The Architecture of Modernity: How the Credit Economy System Reforms Society

Discover how the architecture of modernity is shaped by the credit economy. This article explores how credit systems influence social structures, drive economic reform, and reshape the way individuals, businesses, and nations engage with the future.

By Blessing R. Akhigbe

Abstract: The Invisible Framework

We often mistake the economy for a natural landscape, a terrain of mountains (big corporations), rivers (cash flow), and valleys (recessions) that we must navigate. But this is an illusion. The modern economy is not a found landscape; it is a constructed environment, and its primary architectural material is credit. This article argues that credit is the invisible rebar and concrete of our social reality. It is a social technology that shapes behavior, redefines relationships, and rewires our very conception of the future. The recent upgrade of Nigeria's credit rating by Fitch to 'B' is not merely a financial adjustment. It is a structural renovation of the nation's potential, a recalibration of the trust mechanism that underpins everything from a multinational corporation's billion-dollar investment to a market trader's ability to buy inventory. This exploration moves beyond balance sheets to understand how this credit system reforms our world, for better and for worse.

1. Introduction: The Metamorphosis of Trust - From Handshakes to Algorithms

Before credit, there was trust, but it was intimate and geographically bound. A handshake between farmers, a ledger at a local shop, these were credit systems built on personal reputation and communal enforcement. The quantum leap to a modern credit economy was the securitization and institutionalization of trust.

This transformation replaced the handshake with the algorithm, the local reputation with the Fitch rating. A sovereign credit rating like Nigeria’s ‘B’ is, in essence, a quantified measure of a nation’s collective trustworthiness. It is a signal to the impersonal, global market that this society is a reliable bet. This shift is as profound as the move from barter to currency. It allows trust to be packaged, traded, and leveraged across continents and cultures, enabling the scale of modern civilization.

Nigeria's upgrade, spurred by reforms like currency liberalization and fiscal discipline, is therefore a fundamental rewrite of its social contract with the global community. It signals that the nation is transitioning from an economy perceived as high-risk and unpredictable to one that operates on principles of calculable risk and institutional predictability. This change in perception is the first and most crucial reform as it changes the very air that the economy breathes.

2. The Macro-Social Shift: Recalibrating a Nation's Temporal Horizon

A sovereign credit upgrade does more than lower interest rates; it lengthens a nation's temporal horizon. In a state of economic crisis and high risk, planning is short-term: how to manage next month's import bill, how to stabilize the currency this quarter. It is a society living in a perpetual present tense.

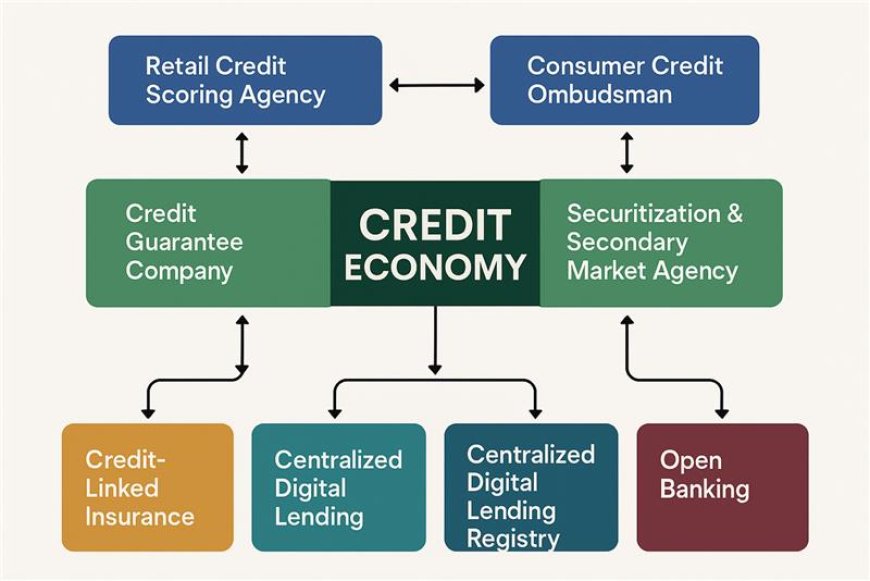

An upgrade, by contrast, is an invitation to the future tense. Key Aspects of Credit Economy Reforms:

