Why Aggressive Loans and Short-Term Targets Harm Banks and Borrowers

This article explores how aggressive lending practices and short-term profit targets damage banks and borrowers alike, leading to higher risks, loan defaults, and long-term instability in Nigeria’s financial sector.

Introduction

Nigeria’s banking sector has weathered storms of change such as oil shocks, inflation, regulatory reforms, yet a lingering crisis remains: rising loan defaults. It’s not just only bad luck or weak borrowers with lack of integrity-in-business culture at play. Often, it’s the banks themselves, driven by aggressive market push strategies, chasing short-term income and selling risky assets, who create mismatched financing: funding long-term assets like aircraft or vessels with short-term deposits. This misalignment hides in plain sight, sowing instability for banks and hardship for borrowers alike.

In this article, we humanize the stats. We explore what really drives defaults; not only blame the borrowers, but shine the light on the banking system’s pressures. And we frame it with CBN statistics, NDIC insights, IMF/World Bank data (as recent as December 2024 and August 2025).

Integrate recent CBN statistics

The CBN Credit Conditions Survey for Q2 2025 reveals that lenders reported higher default rates across secured, unsecured, and corporate lending categories, with households experiencing increased defaults on both secured loans such as mortgages and unsecured loans like personal loans and credit cards, while corporate defaults rose across small businesses, medium-sized PNFCs, large PNFCs, and Other Financial Corporations (OFCs). This rise in defaults occurred even though credit supply and loan approvals increased during the quarter, indicating that although more loans were disbursed, repayment performance weakened due to economic pressures. Lenders further noted that spreads on household loans widened, meaning borrowers faced higher costs of credit relative to the Monetary Policy Rate (MPR), while corporate loan spreads narrowed but still failed to prevent a deterioration in asset quality. Overall, the survey paints a picture of rising credit risk in Nigeria’s banking sector in mid-2025, with defaults increasing across both household and business segments despite the expansion of lending activities.

This suggests the defaults aren’t due to careless underwriting alone—they reflect structural vulnerabilities. When banks chase volume and revenue, pushing products that don’t align with clients’ funding needs, risk piles up. Funding, say, an airline’s long-life asset with call-deposit inflows exposes both lender and borrower to maturity mismatch.

Nigerian Deposit Insurance Corporation (NDIC) reports

The Nigeria Deposit Insurance Corporation (NDIC) was established to protect depositors and ensure stability in the financial system. It does this through effective supervision, financial and technical support to insured institutions, prompt payment of guaranteed sums, and orderly resolution of failed banks. Once the CBN revokes a bank’s license, NDIC steps in as the liquidator, closing the bank and reimbursing depositors. As of 2024, NDIC had closed 651 failed banks, including 50 DMBs, 55 PMBs, and 546 MFBs. It has improved insurance coverage, raised limits (e.g., DMBs from ₦500,000 to ₦5 million), and introduced innovations like BVN-linked payments to ensure speed—paying some Heritage Bank customers within four days. NDIC also works with the judiciary to expedite prosecutions, resolve long-standing cases, and recover debts. Despite challenges like loan recovery, hostile environments, and resource constraints, NDIC remains a beacon of hope, safeguarding depositors’ interests and public trust in Nigeria’s banking system.

While NDIC hasn't published a late-2024 or mid-2025 loan default report publicly searchable right now, its role as liquidator looms large in recent watchdog actions. For instance, the CBN revoked Heritage Bank’s operating license in June 2024, citing compliance failures, with NDIC stepping in to manage resolution Wikipedia. That move signals how serious systemic risk from mismatched portfolios can become.

NDIC’s work in winding up distressed banks highlights the consequences when aggressive market push is driven by deposit targets and income-yield quests that collides with asset-liability fragility.

IMF/World Bank data

The IMF, through technical assistance to the CBN since 2009, has helped strengthen supervisory capacity, yet challenges persist, including weak validation of banks’ interbank and external asset/liability data iati.fcdo.gov.ukSEC.

Globally, asset-liability mismatch remains a potent risk: it’s when a bank’s assets and liabilities don’t align in currency, tenor, or interest rate terms Wikipedia. In Nigeria, the mix of high inflation, currency volatility, and short-dated deposit funding compounds this risk—making mismatches more dangerous.

Key Insights: What's fueling the crisis?

1. Market Push Over Customer Fit

Banks, motivated by fee income and volume, often push products without tailoring tenor to need. Long-term ventures like aviation require patient funding but depositors may only want short-dated products, forcing banks to stretch their liquidity.

2. Asset-Liability Gaps Breeding Instability

When long-term assets are financed with short-term money, any shock in deposit withdrawals or rate hikes can force fire sales or borrowing at steep costs. Even strong banks like FCMB show signs of this tension: by end-2024, their liquidity ratio climbed to 40.6% (up from 36.6% in 2023) as they attempted to buffer mismatches doclib.ngxgroup.com.

