The Need for Independent Private Investigators to Review AMCON’s Operations Over the Last Decade

A comprehensive review of AMCON's decade-long operations, advocating for independent private investigators to assess its debt recovery strategies, financial accountability, and overall effectiveness in stabilizing Nigeria’s financial sector.

The recent arraignment of former AMCON Managing Director Ahmed Kuru and others in connection with the alleged ₦76 billion and $31.5 million fraud case involving Arik Air underscores a broader concern regarding accountability and transparency in Nigeria’s asset management and debt recovery framework. The allegations, ranging from abuse of office to economic sabotage, raise critical questions about the internal operations of AMCON, particularly its role in asset management, debt recovery, and corporate governance.

For over a decade, AMCON has wielded significant influence over distressed assets and businesses, acting as both a debt collector and an operator of companies placed under its receivership. While its mandate is to stabilize Nigeria’s financial sector, concerns have been raised about opaque practices, potential conflicts of interest, and the alleged victimization of individuals and businesses that resist undue influence or refuse to compromise ethical standards.

Given the magnitude of its influence over the financial and corporate sectors, there is a critical need for independent private investigators to conduct an in-depth review of AMCON’s activities over the last decade. This investigation should focus on the following key areas:

1. Patterns of Power Abuse

AMCON, by design, has extensive authority over distressed companies and assets. However, there is growing concern that this authority has been misused to:

- Suppress Certain Business Entities: Some businesses and individuals have raised concerns that AMCON selectively enforces its debt recovery mandates, targeting specific companies while overlooking others with similar financial issues.

- Political and Corporate Manipulation: There is speculation that AMCON has been used as a tool for corporate warfare, where certain entities are forced into distress, making their assets ripe for acquisition by powerful insiders.

- Receivership Abuse: In cases where AMCON takes over companies, reports suggest that instead of restructuring and revitalizing them, insiders allegedly siphon funds and strip the company of valuable assets.

- Altering Debt Figures: As seen in the Arik Air case, where a questionable figure of ₦71 billion was transferred to AMCON, a forensic investigation is necessary to determine if the agency has inflated debts or manipulated figures to justify asset takeovers.

A detailed private investigation could expose whether AMCON has been used as a weapon to either unfairly punish business entities or serve the interests of a few individuals at the expense of the Nigerian economy.

2. Unfair Targeting of Non-Compliant Entities

Whilst AMCON’s mission is to recover bad debts, evidence suggests that companies and individuals who refuse to comply with certain unofficial demands may face harsher treatment. This raises concerns of selective enforcement, where:

- Businesses that refuse to "cooperate" with AMCON officials or politically connected individuals are more likely to be forced into receivership.

- Certain firms receive preferential treatment and are given more flexible repayment terms or restructured debt options while others are pushed into liquidation.

- The legal system may be used to prolong financial battles against companies that resist AMCON’s influence, discouraging future investment in key industries.

A transparent investigation into AMCON’s past cases could determine whether there has been a systematic pattern of unfair targeting, particularly against firms that refuse to engage in corrupt dealings.

- How Non Payment Of Your Debt Affect Your Integrity

- Strengthening Fight Against Financial Fraud in Nigeria

- 1.3BN Fraud: Police To Arraign Obanikoro's Son On February 27

- Debt Repayment And Business Ethics: Why Debt Repayment Enhances A Thriving Economy In Nigeria

- How Religion Can Harness Nigeria's Economic Development

3. Mismanagement and Value Erosion of Seized Assets

AMCON’s duty is to salvage and restructure distressed businesses, ensuring they contribute to economic growth. However, multiple cases suggest that many of the businesses AMCON has taken over have:

- Collapsed further instead of recovering, raising concerns about mismanagement.

- Experienced severe asset depreciation, often due to the appointment of incompetent or politically connected individuals as administrators.

- Had their key assets stripped and sold at questionable valuations, benefiting a few while rendering the original business worthless.

The case of Arik Air is a prime example—once Nigeria’s leading airline, it struggled under AMCON’s receivership, with key assets allegedly transferred to another airline (NG Eagle) at the expense of Arik’s growth. Similar trends have been observed in other industries where AMCON has taken over companies.

A forensic review is needed to track the outcomes of all major assets AMCON has seized over the last decade to determine whether the agency has fulfilled its mandate of financial stabilization or merely facilitated value destruction for private gain.

4. Accountability in Asset Disposal and Financial Transactions

One of the most controversial aspects of AMCON’s operations is how seized assets are disposed of. Concerns include:

- Undervaluation of prime assets: Businesses and properties worth billions may have been sold at ridiculously low prices to individuals with insider connections.

- Opaque bidding processes: Instead of a transparent competitive process, assets may have been allocated to preferred buyers without proper due diligence.

- Failure to remit full proceeds to the Nigerian government: AMCON’s financial records should be audited to confirm whether funds from asset disposals align with declared figures.

Given that AMCON is a public institution, an independent investigation should examine all major asset sales over the last 10 years, ensuring that proper financial records exist and that transactions were conducted at fair market value.