-

Investor Confidence as a Vector for Institutional DNA: The foreign investment attracted by an upgrade is not just capital. It is a carrier of institutional practices. A tech firm from Berlin or a manufacturing giant from Seoul brings with it a culture of corporate governance, environmental and social standards, and operational efficiency. This forces a positive institutional performance upon domestic firms. The reform, therefore, is not just economic; it is a reform of corporate culture and professional ethics, elevating the entire ecosystem.

-

Lower Borrowing Costs and the Re-emergence of the Public Good: When a government’s debt servicing costs fall, fiscal space opens up. This space is not an abstract accounting term; it is the physical space for a new hospital wing, the digital space for a broadband network, the intellectual space for a better-funded university. By reducing the cost of public capital, credit reform empowers the state to re-engage in its classic role: providing long-term public goods that the market will not. This rebuilds the literal and metaphorical infrastructure of opportunity, strengthening the bond between citizen and state.

-

From Survival to Strategy: Macroeconomic stability ends the tyranny of the immediate. Families can save for a child's university education, due in 15 years, with confidence that the currency will retain its value. Businesses can invest in five-year R&D projects. This societal shift from reactive survival to proactive strategy is the bedrock of sustained development. It fosters a culture of patience and investment, which is the antithesis of the extractive, short-termism that plagues resource-dependent economies.

3. The Reconfiguration of Class and Mobility: The Algorithmic Gatekeeper

If the macro shift is about time, the individual shift is about access. The most potent social reform of the credit economy is its power to redefine the pathways to power and prosperity.

-

The Democratization of Ambition: In a pre-credit society, capital was largely inherited or accumulated slowly. This cemented class structures. The formal credit system, in its ideal form, is a meritocracy of ambition. It assesses not who you are, but what you can do. A young, brilliant Nigerian software developer with no family wealth can now present a business plan and a credit history to a bank (or a venture capital algorithm) and receive the capital to build her company. This severs the ancient link between lineage and opportunity, creating a fluid, dynamic society where class is—theoretically—based on productivity and innovation.

-

The Rise of the Data-Defined Caste System: However, this system has a dark reflection. The same algorithm that empowers the developer can exclude the market woman in a rural area who deals only in cash. Her trustworthiness is invisible to the digital system. This creates a new, rigid hierarchy: a data-defined caste system. The "banked" have a digital shadow—a credit score—that acts as a passport to modern life (mortgages, car loans, business credit). The "unbanked" are stateless in this new territory of opportunity. The risk is that credit reforms, while uplifting the urban formal sector, could further marginalize the poor and rural populations, creating a more insidious, algorithmically-enforced inequality than the old aristocracies ever could.

4. The Cultural and Behavioral Revolution: The Psychology of the Leveraged Self

The credit economy does not just reside in banks; it takes root in our minds. It fundamentally alters our psychology, our values, and our conception of the self.

-

The Virtue of Leverage Over Thrift: Traditional morality celebrated thrift—denying present consumption for future security. The credit economy, when functioning well, inverts this. It promotes strategic leverage —the "virtuous" use of debt to acquire assets that appreciate. Taking a student loan for education or a business loan for a startup is not seen as imprudent but as intelligent ambition. This represents a profound cultural shift: the ideal citizen is no longer the cautious saver but the savvy investor in their own human capital.

