Access Holdings Plc Reports ₦616.25 Billion Pre-Tax Profit in Nine Months | Q3 2025 Financial Results

Access Holdings Plc posted a ₦616.25 billion profit before tax for the nine months ended September 30, 2025, up 10.4% from last year. Despite a 2.23% drop in post-tax profit, the Group shows strong balance-sheet growth and investor resilience in Nigeria’s banking sector.

Access Holdings Plc has announced a profit before tax (PBT) of ₦616.25 billion for the nine-month period ended September 30, 2025, representing a 10.4% rise compared to ₦558.18 billion recorded in the same period of 2024.

However, according to the unaudited financial statements released on Thursday, October 30, 2025, the profit after tax (PAT) declined by 2.23% to ₦447.55 billion, reflecting higher tax expenses and cost adjustments during the period.

The group’s earnings per share (EPS) also fell by 35.48%, dropping to ₦8.00 (800 kobo) in 9M 2025, from ₦12.40 (1,240 kobo) in the corresponding period of 2024.

On a positive note, gross earnings grew by 14% year-on-year to N3.9 trillion, compared to N3.4 trillion in 9M 2024.

- NestOil Headquarters Sealed Over $1 Billion Debt, Stakeholders Receive Urgent Update

- OTL 2025: Oyebanji Says Deregulation Sparks Renewed Focus on Infrastructure and Long-Term Growth in Downstream Sector

- OTL Platform Has Played A Crucial Role In Shaping Agenda For Downstream Development Across Africa- Sanwo-Olu

- Tinubu Reaffirms Support for Dangote Refinery Expansion, Calls on Africa to Harness $120B Oil Market

- OTL 2025: Africa’s Downstream Energy Leaders Unite to Drive Market Innovation and Strategic Investment

- OTL Africa Downstream Energy Week 2025 in Lagos: Driving Africa’s Downstream Transformation

Key Highlights (9M 2025 vs. 9M 2024)

- Interest Income: N2.904 trillion (+21.11% YoY)

- Interest expenses: N1.646 trillion (+6% YoY)

- Net interest income: N1.258 trillion (+48.90% YoY)

- Impairment: N349.985 billion (+141.45% YoY)

- Net interest income after impairment: N907.955 billion (+29.73% YoY)

- Fees and Commission income: N600.404 billion (+49.53% YoY)

- Fair value & foreign exchange gain: N255.400 billion (-53.43% YoY)

- Total operating expenses: N1.164 trillion (+6.74% YoY

- Total Assets: N52.2 trillion (+25.8%)

- Customer Deposits: N33.1 trillion (+47.0%)

- Loans and Advances to Customers: N12.89 trillion (+12.3%)

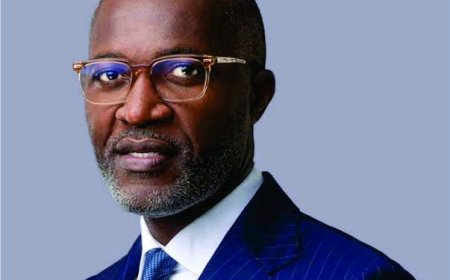

Mr. Innocent Ike - Group Chief Executive Officer, Access Holdings Plc

Driving the numbers

Access Holdings’ top-line growth was largely driven by strong gains in interest income, which rose by over N506 billion year-on-year due to a larger loan book and expanded holdings in investment securities.

- Investment securities stood at N15.25 trillion, now exceeding loans and advances to customers, which totaled N12.89 trillion.

This suggests that Access Holdings is investing more in investment securities (like government bonds or treasury bills) than it is in giving out loans to customers.

The bank is playing it safer, which can protect profits in tough times, but it could also mean they’re less focused on rapid growth through lending, possibly due to concerns about rising defaults.

That cautious stance is further reflected in the Group’s interest expense, which rose modestly by 6% YoY to N1.65 trillion, suggesting Access was able to grow interest-earning assets faster than the cost of funding.

- This helped drive a strong 48.90% increase in net interest income, which reached N1.26 trillion

However, the benefit from interest income was significantly impacted by surging impairment charges, which more than doubled to N349.99 billion, up 141.45% YoY.

- This sharp increase suggests the bank is either facing rising loan defaults, being more conservative in provisioning, or both.

Consequently, net interest income after impairment grew at a slower pace of 29.73% YoY to N907.96 billion.

Non-interest income

Beyond interest income, non-interest revenue was another key contributor to performance. Fees and commission income surged by 49.53% YoY to N600.40 billion, driven by increased customer activity across digital channels, payments, and core banking services.

- The bank made N284 billion from credit-related fees and commissions.

- Another non-interest income Centre was from channels and other E-business income of N151 billion

However, fair value and foreign exchange gains came in at N255.40 billion, representing a significant decline of 53.43% YoY.

On the cost side, total operating expenses rose modestly by 6.74% YoY to 1.16 trillion, a commendable feat considering the inflationary environment and ongoing investments in people, systems, and infrastructure.

- However, while the growth rate is relatively contained, the absolute cost base remains significant, consuming nearly a third of gross earnings.

Balance Sheet

Access Holdings’ balance sheet reflected solid growth momentum, with total assets rising by 25.8% to ₦52.2 trillion as of September 2025, compared to ₦41.5 trillion recorded at the end of December 2024.

This expansion was primarily driven by a surge in customer deposits, which increased by ₦10.6 trillion to reach ₦33.1 trillion, underscoring continued confidence in the Group’s banking operations.

The Group also recorded growth in its loan portfolio, as loans and advances to customers rose by ₦1.41 trillion to ₦12.89 trillion, reflecting cautious but sustained credit expansion.

However, investment securities, valued at ₦15.25 trillion, have now surpassed the total loan book, signaling a strategic portfolio shift toward liquid, interest-bearing assets amid a more conservative risk environment.

On the liabilities side, equity attributable to shareholders strengthened to ₦3.73 trillion, supported by retained earnings and profit accumulation over the review period.

Market Reaction

On the day Access Holdings released its Q3 2025 results—Thursday, October 30, 2025—the company’s share price closed at ₦23.00, representing a 0.6% decline from the previous day’s ₦23.15.

Year to date, the stock has shed 3.56%, having opened 2025 at ₦23.85.

Within the FUGAZ tier-one banking group comprising of First Bank Holdco, UBA, GTCO, Access Holdings, and Zenith Bank, Access Bank’s decision not to declare an interim dividend stood out, particularly given its earlier commitment.

At its 3rd Annual General Meeting (AGM) held on May 15, 2025, the Group had acceded to shareholder pressure by pledging to pay an interim dividend of ₦1.00 per share, more than double the ₦0.45 paid in the previous year.

However, with no interim payout accompanying the Q3 results, investors are now turning their expectations toward the final dividend, viewing it as a possible opportunity for redemption.

A strong year-end dividend could serve as Access Holdings’ move to honour its AGM promise and reassure shareholders, particularly after a year marked by robust revenue growth, rising earnings, and heightened caution around impairments and balance sheet stability.

ADVERTISEMENT

Share this story: Tinubu's Support For Dangote

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The Probitas Report on WhatsApp for real-time updates, breaking news, and exclusive content—especially on integrity in business and financial fraud reporting. Don’t miss any headlines—connect with us on social media @probitasreport and visit www.probitasreport.com

© 2025 Probitas Report – All Rights Reserved. Reproduction or redistribution requires explicit permission.

What's Your Reaction?