The Double-Edged Sword of Bad Debts: How Nonperforming Loans Shape Nigeria’s Economic Future

Discover how nonperforming loans impact Nigeria’s economy. Explore the risks, opportunities, and lessons from bad debts shaping the financial sector and the nation’s economic future.

Introduction: The Ghost in Nigeria’s Financial Machine

Picture this: A small business owner in Lagos secures a loan to expand her bakery. For months, she repays diligently—until inflation spikes, customers vanish, and her loan slips into delinquency. Meanwhile, her bank tightens lending rules, refusing loans to other entrepreneurs. This domino effect isn’t just her story—it’s a snapshot of how nonperforming loans (NPLs) and bad debts silently strangle Nigeria’s path to a sustainable economy.

In this post, we’ll unpack how NPLs impact businesses, weigh their unintended “benefits,” and explore why emerging entrepreneurs must champion integrity to break this cycle. Let’s dive in.

Nonperforming Loans: The Silent Drain on Nigeria’s Economy

Nonperforming loans (NPLs) —loans unpaid for 90+ days—are more than just numbers on a bank’s balance sheet. They’re economic termites, gnawing at Nigeria’s financial stability. According to the [Central Bank of Nigeria (CBN)](https://www.cbn.gov.ng/Out/2021/RSD/Non-Performing%20Loans%20and%20Profitability%20of%20the.pdf) , NPLs reduce banks’ profitability by up to 30%, starving them of the interest income needed to lend further.

But why should businesses care? Let’s break it down:

1. Credit Crunch: Banks burned by defaults become risk-averse. A 2023 report by [S&P Global](https://www.spglobal.com/_assets/documents/ratings/research/101612115.pdf) found that Nigerian banks slashed lending to SMEs by 18% after NPL ratios crossed 5%.

2. Economic Stagnation: Fewer loans mean fewer businesses scaling, hiring, or innovating. It’s a vicious cycle: less credit → slower growth → more defaults.

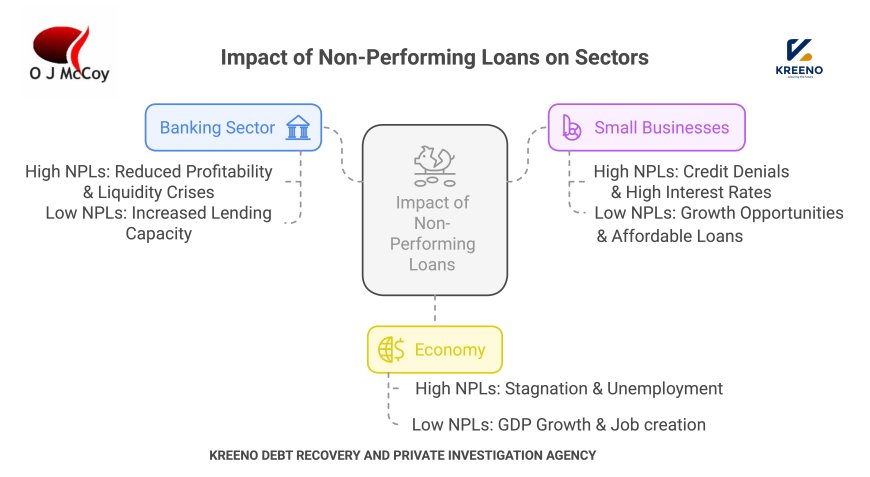

The Ripple Effect of High NPLs

This table shows how NPLs act as either anchors or engines for progress.

Bad Debts: A Double-Edged Sword

Bad debts—loans that banks ultimately write off—are often viewed as financial sinkholes, but they have unexpectedly driven significant reforms in Nigeria’s banking sector. While defaults hurt profitability, they have also spurred innovation and policy improvements.

- Proactive Risk Management: After the 2017 surge in non-performing loans (NPLs), Nigerian banks tightened their risk assessment processes. Today, fintech companies like [FairMoney](https://fairmoney.io) leverage artificial intelligence to evaluate borrowers' repayment capacity, reducing loan defaults through data-driven decision-making.

- Regulatory Reforms: Recognizing the need for balance, the Central Bank of Nigeria (CBN) introduced the [Loan-to-Deposit Ratio (LDR) policy]https://dc.cbn.gov.ng/jas/vol9/iss2/3/ in 2018 and https://dc.cbn.gov.ng/cgi/viewcontent.cgi?article=1042&context=jas , requiring banks to lend at least 65% of their deposits. This policy encourages lending while ensuring credit flows to businesses, particularly SMEs, driving economic activity without excessive risk.

Ultimately, whilst bad debts expose vulnerabilities, they also drive necessary improvements, making Nigeria’s financial ecosystem more resilient and adaptive.

But the cons outweigh the pros:

- Business Collapses: A 2022 [Dataphyte report](https://dataphyte.com/latest-reports/is-nigerias-falling-non-performing-loans-a-sign-of-tightening-credit-or-bank-stability/) linked 12% of SME closures to loan defaults.

- Eroded Trust: Banks now demand collateral worth 150% of loan values, stifling startups without assets.

