Breaking: Goldman Sachs Says Decade Needed to Challenge China's Rare Earth Dominance

Goldman Sachs reports it could take 10+ years for the West to build a supply chain rivaling China's stranglehold on rare earth metals. Discover the implications for tech, defense, and the global economy.

By Joyce Idanmuze

- The West may need a decade to loosen China's iron grip on rare earths, according to Goldman Sachs.

- Beijing's control of 92% of refining and 98% of magnet production gives it powerful leverage in global trade.

- The West's push to rebuild rare-earth supply chains is lagging despite the metals' strategic importance.

China’s overwhelming control of the global rare earth industry could take Western nations up to a decade to meaningfully reduce, according to a new analysis by Goldman Sachs.

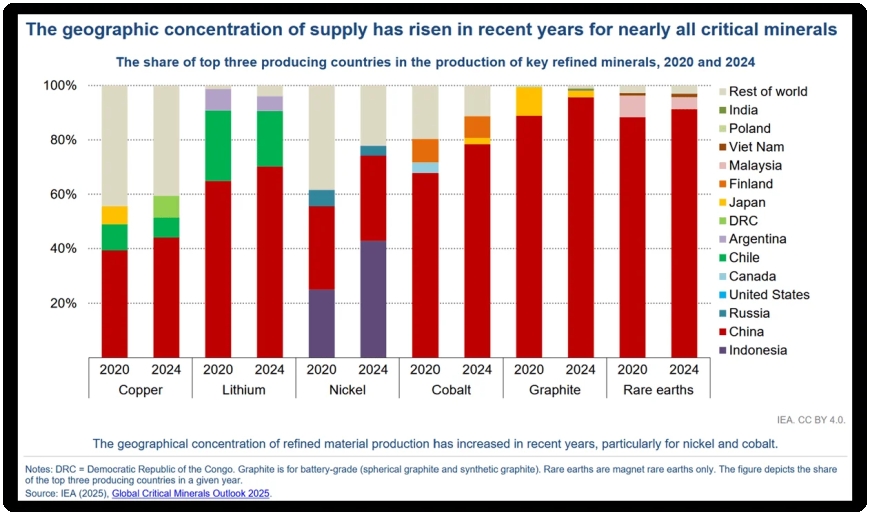

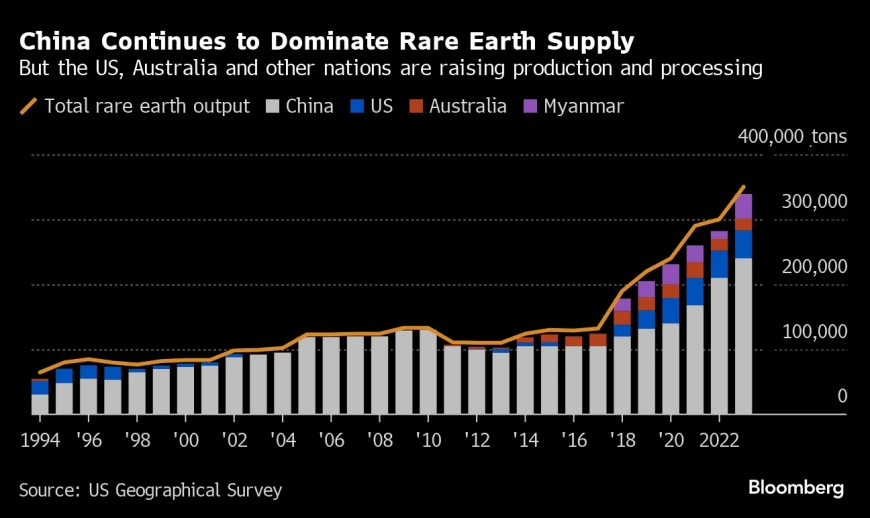

Daan Struyven, Co-Head of Global Commodities Research at Goldman Sachs, stated in a recent podcast that China currently refines about 92% of the world’s rare earth elements and produces 98% of the high-strength magnetsderived from them. This near-monopoly gives Beijing significant influence over global supply chains, trade negotiations, and the broader clean energy transition.

