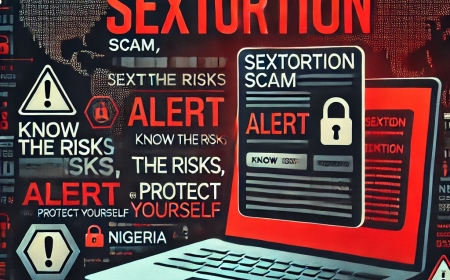

EFCC Arraigns Lawyer for Alleged N1.3 Billion Forex Fraud in Uyo

The EFCC has arraigned Barrister Alexander Uchenna Ozougwu before the Federal High Court in Uyo for allegedly defrauding victims of ₦1.3 billion through a fake forex investment scheme. The court granted him bail at ₦500 million, with the trial set for March 31, 2025.

EFCC Arraigns Lawyer for Alleged N1.3 Billion Forex Fraud in Uyo

The Economic and Financial Crimes Commission (EFCC), Uyo Zonal Directorate, on Wednesday, February 12, 2025, arraigned a legal practitioner, Barrister Alexander Uchenna Ozougwu, before Justice Sergius Onah of the Federal High Court, Uyo, Akwa Ibom State, for allegedly defrauding victims of ₦1,323,850,000 (One Billion, Three Hundred and Twenty-Three Million, Eight Hundred and Fifty Thousand Naira) through a fraudulent foreign exchange investment scheme.

Ozougwu was arraigned on a six-count charge of obtaining money by false pretence, in violation of Section 18(2)(d) of the Money Laundering (Prevention and Prohibition) Act, 2022.

Charges Against the Defendant

One of the counts reads:

"That you, Alexander Uchenna Ozougwu, sometime in September 2024, within the jurisdiction of this Honourable Court, knowingly took possession of the sum of ₦268,850,000 (Two Hundred and Sixty-Eight Million, Eight Hundred and Fifty Thousand Naira) through a bank account registered under the name ‘Starlight Attorneys,’ knowing that the funds were proceeds of an unlawful act—obtaining money by false pretence. You thereby committed an offence contrary to Section 18(2)(d) of the Money Laundering (Prevention and Prohibition) Act, 2022, and punishable under Section 18(3) of the same Act."

Another count states:

"That you, Alexander Uchenna Ozougwu, sometime in July 2024, within the jurisdiction of this Honourable Court, knowingly took possession of the sum of ₦213,000,000 (Two Hundred and Thirteen Million Naira) through the same bank account, knowing that the funds were proceeds of an unlawful act—obtaining money by false pretence. You thereby committed an offence contrary to Section 18(2)(d) of the Money Laundering (Prevention and Prohibition) Act, 2022, and punishable under Section 18(3) of the same Act."

Court Proceedings

The defendant pleaded not guilty to all charges.

Following his plea, the prosecution counsel, Joshua O. Abolarin, requested that the court remand Ozougwu in a correctional facility and set a trial date. However, the defence counsel, C. M. Onuchukwu, informed the court of a pending bail application on self-recognizance, assuring that the defendant would be available for trial.

After hearing both arguments, Justice Onah granted bail in the sum of ₦500,000,000:00 (Five Hundred Million Naira) with two sureties in like sum. The sureties must:

- Be civil servants of Grade Level 12 and above.

- Own landed property within the jurisdiction of the court.

Additionally, the court ordered Ozougwu to:

- Surrender his international passport.

- Provide two recent passport photographs to the court.

Fraud Allegations and Investigation Findings

The charges stem from four petitions alleging that Ozougwu falsely presented himself as a registered Bureau de Change (BDC) operator licensed by the Central Bank of Nigeria (CBN). Gaining the trust of his victims, he allegedly collected passwords to their betting accounts under the pretense of funding them but instead diverted the funds.

Investigations revealed that Ozougwu operated a Ponzi scheme disguised as a forex trading service. Most of the funds were reportedly channeled into various betting platforms instead of currency exchange transactions. A total of ₦1,323,850,000 was discovered to have been diverted from the victims' accounts.

The case was adjourned to March 31, 2025, for trial.

Dele Oyewale

Head, Media & Publicity

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?