Broken Promises, Broken Economy: Why Loan Ethics Decide Nigeria’s Financial Fate

Nigeria’s economic revival depends on more than fiscal policies. This article by Dr. Ohio O. Ojeagbase explores how integrity in loan contracts, ethical lending, and repayment culture can determine the success or failure of President Tinubu’s Renewed Hope agenda.

By Dr Ohio O. Ojeagbase

You’ve felt it, haven’t you? That collective wince when a business deal feels a little too flexible on the details, or when a promise seems to come with an invisible asterisk. In Nigeria’s bustling financial corridors, from the high-rises of Lagos to the markets of Kano, a quiet epidemic is undermining our collective prosperity. It’s not just about inflation or the exchange rate; it’s about a fundamental breakdown in trust, starting with the very promises that fuel an economy: loan contracts.

When a loan is granted with a wink and a nudge, or a borrower treats repayment as an optional courtesy, it’s more than a private misunderstanding. It’s a crack in the foundation of our financial system. As President Bola Tinubu’s Renewed Hope agenda seeks to steer the nation toward sustainable growth, the integrity of lending practices has emerged as the unshakeable bedrock upon which our economic future will be built or crumble.

The High Cost of a Broken Handshake: Understanding Non-Performing Loans 2025

Let's cut through the jargon. A non-performing loan (NPL) is, quite simply, a loan where the borrower has stopped making the promised payments for a significant period, usually 90 days or more. It’s a broken handshake. And the scale of this problem in Nigeria is staggering.

While the Central Bank of Nigeria (CBN) has done commendable work in bringing the official NPL ratio down to a reported 4.50% in 2024, this headline figure masks a more complex reality. A deeper dive reveals that as of April 2025, eleven major Nigerian banks had seen their bad debt levels cross the prudential threshold of 5%, with total non-performing loans soaring to an estimated ₦3.25 trillion.

But what does this number actually mean for you and me? Every defaulted loan isn't just a line item on a bank's balance sheet; it's capital that is now frozen. It’s money that could have been lent to a small business owner in Aba to buy new machinery, to a farmer in Niger State to expand his acreage, or to a tech startup in Yaba to hire more developers. This is the hidden strain how loan defaults are stifling growth for everyday Nigerians. "When trust evaporates, credit seizes up, and the entire economy pays the price" says Dr Ohio O. Ojeagbase of KREENO CONSORTIUM.

Integrity in Lending: More Than Just a Contract, It's a Covenant

So, where does ethics come in? Integrity in lending means treating a loan contract not as a mere piece of paper to be exploited, but as a sacred covenant of mutual trust. This integrity is a two-way street.

For lenders, it means conducting thorough due diligence, being transparent about all terms and fees, and avoiding predatory practices. It’s about ensuring that the borrower truly understands the commitment they are making. As noted in a recent Probitas Report journal, ethical lapses like unclear documentation and deliberate misrepresentation have severely undermined contractual obligations in our system.

For borrowers, it’s about the moral duty to honour one’s word no matter the economic situation. It’s about viewing repayment not as a burden to be avoided, but as a commitment that builds one’s financial reputation and, by extension, the nation’s.

When this pact is broken, the signal to international investors is clear: Nigeria’s financial sector carries excessive risk. This perception forces lenders to price in that risk, leading to higher interest rates for everyone. “The role of integrity in business culture in the Nigerian banking sector, therefore, isn't just a moral nicety; it's a direct determinant of the cost of capital and the ease of doing business” says Dr Ohio O. Ojeagbase of KREENO CONSORTIUM.