- OTL 2025: Africa’s Downstream Energy Leaders Unite to Drive Market Innovation and Strategic Investment

- Federal Government Unveils New Roadmap to Accelerate Solid Minerals Development in Nigeria

- Celebrating The Birthday Of The King Of Debt Recovery In Nigeria 2024

- Rape In Nigeria Law: Penalties, Legal Complexities Explained

“China’s dominance is truly extraordinary,” Struyven observed, noting that efforts by the United States, Japan, and their allies to diversify supply remain far behind China’s established infrastructure.

Rare earth elements, 17 strategically important metals essential for defense systems, electric vehicles, and advanced semiconductors that have become one of the most geopolitically sensitive resources in the modern economy. Despite their importance, the market’s overall value remains relatively small, approximately 33 times lower than copper.

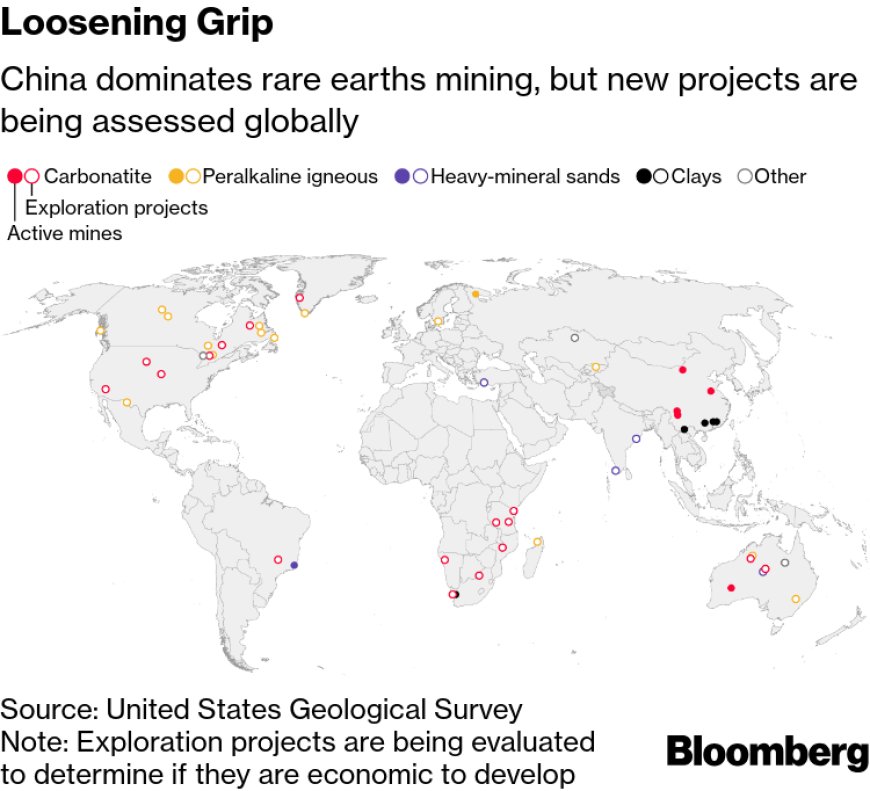

Western governments have committed billions toward rebuilding domestic rare earth mining and processing capabilities. However, Goldman Sachs warns that it will take roughly 10 years to develop new mines and five years to construct modern refineries, making short-term independence unrealistic.

The issue is also expected to surface during ongoing diplomatic engagements between Washington and Beijing, as China recently expanded export restrictions on critical minerals, tightening global supply ahead of renewed trade negotiations.

“The rare earth question will remain central to global industrial strategy for years to come,” Struyven concluded.

Gain exclusive access to in-depth energy reports and market research from Probitas Report. For details on our paid services, contact us at report@probitasreport.com or WhatsApp Only on +234 902 148 8737.

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?