3. Short-Term Income Targets & Risk Sell

Zenith Bank’s 2024 reports reflect this squeeze: stage-2 (watch-list) loans rose to 37% of gross loans by September 2024, partly as currency devaluation fueled defaults in foreign-currency obligations. Their cost of risk hit 7.3% which is far above the industry average (~3%) Zenith Bank Plc.

4. Economic Headwinds as Amplifiers

Inflation and Naira weakness not just internal missteps but stress borrowing. Nigeria's current headline inflation eased to 21.88% in July 2025, down from 22.22% in June, marking the fourth straight month of decline. Food inflation that is a critical contributor, rose to 22.74% year-on-year in July, slightly higher than June’s 21.97%.

Table: Snapshot of Key Metrics in 2024

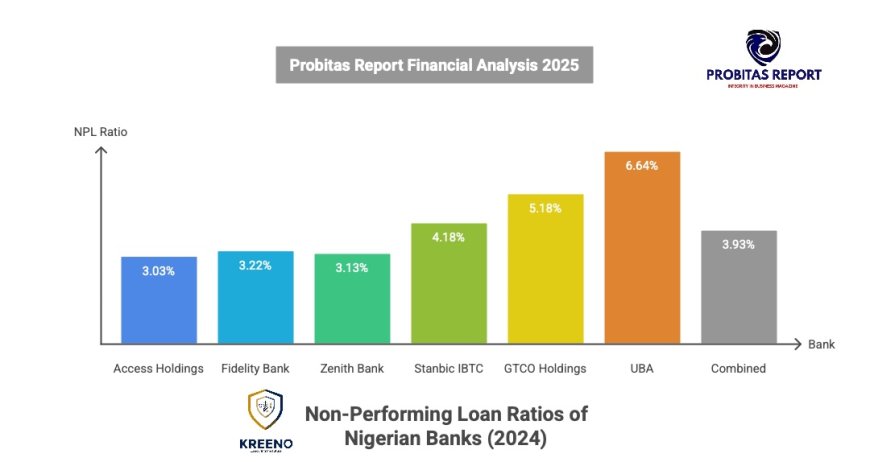

Overall NPL Ratio for Nigerian Banks in 2024

· In December 2024, the Central Bank of Nigeria (CBN) reported that the banking sector's NPL ratio stood at 4.50%, down from 4.58% in September 2024, and remained below the regulatory prudential threshold of 5.0%.

· Earlier in May 2024, the industry-level NPL ratio was 3.81%, down from 4.79% in April showing notable improvement mid-year.

· Complementing these figures, a broader data point indicates that by 2024 the NPL ratio had roughly fallen to 3.9%, significantly lower than earlier years.

Interpretation

·Overall, Nigeria’s banking sector maintained a moderate NPL ratio in 2024, hovering between 3.8% and 4.5%, safely within regulatory norms but slightly elevated towards year end.

· At the bank-level, most big players like Access, Fidelity, Zenith, and Stanbic IBTC kept their NPLs between 3% and 4% solid performance. But GTCO breached the 5% regulatory limit, and UBA’s credit-impaired (stage-3) loans are concerningly high at 6.64%, indicating wear and tear in credit quality for these banks.

· Together, these insights suggest that while the sector largely remains stable, specific banks are showing distress, which can ripple across the broader system if not addressed.

Consequences for Borrowers and Banks

1. Borrowers get mis-matched loans: Imagine a vessel owner financing a 15-year asset with a 6-month loan. Every renewal becomes a gamble-rate flare-ups can sink viability.

2. Banks strain reserves and liquidity: As stage-2 loans balloon and provisions escalate, capital drains. Zenith's high provisioning tells that story, banks bleed whilst chasing income, then scramble when defaults spike.

3. Systemic fragility mounts: Heritage Bank’s collapse reminds us: pockets of misalignment can infect confidence, trigger license revokes, and plunge institutions toward NDIC resolution.

4. Macro-stress compounds micro fragility: Loose matching in inflationary, FX-volatile Nigeria is reckless. Borrowers default; banks scramble; the cycle deepens.

Conclusion: Healing the Mismatch

We’ve mapped how Nigeria’s loan default crisis isn’t just only about the weak borrowers lack of iintegrity in business culture, or poor governance, it’s rooted in how banks push sales and chase income, building mismatched portfolios that crack under macro pressure.

Next steps, rooted in tradition and proven safeguards:

· Enforce longer-tenor funding windows for long-lived assets—match asset to liability.

· Strengthen liquidity buffers and stress tests, guided by CBN and IMF-backed supervision

· Incentivize client-centric lending, not just volume targets—design products that align with projects’ lifecycles.

· Use NDIC and CBN data to flag mismatch risks early—monitor stage-2 and provisioning ratios, asset-liability gaps.

Let’s hold to tradition—not as rigidity, but as wisdom: banks fund wisely, borrowers invest with matching support, and stability and prosperity can grow hand-in-hand.