A Continental Perspective: How Nigeria Stacks Up

To truly understand our position, it helps to look at our peers. The impact of NPLs on Nigeria's economic growth becomes clearer when we see how we manage this challenge compared to other African economies. The following table provides a snapshot of the NPL landscape across the continent:

Comparative NPL Ratios (closest publicly reported figure up to Sept 2025)

|

Country |

NPL ratio (%) |

Latest reported date (source) |

|

Nigeria |

4.5% |

Latest reported (2024 figure reported in IMF Article IV, cited July 2025). |

|

Kenya |

17.1% |

Reported for September 2025 (asset-quality update cited Sep 2025). |

|

South Africa |

~5.6% |

Major banks, H1 2025 (press analysis / industry reporting, Sep 2025). |

|

Egypt |

~2.2% |

Banking-sector NPL ratio Q1 2025 (CBE / sector update). |

|

Ghana |

~20.8% |

Industry NPL ratio, Sept 2025 (Bank of Ghana MPC release). |

|

Angola |

~10% (or ~19.8% incl. problem banks) |

Fund staff note / IMF (Mar–Jul 2025 reporting on 2024–25 data, shows ~10% excluding problem banks, ~19.8% if problem banks included). |

|

United States |

~1.7% |

Latest published (Dec 2024 series; asset quality favorable through mid-2025 per regulators). |

|

United Kingdom |

~1.0% |

World Bank / CEIC historical series (latest public series points to ~1% level in recent official series; UK NPLs remain low). |

|

Canada |

~0.6–0.7% |

Latest public series (Sep/Dec 2024 / early-2025 data shows ~0.6–0.7% NPL ratio). |

Short interpretive notes (one line each)

-

Nigeria’s 4.5% (IMF/CBN reporting) is the officially-reported baseline but other market/ratings commentary flagged higher, stressed readings in 2025 — check regulator disclosures for bank-level variance.

-

Kenya’s 17.1% (Sep 2025) reflects persistent stress in some loan segments and shows a sharper pocketed deterioration vs earlier years.

-

South Africa’s banking sector broadly reports mid-single digit NPLs (major banks ~5–6%), a healthier profile than several peers.

-

Egypt, UK, Canada and the US show low single-digit (often sub-2%) NPLs consistent with advanced-market banking systems and strong provisioning regimes.

-

Ghana and Angola continue to show elevated NPLs (double-digit), underlining structural credit-quality issues and the need for recapitalisation or active resolution policies.

Whilst Nigeria's ratio appears healthier than some of its West African neighbours, the devil is in the details. The fact that major banks are breaching the 5% threshold indicates underlying stress. Our aspiration shouldn't be just to be better than the worst-performing; it should be to rival the stability of systems like South Africa's and, ultimately, global benchmarks. This is crucial for attracting the foreign direct investment that the Renewed Hope agenda depends on.

There are key factors contributing to the very low Non-Performing Loan (NPL) ratios reported for the United States (~1.7%), United Kingdom (~1.0%), and Canada (~0.6-0.7%) based on latest data (2024–early 2025) and analyses from regulators and economic reports:

- Blackmail and Extortion in Nigeria and The Punishment in The Law

- Moral Minefield or Smart Move? The Silent Epidemic of Strategic Defaulters in Nigeria’s Lending System

- Celebrating The Birthday Of The King Of Debt Recovery In Nigeria 2024

- Rape In Nigeria Law: Penalties, Legal Complexities Explained

United States (~1.7% NPL ratio)

-

Robust Regulatory Framework and Supervision

The Federal Reserve and other agencies enforce stringent capital and risk management standards ensuring early identification of distressed loans, minimizing defaults. Stress testing and transparency reinforce financial discipline. -

Diverse and Mature Financial Markets

The US benefits from diversified credit markets, with broad access to capital sources and sophisticated risk mitigation tools, leading to healthier loan portfolios and better risk pricing. -

Advanced Debt Restructuring and Bankruptcy Mechanisms

Effective out-of-court workouts, restructuring options, and clear bankruptcy laws enable timely resolution without permanent default buildup. -

Strong Economic Fundamentals

Improved employment rates, stable inflation, and GDP growth create favorable borrower conditions. Although consumer and household debt is high, the stability allows most borrowers to meet obligations. -

Technological and Data-Driven Lending Practices

Lenders use advanced data analytics and credit scoring models for precise risk assessment, reducing loan losses.