Loan Defaulters: The Domino Effect on Businesses

Loan defaulters aren’t just individuals—they’re catalysts for systemic crises. Take the agriculture sector: when farmers default due to poor harvests (blamed on inflation and [currency depreciation ](https://www.spglobal.com/_assets/documents/ratings/research/101612115.pdf)), banks freeze loans for agro-processors. Suddenly, tomato paste factories can’t afford machinery, leading to layoffs and higher consumer prices.

But here’s the twist: Defaults aren’t always deliberate. Nigeria’s volatile economy—27% inflation in 2023—pushes even well-meaning entrepreneurs into delinquency. The key is distinguishing willful defaulters from circumstantial ones.

Building a Sustainable Economy: Why Integrity Matters

A sustainable economy is built on trust, reliability, and ethical financial practices. When businesses uphold their financial obligations, they not only ensure their own long-term survival but also contribute to the stability of the broader economy. Defaulting on loans, particularly without legitimate cause, has far-reaching consequences that extend beyond individual companies. It weakens investor confidence, restricts access to capital, and slows down overall economic growth. For emerging business founders, integrity in financial dealings is not just a moral obligation—it is a strategic advantage that paves the way for expansion, investment, and long-term success.

1. Access to Future Credit

Creditworthiness is a currency of its own in the business world. Banks and financial institutions maintain databases of defaulters, which are shared across networks, limiting opportunities for those with poor repayment histories. A single loan default can make it exceedingly difficult for an entrepreneur to secure financing in the future, even if their business later becomes profitable. Conversely, maintaining a strong repayment record allows businesses to access larger loans at lower interest rates. This financial credibility ensures that as a business scales, it has the financial backing necessary to expand operations, invest in innovation, and sustain growth.

2. Investor Confidence

Investors, whether venture capitalists, angel investors, or institutional financiers, prioritize companies with strong financial discipline. They analyze cash flow, debt servicing, and repayment history before committing funds. A company with a record of ethical financial management attracts high-quality investors who provide not only capital but strategic support. For example, Flutterwave, a Nigerian fintech giant, successfully secured $250 million in funding due in part to its transparent financial operations. Investors seek assurance that their funds will be used responsibly and that the business can manage financial obligations without unnecessary risk or mismanagement.

3. Collective Growth

An economy thrives when businesses and financial institutions maintain a symbiotic relationship based on trust. When businesses borrow responsibly and repay diligently, it sustains the availability of credit, enabling more entrepreneurs to access funding. However, a culture of defaulting restricts lending, leading banks to tighten their policies, increase interest rates, and ultimately stifle economic activity. Responsible borrowing ensures that financial institutions remain willing to support emerging businesses, fostering a cycle of investment, job creation, and overall economic prosperity. By honoring financial commitments, business owners contribute to a healthier, more resilient economic environment for all.

Case Study: The “Omonile” Effect

In Lagos’ real estate sector, the impact of loan defaults is strikingly evident. When developers fail to service their construction loans, projects stall, leading to unfinished buildings and financial losses for both banks and buyers. This phenomenon, commonly known as the *Omonile* effect, erodes investor confidence, discouraging future real estate investments. Conversely, firms like [Cobblestone Properties](https://cobblestone.ng) have built strong reputations through timely loan repayments, ensuring project completion and attracting repeat buyers. Their financial discipline has also fostered long-term partnerships with banks, securing better loan terms and reinforcing trust within Nigeria’s growing property market (Adetokun, 2023).

The Path Forward: Solutions for Businesses and Banks

The challenge of non-performing loans (NPLs) in Nigeria demands proactive solutions from both entrepreneurs and financial institutions. By adopting strategic measures, businesses and banks can mitigate risks and drive sustainable economic growth.

1. For Entrepreneurs:

- Transparent Bookkeeping: Many startups fail due to poor financial management. Using accounting tools like [QuickBooks](https://quickbooks.intuit.com) ensures accurate cash flow tracking, reducing financial missteps.

- Debt Counseling: Lack of financial literacy fuels defaults. NGOs like [FATE Foundation](https://fatefoundation.org) offer free financial literacy programs, helping business owners develop repayment strategies.

2. For Banks:

- Flexible Repayment Plans: Economic downturns can hinder businesses' ability to meet obligations. Implementing crisis-driven adjustments, such as COVID-19 loan moratoriums, can stabilize both businesses and the financial system.

- Sector-Specific Loans: Tailoring credit to industry-specific risks—like insurance-backed loans for agriculture—reduces default rates and encourages responsible borrowing.

Conclusion: Rewriting Nigeria’s Debt Narrative

Nigeria’s NPL crisis isn’t just a problem; it’s an opportunity for transformation. Whilst bad debts expose systemic flaws, they also inspire innovation in lending and borrowing practices. For emerging entrepreneurs, integrity isn’t merely ethical—it’s a smart business strategy. Honoring debts strengthens reputations, secures future credit, and fuels a sustainable economy where businesses, banks, and investors can thrive together. So, next time you consider skipping a loan payment, ask: Am I building a legacy—or a liability?

Let’s Connect!

Have thoughts on Nigeria’s debt landscape? Share this post and tag #NaijaBusinessMatters. Together, we can redefine growth.

What's Your Reaction?