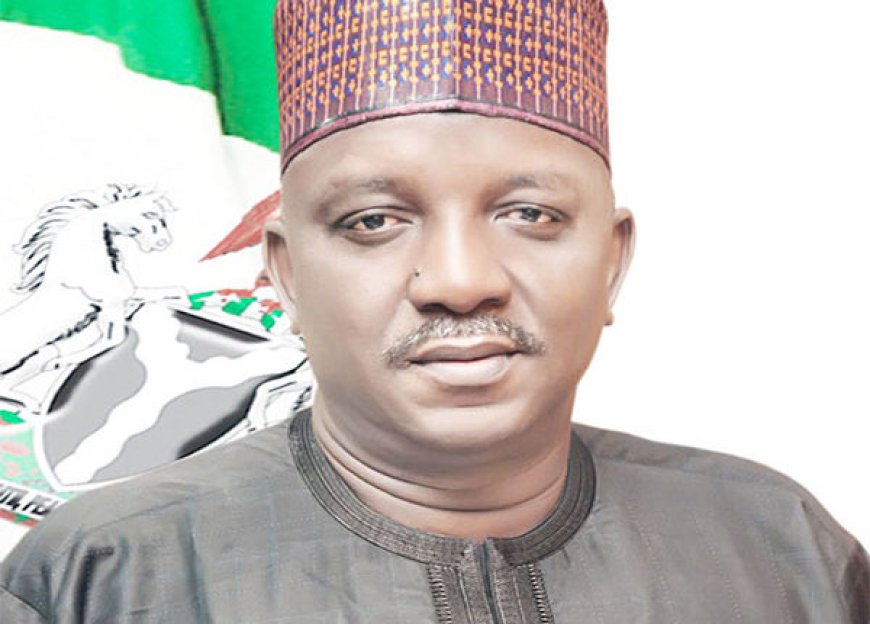

Alleged N33.8bn Fraud: BDC Operator Reveals Receipt of Over N22bn from Federal Ministry of Power

A Bureau de Change operator testifies in the ongoing N33.8bn fraud case involving former Minister of Power, Saleh Mamman. The operator reveals details of how more than N22bn was allegedly siphoned from the ministry through his business accounts for dollar exchanges.

The trial of former Minister of Power, Saleh Mamman continued on Wednesday, January 22, 2025 at the Federal High Court, Abuja, presided over by Justice James Omotosho with the Economic and Financial Crimes Commission, EFCC presenting its 8th witness, PW8.

The witness, PW8 Abdullahi Suleman, a bureau de change operator, narrated how more than N22 billion was allegedly siphoned from the Federal Ministry of Power while Mamman was Minister. He said the naira equivalent of the money was exchanged for United States dollars through his business accounts.

Mamman is being prosecuted by the EFCC on a 12-count charge bordering on conspiracy to commit money laundering to the tune of N33,804,830,503.73 (Thirty-three Billion, Eight Hundred and Four Million, Eight Hundred and Thirty Thousand, Five Hundred and Three Naira, Seventy-three Kobo).

At Wednesday’s proceedings, Suleiman, while being led in evidence by prosecution counsel, Rotimi Oyedepo, SAN narrated that about 12 of his business accounts received money from the Federal Ministry of Power without carrying out any service, contact or project. His companies; Prymint Investment Limited, Strong Field International Projects Limited, Mintedge Nigeria Limited, First Class Construction and Project, Silverline Ocean Ventures, Golden Bond Nigeria Limited, Sipikin Global Enterprise, Spinhiills Biz International limited, Fullest Utility Concepts Limited, Platinum Touch Enterprises, Breathable Investment Limited and a company owned by his brother named Gurupche Business Enterprises were used for the transactions.

“I know Alhaji Maina Goje, we are in the same business, sometimes in 2019, Maina Goje met me that he has transaction that I should give him some of my account numbers, the first account I gave him was Fullest, he will send money and I will give him dollars, he started asking for more accounts, he will tell me what to do with the transactions, I will get the dollar and give him and sometimes I will do a transfer to other accounts. We have been working together since then till 2024. From my rough calculations, the amount I have received through the transactions will be more than 22 billion naira. Also Maina used to send someone called Musbhu anytime he was not available, he would send him and give me instructions on what to do with him, we do call him Yaro Minister because he is from Saleh Mamman", he said.

Continuing, “ I also know Mr Mustapha Muhammed, Goje told me that he is his oga, I didn’t know him before until Maina Goje introduced him to me, then I learnt he works with Federal Ministry of Housing and instructed that anytime they can’t reach him, I should give him the amount of dollars he requested”

When shown Exhibit X series, which contained bank statements generated from his companies showing evidence of money inflows into his bank accounts with Strong Field international Projects Limited, Mintedge Nigeria Limited, Prymint Investment Limited, the witness admitted that they were the accounts he gave Maina Goje.

Among some of the notable transactions shown to him on the accounts were; N285,983,285 received on 24th May 2021, N278, 248.611 on 26th May 2021, , N320m on 1st January, 2021, 184m on 18 June, 2021, N178,300,285 on 14th July 2021, , N75,420, 000 on 5th August 2021, N75,120,000 on 1st December 2021, N68,150,620 and N70,650 on 15th December 2021, N90,247,395 on 12th Jan 2022, N64, 747,627 on 16 February 2022, among others and he agreed receiving them.

Earlier, a Compliance Officer from FCMB presented and tendered bank statements and attachments in a reply letter to the EFCC dated August 16, 2024 in respect of Prymint Investments Limited, Platinum Touch Enterprises, Royal Perimeter Ventures, Golden Bond Nigeria Limited, Flex Utility Concepts Limited, Bentech Nigeria Limited admitted and marked Exhibit XTUB.

The judge subsequently adjourned the case to January 23, 2025, for the continuation of the hearing.

Dele Oyewale

Head, Media & Publicity

January 22, 2025

- The Acting Group CEO of Access Holdings PLC

- Blackmail And Extortion In Nigeria And Consequences

- Tribute To Mrs Titilayo Osuntoki HCIB

- The Place Of Collaboration As New Competition Part 2

Probitas Report Moral Lessons from the Alleged N33.8 Billion Fraud Case

1. Accountability is Key: Public officials must be held accountable for the management of public funds to prevent abuse of office and corruption.

2. Integrity in Business Matters: Businesses and professionals, including Bureau De Change operators, should avoid becoming complicit in fraudulent activities, regardless of the profit involved.

3. Transparency in Government Operations: A lack of transparency fosters corruption. Government ministries must adopt stringent oversight measures to monitor financial transactions.

4. Beware of Greed: Greed often leads to ethical compromises. The consequences of dishonesty can ruin reputations and attract severe legal penalties.

5. Strengthen Financial Oversight: Weak controls in financial systems create opportunities for fraud. Regular audits and compliance checks are essential.

6. The Law Will Catch Up: No matter how long fraud is concealed, the truth often surfaces, leading to legal action and public disgrace.

7. Collaboration Breeds Corruption: Networks of collaborators amplify corruption. Combating fraud requires dismantling such networks.

8. Public Trust is Fragile: Corruption undermines public trust in institutions. Leaders must uphold ethical standards to restore confidence in governance.

9. Every Action Has Consequences: Those who engage in fraudulent practices face consequences that can extend beyond themselves to their families and associates.

10. Support Anti-Corruption Efforts: Citizens and organizations must support anti-corruption agencies to create a culture of accountability and justice in society.

By Jason Okhai, Security And Financial News Reporter For Probitas Report, NG

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?