United Kingdom (~1.0% NPL ratio)

-

Proactive Supervisory Actions and Regulatory Reforms

The Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) mandate prudent lending, capital adequacy, and risk controls. Post-2008 reforms focus on resilience and early intervention. -

Relatively Low Household and Corporate Debt Stress

UK households and businesses maintain manageable leverage levels, supported by stable income growth and government support systems. -

Efficient Mortgage Market and Loan Servicing

Strong enforcement of mortgage contracts and proactive management of payment difficulties prevent escalation of arrears. -

Risk-Based Pricing and Conservative Lending

UK lenders emphasize risk-based interest rates and thorough credit evaluations that filter out higher-risk borrowers with potential default risk.

Canada (~0.6–0.7% NPL ratio)

-

Robust Banking Sector with Conservative Lending

Canadian banks adopt cautious underwriting with high capital buffers and loan-loss reserves. This prudence inhibits excessive credit risk-taking. -

Strong Consumer Protection and Financial Literacy

Laws safeguard borrowers, while high financial literacy fosters responsible borrowing and repayment habits. -

Comprehensive Monitoring and Early Warning Systems

Bank of Canada and regulators maintain strong surveillance capacities to detect credit deterioration early. -

Stable Economy with Strong Employment and Real Estate Markets

Steady job growth and sound housing markets support loan repayment capacity, limiting defaults.

Summary Table

|

Factor |

United States |

United Kingdom |

Canada |

|

Regulatory Strength |

Very strong |

Strong |

Very strong |

|

Economic Fundamentals |

Robust |

Stable |

Stable |

|

Credit Risk Management |

Advanced analytics |

Conservative lending |

Conservative lending |

|

Debt Restructuring & Bankruptcy |

Effective mechanisms |

Efficient mortgage services |

Proactive monitoring |

|

Consumer/Corporate Leverage |

High but managed |

Moderate |

Moderate |

|

Financial Literacy & Protection |

High |

Moderate-High |

High |

|

Market Diversification |

High |

Moderate |

Moderate |

The Ripple Effect: From Your Wallet to the National Purse

The economic impact of NPLs is a vicious cycle that touches every single Nigerian.

Here’s how:

1.Reduced Lending: Banks with high NPLs become risk-averse. They tighten their lending standards, making it harder for even creditworthy individuals and SMEs to get loans.

2. Higher Interest Rates: To cover the losses from defaults, banks charge higher interest rates on the loans they do approve. This stifles business expansion and consumer spending.

3.Weakened Financial Stability: A pile-up of bad loans weakens the bank's capital base. In a severe scenario, this can lead to bank failures, threatening the entire financial stability of Nigeria and requiring costly government bailouts.

4. The AMCON Burden: The establishment of the Asset Management Corporation of Nigeria (AMCON) was a necessary intervention to absorb the toxic assets of banks. However, its ongoing struggle with debt recovery highlights the systemic nature of the problem. The billions used to capitalise AMCON are public funds that could have been channeled into healthcare, education, or infrastructure.