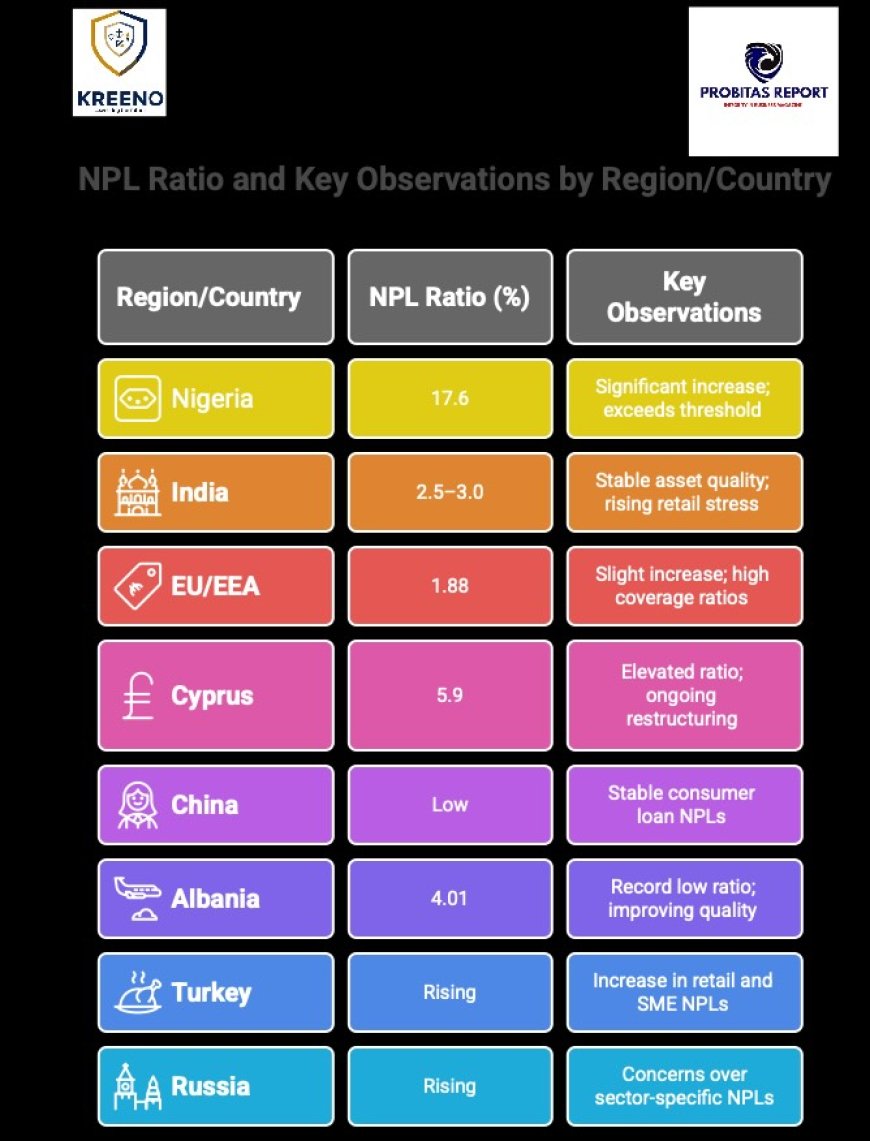

The Non-Performing Loan (NPL) data for Nigeria's banking sector as of June 2025, providing a comparative analysis to better understand the current landscape.

NPL Overview – Nigeria Banking Sector (June 2025)

· NPL Ratio: The Gross Non-Performing Loans (NPL) ratio in Nigeria's banking sector rose to 17.6% in June 2025, indicating a significant increase in asset quality concerns.

· Prudential Threshold: This figure substantially exceeds the Central Bank of Nigeria's (CBN) prudential threshold of 5%, highlighting a pressing need for strategic interventions. (Businessday NG)

· Sectoral Impacts: The elevated NPL ratio is attributed to various factors, including economic challenges and sector-specific stresses.

Comparative Analysis – NPL Ratios in Context

�� Strategic Implications & Recommendations

· Regulatory Oversight: The substantial deviation from the prudential threshold underscores the necessity for enhanced regulatory scrutiny and timely interventions.

· Asset Quality Management: Banks should prioritize strengthening their asset quality management frameworks to mitigate further deterioration.

· Sectoral Support: Targeted support for sectors facing specific challenges can aid in reducing sector-specific NPLs.

· Capital Adequacy: Ensuring robust capital buffers is crucial to absorb potential shocks arising from elevated NPLs.

By

Dr. Muhammed Bubuce

Director of Operations / Transorganized Crime

KREENO DEBT RECOVERY & PRIVATE INVESTIGATION AGENCY

KREENO CONSORTIUM

Kreeno Place: Plot 1, Rufus Ojeagbase Street, WAEC Estate, Arogun Junction,

Mowe-Ofada Rd, Mowe, Ogun State, Nigeria

Tel: +234 803 459 3785 and WhatsApp Only: +234 902 128 8737

Email: info@kreenoholdings.com and info@kreenoplus.com

Web: www.kreenoholdings.com /// www.kreenoplus.com

What's Your Reaction?