-

Identity as Consumption Stream: Credit untethers desire from immediate purchasing power. This fuels a culture where identity is increasingly constructed through consumption. The ability to "buy now, pay later" allows for the continuous performance of a desired lifestyle. This can be empowering (access to tools, education, experiences) but also leads to an externalization of identity, where self-worth becomes tied to the ability to consume, creating a fragile sense of self built on a foundation of debt.

-

The Individualization of Risk: This system downloads systemic risk onto the individual. In the past, families or communities acted as safety nets. Now, financial failure is increasingly framed as a personal failing - a poor credit score becomes a moral stain. This psychologizes poverty, transforming economic hardship into an individual pathology thereby eroding the sense of collective responsibility.

5. The Nigerian Case Study (NICA): Building on a New Foundation

Nigeria’s position is a live-action drama of these conceptual forces. The Fitch upgrade is the moment the architectural plans are approved; now the real building must begin.

-

The Blueprint for Transformation: The lower cost of capital provides the concrete and steel to finally address the nation's infrastructural deficit. Reliable power grids and efficient transport networks are not just economic projects; they are productivity multipliers that reduce the cost of doing business for everyone, from a multinational to a sole proprietor. This is the tangible outcome of reformed trust.

The Structural Vulnerabilities:

-

The Peril of Incompletion: The upgrades from Fitch and S&P are conditional. They are a bet on the continuation of reform. Halting this process through fiscal irresponsibility or reversing currency reforms would not just be a policy failure; it would be a collapse of a newly constructed trust framework, with devastating consequences for investment and stability.

-

The Inclusion Imperative: The benefits of this new architecture must be deliberately designed for inclusivity. Without massive investment in financial literacy, digital infrastructure, and tailored products for the informal sector, the credit economy will simply build a sleek, modern city atop a vast slum of financial exclusion. The gap between the data-rich and the data-poor will become the defining social challenge.

-

The Discipline of Investment: Cheap debt is still a claim on future production. The government must exercise extreme discipline, ensuring borrowed funds are channeled into revenue-generating assets (like infrastructure and industrial parks) rather than being consumed in recurrent expenditure. Failure to do so would be to build a beautiful facade on a foundation of sand.

6. Conclusion: The Covenant of Capital—Building a Humane Architecture

The credit economy is an irreversible force. It is the operating system of global modernity. Nigeria’s upgrade is a successful login to this system with higher privileges. The question is no longer whether to use this system, but how to design it humanely.

The goal must be to forge a sustainable credit-society covenant. This requires:

1. Architects of Regulation: Oversight must be proactive, designed to prevent the speculative bubbles and predatory practices that corrupt the system's integrity.

2. Educating the Inhabitants: Widespread financial literacy is the essential civic education for this new world. It is the difference between citizens being masters of credit or its servants.

3. An Ethos of Ethical Finance: The financial sector must see itself as a steward of societal well-being, prioritizing long-term partnership over short-term extraction.

4. A Commitment to Inclusive Design: Policy must consciously bridge the digital and financial divide, ensuring the architecture of credit supports the whole society, not just its most visible tiers.

In the end, the credit economy is a tool. Like any powerful tool, it can build palaces or prisons. Nigeria’s journey offers a lesson for all emerging economies: the upgrade of a credit rating is the easy part. The real, ongoing work is the ethical and intelligent construction of a society that is not just richer, but wiser, more stable, and more just.

About Avanoo Capital:

Avanoo Capital Limited is a Nigerian digital money-lending and financial services company that describes itself as a multifaceted decentralized lender. It is licensed Money Lending Company by the Lagos State Government’s Ministry of Home Affairs and by the Special Control Unit Against Money Laundering (SCUML) under the EFCC. The company offers a range of services including consumer lending (such as salary advances, working capital, and durable goods loans), corporate and SME financing, financial advisory, and alternative investments. In addition, Avanoo Capital provides proof of funds services for students and travelers, LPO financing, and investment advisory services to individuals and businesses.

ADVERT

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline and follow ProbitasReport on social media platforms @probitasreport

©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.

What's Your Reaction?