5. The Impact of AMCON’s Operations on Nigeria’s Economic Stability

Beyond individual cases, a broader assessment of AMCON’s impact on Nigeria’s economy is necessary. While it was created to stabilize the financial system, there is evidence that its operations may have:

- Reduced investor confidence: Foreign and local investors may be hesitant to invest in Nigerian businesses due to fear of arbitrary asset seizures.

- Worsened Nigeria’s credit and banking sector: By mismanaging distressed companies, AMCON may have discouraged banks from providing loans to businesses in need of financial restructuring.

- Hindered job creation and business growth: Many companies placed under AMCON’s receivership have failed, leading to job losses and further economic stagnation.

If AMCON has, in fact, done more harm than good to Nigeria’s economy, a complete structural overhaul or even a reassessment of its mandate may be necessary.

(credit proshare)

ADVERT: Report All Forms Of Unfair Hearing, Land Scams, Dud Cheques Issuance, Non Performing Loans, and other Financial Frauds to KREENO on WhatsApp +234 802 363 9830 or info@kreenoholdings.com and operations@kreenoplus.com

6. The Illegal Dismissal of AMCON Directors Who Do Not “Play Ball”

A deeply troubling aspect of AMCON’s internal governance is the removal of officials and directors who refuse to engage in unethical or illegal activities. Reports suggest that:

- Whistleblowers within AMCON are silenced—officials who raise concerns about financial misconduct or irregular asset sales are either dismissed or sidelined.

- False Allegations are Created to Justify Dismissals—AMCON directors who resist corrupt dealings or refuse to endorse dubious asset sales may find themselves accused of misconduct and removed from office.

- Boards are Packed with Compliant Members—Instead of ensuring an independent and professional board, AMCON allegedly removes dissenting voices and replaces them with individuals willing to rubber-stamp questionable decisions.

- Unfair Hearings and Lack of Due Process—Dismissed officials often face biased hearings where the outcome is pre-determined. There is little room for a fair appeal, and these cases rarely receive public attention.

The illegal dismissal of AMCON directors raises serious concerns about transparency and accountability within the organization. A private investigation should uncover:

- How many AMCON officials have been dismissed in the last decade.

- Whether their removals were linked to their refusal to cooperate with unethical practices.

- Whether any legal proceedings were manipulated to justify their exits.

If AMCON has been systematically purging non-compliant officials, it further reinforces the argument that the organization is operating as a closed circle of power rather than a legitimate debt recovery agency.

Conclusion: The Need for a Comprehensive, Unbiased Investigation

AMCON plays a crucial role in Nigeria’s financial ecosystem, but allegations of corruption, abuse of power, and mismanagement cannot be ignored. A high-level independent private investigation is necessary to:

- Provide factual evidence on whether AMCON has acted in the public’s interest.

- Hold individuals accountable for any misconduct or illegal activities.

- Ensure future asset management and debt recovery practices align with global best practices.

The AMCON case should not just be about prosecuting a few individuals—it should serve as an opportunity to clean up Nigeria’s debt recovery system and restore investors confidence in the economy. A transparent Corporate Governance, sustainable business practice, and forensic review will not only expose past wrongdoings but also set a precedent for a more sustainable and accountable financial sector moving forward.

Independent private investigators, free from political influence and institutional bias, would be instrumental in uncovering systemic irregularities and ensuring that AMCON’s operations align with global best practices in asset management and financial recovery.

The current legal proceedings against former AMCON executives, if handled properly, could set a precedent for accountability. However, without independent scrutiny, there remains a risk that entrenched power structures within Nigeria’s financial regulatory system will continue unchecked, leading to further abuse and economic instability.

A thorough investigation by seasoned private investigators with expertise in Corporate Governance and Sustainable business practices, would not only restore confidence in the financial system but also ensure that Nigeria’s debt recovery mechanisms serve their intended purpose—reviving distressed businesses, fostering economic stability, and ensuring inclusive growth rather than facilitating elite-driven asset stripping and financial manipulation.

Recommendation to the Federal Government on Private Sector Involvement in Debt Recovery

To enhance transparency and efficiency in debt recovery, the Federal Government should actively involve private sector-driven debt recovery agencies with proven expertise in handling non-performing loans. Engaging independent professionals will minimize bureaucratic inefficiencies, curb corruption, and ensure fair asset disposal. Additionally, Coalition Against Financial Fraud Initiative In Africa (CAFFIA) Global and the Institute of Debt Recovery Practitioners of Nigeria (IDRPN) should be formally integrated into government operations to provide independent expert opinions on debt recovery policies and cases. This collaboration will introduce best practices, uphold ethical standards, and promote a structured, accountable debt resolution framework. A multi-stakeholder approach will restore investors confidence, boost economic stability, and enhance government revenue through transparent recovery processes.