Restoring Trust in Nigeria's Financial System: A Path Forward

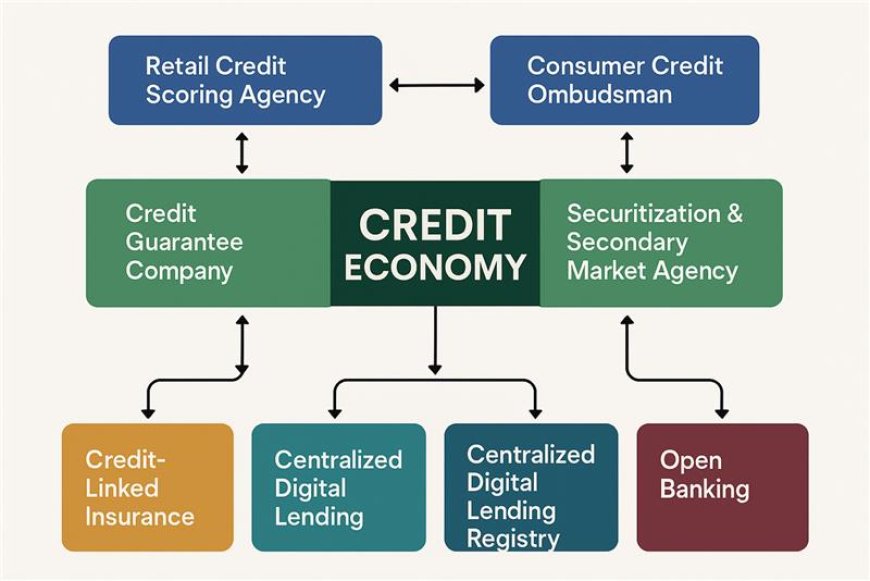

The situation is challenging, but far from hopeless. Fixing the rot requires a concerted effort from all stakeholders such as regulators, lenders, borrowers, and the government. Here’s what a roadmap to restoring trust in Nigeria's financial system could look like:

- For Regulators (CBN): The push for stricter risk classification must continue. Beyond that, championing ethical lending practices in Nigerian banks through a publicly available "integrity index" could shame and shame the laggards while rewarding the virtuous. Strengthening the legal framework for contract enforcement is non-negotiable.

- For Banks: Transparency is key. Moving beyond compliance to genuine loan contract ethics is essential. This means investing in financial literacy for customers and using technology for better credit assessment, not just for aggressive marketing.

- For Borrowers: We must cultivate a cultural shift in which defaulting on a loan is no longer seen as a clever 'hack,' but as a stain on one’s character and reputation. Honoring one’s debts should become a point of personal pride. Moreover, religious institutions, especially churches, have a moral responsibility to actively teach and model the full depth of their faith’s teachings on integrity, honesty, and covenant-keeping. When a loan is entered into willingly and fairly, repaying it even down to the last kobo is not just a legal financial obligation, but a spiritual and ethical one. Any religious teaching that ignores or downplays this principle risks becoming little more than a money-making enterprise or a form of spiritual manipulation, part of a system that is, at its core, morally compromised no matter the witchhaunt or religious blackmail."

- For the Government: The Renewed Hope agenda must explicitly champion financial ethics in Nigeria. This can be done by supporting the CBN’s efforts and ensuring that public sector entities lead by example in their financial dealings.

A Final Word: Our Collective Covenant

Economic renewal is impossible without ethical renewal. Loans are the lifeblood of a modern economy, but without the oxygen of integrity, that blood cannot flow. The conversation about Nigeria's economic growth is often dominated by macroeconomics, but it is built on a million micro-promises kept at the grass root levels.

As we look to rebuild this economy for future generations, the choice is ours. We can continue down a path where short-term cunning is celebrated, and watch as capital flees and opportunities dry up. Or, we can choose the harder, more honourable path of integrity where a handshake is as binding as a contract, and a promise made is a promise kept.

The Renewed Hope agenda provides the vision. But it is our collective commitment to ethical lending practices and financial honesty that will provide the fuel. Let’s choose to build a financial system not just of robust numbers, but of unshakeable trust. Our children’s future depends on it.

About KREENO CONSORTIUM

KREENO Consortium stands at the frontier of Africa’s financial justice system, integrating Debt Recovery, Private Investigation, Corporate Governance, and Forensic Intelligence to protect assets and restore trust. Founded by Dr. Ohio O. Ojeagbase, with other co-founders, KREENO operates from Nigeria and the USA, offering bespoke recovery and private investigative solutions for governments, financial institutions, and private corporations. With a global mindset and African depth, KREENO delivers results anchored on integrity-in-business, precision, professionalism, and accountability. Our mission is clear: To Reclaim, Restore, and Rebuild economic confidence across borders. Each engagement reflects our promise to recover value ethically and rebuild reputations responsibly. As thought leaders in debt recovery, debt restructuring, financial management, sustainable business, and asset protection, KREENO remains the trusted partner for those who seek justice with honor, and profit with principle.

ADVERT:

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?