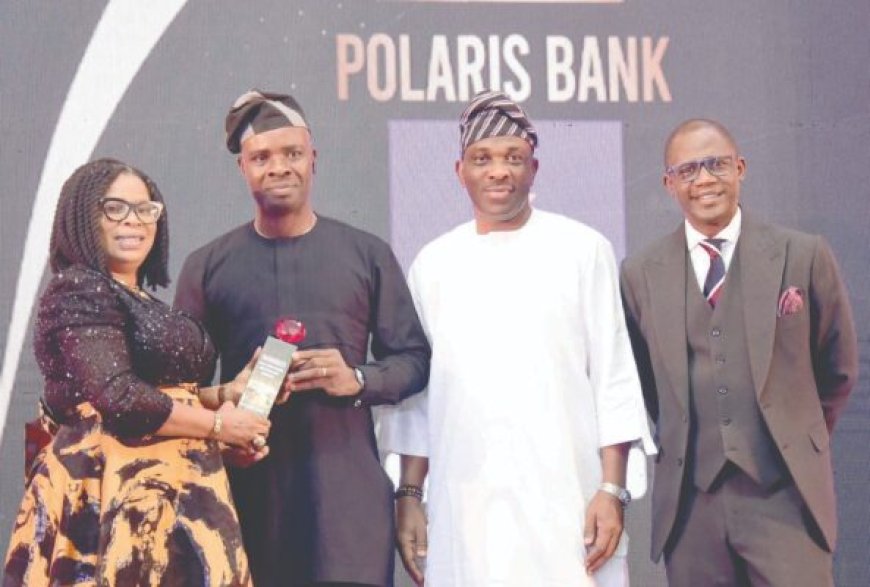

Polaris Bank Dominates 2025 BAFI Awards, Wins Digital Bank and Best MSME Bank for Fifth Straight Year

Polaris Bank continues its reign as Nigeria’s most innovative financial institution, winning Digital Bank of the Year and Best Bank for MSMEs at the 2025 BusinessDay BAFI Awards. This marks the Bank’s fifth consecutive victory, reinforcing its leadership in digital innovation, financial inclusion, and SME empowerment.

Polaris Bank has once again demonstrated its leadership in Nigeria’s financial technology space, emerging as the ‘Digital Bank of the Year’ and ‘Best Bank for MSMEs’ at the 2025 BusinessDay Banks and Other Financial Institutions (BAFI) Awards. These honors, marking the Bank’s fifth and fourth wins respectively, affirm its consistent excellence in digital innovation, customer trust, and support for enterprise growth.

The Bank’s flagship platform, VULTe 3.0, powered by artificial intelligence, has redefined the digital banking experience in Nigeria by providing tailored services that make transactions smarter, faster, and more personal. Through strategic SME financing programs, streamlined digital credit access, and initiatives that uplift women-led and creative enterprises, Polaris Bank continues to deepen its commitment to inclusive economic empowerment.

This recognition reflects a sustained journey of innovation and customer focus. Polaris Bank’s digitally driven strategyis transforming the way Nigerians access, manage, and grow their finances, fostering a culture of convenience, accountability, and financial literacy.

At the center of this transformation lies VULTe, the Bank’s trailblazing digital platform, which achieved remarkable growth in 2025. Within just the first eight months of the year, VULTe processed millions of transactions, a testament to its reliability, accessibility, and widespread adoption. More than a banking tool, it serves as the financial lifeline for individuals and businesses nationwide, powering prosperity through technology, integrity, and innovation.

News continues after this ad:

- Blackmail and Extortion in Nigeria and The Punishment in The Law

- Moral Minefield or Smart Move? The Silent Epidemic of Strategic Defaulters in Nigeria’s Lending System

- Celebrating The Birthday Of The King Of Debt Recovery In Nigeria 2024

- Rape In Nigeria Law: Penalties, Legal Complexities Explained

More than just a typical banking app, the enhanced VULTe 3.0 has emerged as one of the most advanced digital banking platforms in the industry. It leverages artificial intelligence to deliver personalized experiences, streamline user interactions, and boost efficiency across all banking operations.

