans, reducing exposure to risky borrowers.

- Special Purpose Vehicles (SPVs): These are legally separate entities created specifically to hold and manage loans, shielding the parent lending institution from financial risks while ensuring that collateral remains properly structured and safeguarded against potential defaults.

By adopting these structured lending mechanisms, financial institutions can enhance risk management and ensure borrower accountability.

2. Eliminating Clean Lending: Ensuring Borrowers Have a Meaningful Stake in Repayment

For many lending companies, the practice of issuing loans without sufficient collateral (clean lending) has proven to be a major pitfall, leading to high default rates and increased financial losses. Moving forward, lending institutions especially LendCos must prioritize securing loans against tangible assets to instill a sense of responsibility and financial discipline in borrowers as most borrowers with titles that should be revered have turned out to be devils and worst loans default.

- Tie Loans to Valuable Collateral: Ensure that every loan is secured against verifiable asset, whether it's real estate, vehicles, business equipment, or financial guarantees. This discourages reckless borrowing and compels the borrower to think twice before defaulting.

- Legal and Contractual Binding Agreements: Establish legally binding agreements that clearly outline the consequences of default, including seizure of pledged assets, blacklisting from future credit, and legal prosecution.

- Reassessing Personal and Relationship-Based Lending: Many loan defaults stem from borrowers exploiting personal relationships, using friendship and goodwill as excuses for non-repayment. Lenders must adopt a strict credit risk assessment approach that ensures no loan is granted without enforceable security or repayment assurances. In the event you have none, you can still het justice by contacting KREENO DEBT RECOVERY AND PRIVATE INVESTIGATION AGENCY of KREENO HOLDINGS to secure all assets as all debts must be repaid as "DEBTS No Get EXPIRY DATE O" You can WhatsApp KREENO DEBT RECOVERY AGENTS on +234 708 832 5000 or Email: operations@kreenoplus.com or drkreeno@gmail.com

- How Non Payment Of Your Debt Affect Your Integrity

- Strengthening Fight Against Financial Fraud in Nigeria

- 1.3BN Fraud: Police To Arraign Obanikoro's Son On February 27

- An Abuja-Based Bishop Sentenced To 20 Years Imprisonment For Rape of A Minor

3. Case Study: The Impact of Weak Collateral Control

A microfinance institution in Nigeria recently suffered massive losses after issuing **unsecured loans to traders and SMEs** based on **verbal assurances and relationship-driven trust**. Many borrowers defaulted, citing **economic hardship and personal issues**, leading to **over 40% of loan accounts turning non-performing**. Had the institution **implemented strong collateral control measures**, these defaults could have been mitigated, protecting both the lender and the financial ecosystem.

The future of sustainable lending in Nigeria must prioritize collateral-backed financing. By implementing loan warehousing, SPVs, and enforceable collateral structures, lenders can drastically reduce default rates, protect capital, and create a more disciplined borrowing culture. Lending companies must shift from clean lending to secured lending, ensuring that borrowers have something at stake—forcing them to approach borrowing with a higher sense of responsibility. After all, a borrower who knows their assets are at risk is far less likely to default.

Warehouse lending, when executed responsibly, offers a low-risk model characterized by diversification across multiple clients and short-term exposure (often around 15 days). Such frameworks empower lenders while safeguarding the broader financial system.

Striking the Right Balance

While debt can fuel growth, excessive leverage poses significant risks. Business owners must strike a delicate balance, ensuring they borrow only what they can responsibly repay. Over-leveraging not only threatens solvency but also undermines the trust that forms the bedrock of our financial systems.

As Dr. Ojeagbase reminds us, "Choose the path of integrity in business, for it is not only the ethical choice but also the most sustainable and rewarding one in the long run." By prioritizing honesty and accountability, we fortify the foundations of our business ecosystem, creating a climate where all participants thrive.

A Call to Action

Let us commit ourselves to upholding the highest standards of integrity—not just because it’s the right thing to do, but because it’s the smart thing to do. When businesses honor their financial promises, they unlock opportunities for growth, innovation, and prosperity. They build trust, foster collaboration, and inspire confidence.

In closing, I urge each of you to reflect on the power of integrity in your own practices. Together, let’s champion a business environment where trust flourishes, debts are repaid, and economies prosper. Thank you.