The Era of Systemically Important Companies (SIMCs) and AMCON’s Future

Regulatory attention is expanding beyond systemically important financial institutions (SIFIs) like banks to include systemically important non-bank companies (SIMCs) such as Dangote Group, MTN, Airtel, and Seplat. These companies wield significant influence over Nigeria’s economy and may now require heightened regulatory oversight similar to that of banks classified as "too big to fail." To safeguard financial stability, regulators may need to assess the credit risk profil* of the top 20% of companies responsible for 80% of banks' loan exposure. Loan concentration measures and stress testing will be key oversight tools, particularly for companies listed on the Nigerian Exchange (NGX) or other official markets.

The Securities and Exchange Commission (SEC) should play a central role in supervising SIMCs, but it requires a technical upgrade to meet the demands of modern market regulation. SEC’s independence from the Central Bank of Nigeria (CBN) must be strengthened to ensure more effective governance and transparency.

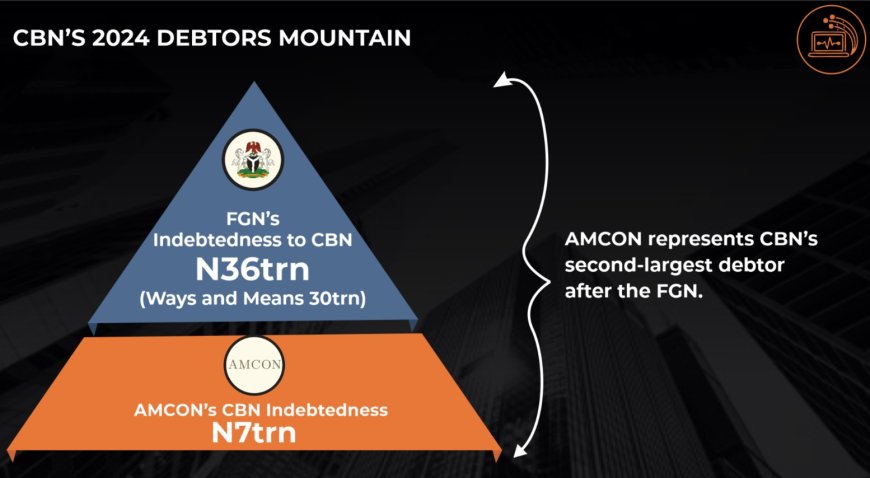

Regarding AMCON, its creation in 2010 by then-CBN Governor Sanusi Lamido Sanusi was seen as a masterstroke in financial stabilization. It successfully managed distressed banks and restored confidence in the financial system through expert leadership and strategic interventions. However, over a decade later, there is a divided opinion on whether AMCON should continue to exist. Some argue that it was designed as a temporary intervention with a planned exit strategy, whilst others believe Nigeria’s fragile economy still requires AMCON to prevent future financial crises.

Critics of AMCON’s prolonged existence note that it was never meant to be permanent but rather a market-driven resolution tool with a sunset period of about **ten years.** They argue that as banks grow stronger, AMCON should be phased out to avoid distorting the financial ecosystem. On the other hand, proponents of AMCON’s continued operation emphasize that economic instability persists, and removing AMCON could expose Nigeria to another banking crisis. They liken it to an "umbrella" that should remain open in case of future financial turbulence. Ultimately, Nigeria must decide whether AMCON remains a necessary safeguard or whether the time has come to transition to a new financial stability framework. (Proshare)

My opinion is that the debt recovery industry in Nigeria should be liberalized by allowing private sector-driven debt recovery agencies to compete alongside AMCON under a level playing field. These private agencies should be granted similar privileges as AMCON, ensuring that both the public and private sectors actively participate in the debt recovery space. This will enhance efficiency, promote transparency, and ensure a more effective resolution of non-performing loans (NPLs).

Financial institutions, credit organizations, and other lenders should be mandated to formally engage private debt recovery agencies that meet the regulatory standards set by the Central Bank of Nigeria (CBN), the Ministry of Finance, or the Securities and Exchange Commission (SEC). This would encourage the development of Debt Recovery Agencies and **Debt Factoring Finance Companies as an integral part of Nigeria’s financial ecosystem.

By expanding the debt recovery industry, Nigeria will create a more competitive and sustainable approach to loan resolution. The presence of independent, regulated recovery agencies will not only reduce the burden on AMCON, or CBN but also accelerate debt resolution, minimize loan defaults, and increase investor confidence in the financial sector.

Author:

Dr. Ohio O. Ojeagbase, FICA, FIDR

Chief Private Investigator/CEO

Kreeno Debt Recovery and Private Investigation Agency

A Subsidiary of KREENO Holdings LLC, USA

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

........................................................................................................................................................................................................................................................................

ADVERT: FOR ALL YOUR JUBEP, PRE-DEGREE, UNDERGRADUATES, MASTERS, DOCTORAL PROGRAMS, JOIN ME AT ABUAD BUSINESS SCHOOL

Contact Information:

ABUAD Business School, Ibadan Campus: 13, Osuntokun Avenue, Bodija, Ibadan

Mrs. Ezekpo Funmilola (Assistant Registrar, Exams and Records)

WhatsApp Only: 0902 505 0410 and Phone: 0806 379 5399

What's Your Reaction?