Since its debut in 2021, Polaris Bank has nurtured a culture of innovation and customer responsiveness, consistently refining VULTe’s capabilities based on direct feedback from users. This commitment to improvement has positioned VULTe not merely as a participant in the digital revolution but as a pacesetter in Nigeria’s financial technology landscape.

At the award presentation, Dele Adeyinka, Chief Digital Officer of Polaris Bank, described the honor as a testament to the Bank’s human-centered digital transformation journey.

“This recognition belongs to our customers,” Adeyinka remarked. “Their trust drives our innovation. VULTe is not just a platform—it’s a living ecosystem where people can bank, save, borrow, and grow seamlessly. Every update we make is guided by our mission to make banking more intelligent, more inclusive, and effortlessly accessible for every Nigerian.”

Polaris Bank acknowledges that Micro, Small, and Medium Enterprises (MSMEs) form the foundation of Nigeria’s economic engine and has intentionally designed digital tools to strengthen this sector. In the second quarter of 2025, the Bank unveiled a robust financing program aimed at supporting professionals in the creative economy through collaborations with Woodhall Capital (UK), the Lagos State Government, and the British Government. In the months that followed, the Bank extended its reach to hundreds of small and medium-sized businesses across multiple industries, prioritizing funding access for women-led and women-owned enterprises in education, fashion, and other high-impact sectors.

These initiatives reaffirm Polaris Bank’s dedication to inclusive growth and gender equity, positioning it as a trusted partner for sustainable enterprise development. By introducing simplified loan applications, digital credit scoring, and integration with the VULTe for Business platform, the Bank has eased access to working capital and eliminated many of the bureaucratic hurdles associated with traditional banking. This innovation-driven strategy is transforming stories of business survival into thriving success narratives across Nigeria.

Reflecting on the Bank’s recent achievements, Kayode Lawal, Managing Director and CEO of Polaris Bank, expressed gratitude to customers and employees, stating that receiving the Digital Bank of the Year (for the fifth consecutive time) and Best Bank for MSMEs (for the fourth time) affirms the Bank’s commitment to innovation centered on customer needs.

“Our mission has always been clear — to harness technology as a bridge to opportunity, making banking not just simpler, but truly life-changing,” said Kayode Lawal, Managing Director and CEO of Polaris Bank. “These recognitions are a tribute to our customers, our dedicated team, and every partner who shares in our vision for a more inclusive financial future.”

Lawal reaffirmed that Polaris Bank will sustain its momentum by investing heavily in digital infrastructure, including its recent core banking system upgrade, while advancing financial inclusion and delivering seamless, connected experiences across all touchpoints.

BusinessDay has consistently recognized innovation and leadership in Nigeria’s corporate space, and Polaris Bank’s evolution embodies both ideals. With the rollout of VULTe 3.0, the Bank has established one of the most adaptive AI-powered digital ecosystems in the country. By grounding innovation in customer insights, Polaris ensures that every technological enhancement solves practical needs and drives real value.

Through its commitment to digital credit access, SME empowerment, and data-driven banking, the Bank is actively fueling economic growth and enabling Nigeria’s entrepreneurial community. In a financial landscape where transformation is often promised but rarely sustained, Polaris Bank stands apart — consistently delivering measurable impact and customer-verified results. Its digitally focused strategy, passion for innovation, and deep-rooted service culture are not only reshaping banking in Nigeria, but defining the standard for the digital era.

Polaris Bank is a leading customer-centric financial institution positioned as a digital, future-forward bank committed to delivering industry-defining value across retail, SME, and corporate segments through innovation, inclusion, and excellence.

On behalf of KREENO CONSORTIUM, we extend our warmest congratulations to Polaris Bank on its remarkable achievement as the Digital Bank of the Year and Best Bank for MSMEs at the 2025 BusinessDay BAFI Awards. This well-deserved recognition reflects Polaris Bank’s visionary leadership, relentless innovation, and deep commitment to empowering Nigeria’s business landscape through technology and integrity. As partners in advancing financial responsibility and sustainable enterprise, we at KREENO celebrate this milestone as a testament to the Bank’s excellence in redefining customer experience and supporting inclusive economic growth. We applaud the Polaris team for setting new benchmarks in digital transformation and remain inspired by their dedication to nation-building through ethical finance.

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?