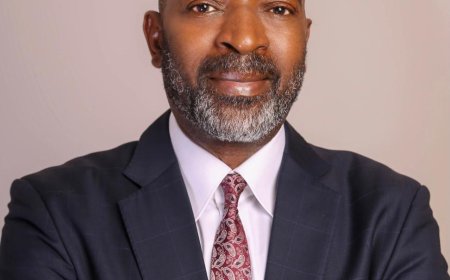

Author:

Ohio O. Ojeagbase, PhD, FICA, FIDR, DBA in View

Chief Private Investigator/CEO

Kreeno Debt Recovery and Private Investigation Agency

A Subsidiary of KREENO Holdings LLC, USA

ADVERT: FOR ALL YOUR JUBEP, PRE-DEGREE, UNDERGRADUATES, MASTERS, DOCTORAL PROGRAMS, JOIN ME AT ABUAD BUSINESS SCHOOL

Contact Information:

ABUAD Business School, Ibadan Campus: 13, Osuntokun Avenue, Bodija, Ibadan

Mrs. Ezekpo Funmilola (Assistant Registrar, Exams and Records)

WhatsApp Only: 0902 505 0410 and Phone: 0806 379 5399

Citations:

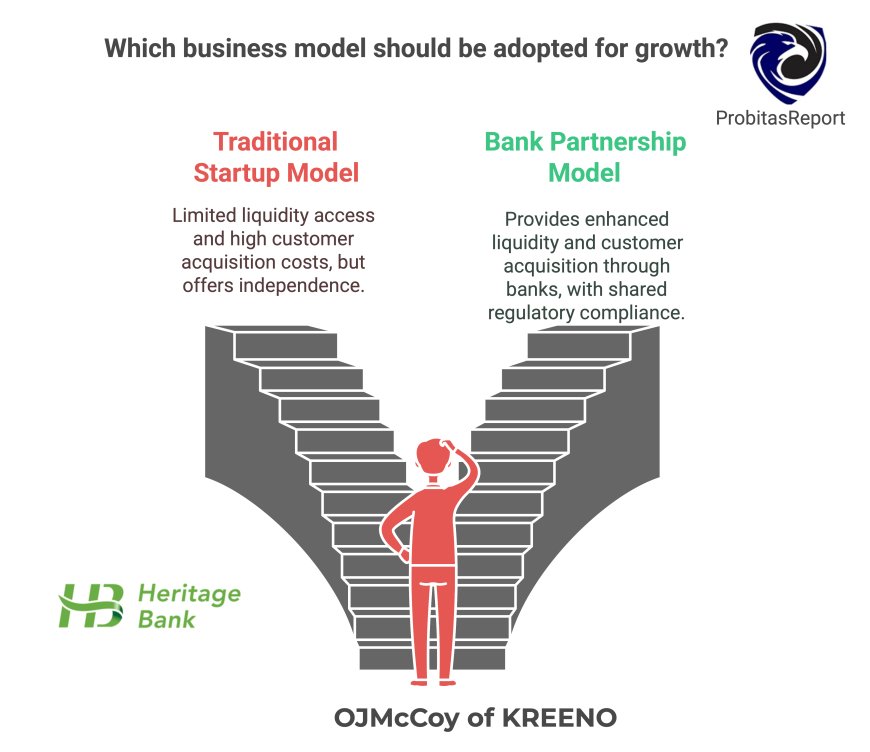

[1] Probitas Report: [How Non-Payment of Your Debts Is Directly Proportional to Your Lack of Integrity in Business Practice](https://probitasreport.com/how-non-payment-of-your-debts-is-directly-proportional-to-your-lack-of-integrity-in-business-practice)

[2] Resistant AI: [Business Loan Fraud](https://resistant.ai/blog/business-loan-fraud)

[3] Scio Capital: [Asset-Based Lending 101: Maximizing Returns with Loan Warehousing](https://www.scio-capital.com/post/asset-based-lending-101-maximizing-returns-with-loan-warehousing)

[4] LW Principles: [Importance of Small Business Owners Being Prudent with Debt Management](https://www.lwprinciples.com/knowledgecenter/importance-of-small-business-owners-being-prudent-with-debt-management)

[5] Feher Law: [Misusing SBA Loan Funds & Bankruptcy Fraud](https://feherlaw.com/misusing-sba-loan-funds-bankruptcy-fraud/)

[6] Mortgage Bankers Association: [Warehouse Lending Brochure](https://www.mba.org/docs/default-source/uploadedfiles/policy/22841-mba-warehouse-lending-brochure-pages.pdf?sfvrsn=a6b36896_0)

[7] Business.com: [What Is a Healthy Business Debt Ratio?](https://www.business.com/articles/healthy-business-debt/)

What's Your Reaction?