How Non-Payment of Debts Undermines Integrity and Threatens Business Ecosystems

Discover how non-payment of debts erodes integrity, damages business trust, and destabilizes economic ecosystems. Learn why financial accountability is crucial for sustainable growth.

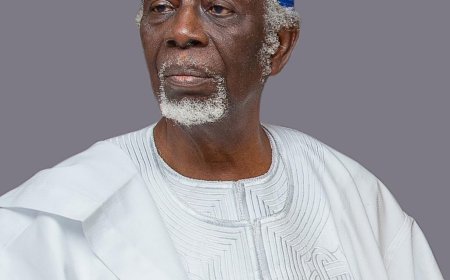

By Dr Ohio O. Ojeagbase FICA, FIDR (a.k.a Dr Kreeno) Email: drkreeno@gmail.com

In an era where trust is as valuable as capital, integrity-in-business remains the cornerstone of enduring business success. Whilst profitability and innovation dominate headlines, ethical practices—particularly in honoring financial commitments—are the silent engines driving long-term credibility in the both workplaces and martketplaces of the world. The failure to repay debts, often dismissed as a mere financial misstep, is increasingly recognized as a glaring signal of ethical decay even in the religious cycles. This breach not only erodes trust but destabilizes entire networks of suppliers, employees, and investors.

This short investigation explores the ethical implications of debt defaults, their cascading consequences, and actionable strategies for businesses and professionals across the divide to uphold their financial vows and not to be filled with excuses.

Debt Repayment: A Litmus Test of Ethical Leadership in Religious and Business Spheres

Integrity in business hinges on accountability, transparency, and respect for loan agreements. When a company secures a loan or procures goods on credit, it enters a covenant of trust. Defaulting on such financial obligations fractures this bond, exposing deeper systemic flaws and the church world is not spared of these infractions that have damaged healthy friendship to become enemies due to lack of integrity in business by those that should be leading as role models are the ones defaulting in loan repayment.

“Non-payment of debts isn’t just a line item on a balance sheet—it’s a betrayal of spirituality and stakeholders trust,” says Dr. Ohio O. Ojeagbase , a corporate ethics scholar cited in the Probitas Report.

Chronic defaults reveal:

- Unreliability: Suppliers and lenders grow wary, often severing ties with loan defaulters.

- Financial Mismanagement: Poor cash flow planning or reckless spending on debtors’ part.

- Ethical Erosion: Prioritizing short-term gains over long-term relationships by loan defaulters and many that are myopic will not reason this way instead they would rather explain it off or rationalise their actions and inactions.

The Domino Effect of Defaults

The fallout from unpaid debts extends far beyond creditors:

1. Supplier Collapse: Small vendors, reliant on timely payments, may furlough workers or shutter operations. A 2023 survey by Business Money revealed that 65% of suppliers tightened terms after payment delays, stifling industry liquidity and leading to total shut down.

2. Employee Distress: Companies diverting funds from debt obligations often delay payroll, cratering morale (rapid decline in motivation within a group). The Insider Threat Mitigation Guide links financial instability to increased internal fraud risks.

3. Credit Crunch: Lenders, burned by defaults, impose stricter terms. Post-2018 recession data shows a 30% drop in loan approvals for sectors and individuals with high default rates.

4. Market Distrust: Systemic defaults deter investment. The UN’s Our Common Future warns that eroded trust hampers sustainable development goals.

“Each default is a pebble tossed into the economic pond—the ripples reach shores we never anticipate,” notes economist Raj Patel.

Debunking the Myths of Non-Payment Of Debts

Debtors often rationalize defaults with flawed logic:

- “Business is slow”: Ethical firms build reserves during boom cycles. The manufacturing case study highlights how contingency funds bridged a 2018 recession.

- “Creditors can wait”: This ignores smaller creditors’ fragility. A 2024 House Oversight Report found 62% of small suppliers operate on <30-day cash buffers.

- “Terms were unfair”: Legal frameworks exist to contest coercion, yet most defaults stem from poor planning, not exploitation.

Transparency is the cornerstone of ethical business practices, ensuring trust and long-term credibility. Proactively renegotiating debts, as evidenced by 58% of successfully resolved cases, helps preserve both professional relationships and corporate reputations. On the other hand, those who attempt to outsmart creditors through avoidance or deceit will inevitably face the consequences of their actions. No matter how long it takes, creditors will persist in recovering their rightful funds, and the damage to the debtor’s reputation may become irreversible.

- The Need For Private Investigators To Review AMCON'S Operations Over The Last Decade

- How Non Payment Of Your Debt Affect Your Integrity

- Strengthening Fight Against Financial Fraud in Nigeria

- Understanding The Dangers of Financial Fraud And How To Stay Clean

- Strengthening Public Trust In Law Enforcement Agencies in Nigeria

Building a Culture of Financial Integrity

To avoid ethical pitfalls, businesses must adopt robust practices:

1. Prudent Borrowing: Prudent borrowing ensures financial stability by aligning loan obligations with a company’s realistic repayment capacity. Leveraging AI-driven cash flow forecasting tools helps businesses anticipate revenue fluctuations and prevent overextension. By adopting this strategic approach, companies can secure necessary funding while maintaining a responsible debt structure that supports long-term growth.

2. Early Communication: Early communication with creditors is crucial for maintaining trust and financial stability in times of difficulty. Studies from Payfor Global reveal that 80% of creditors are willing to grant extensions when notified promptly, reducing the risk of strained relationships or legal action. By addressing potential challenges early, businesses can negotiate better terms, demonstrate integrity, and sustain long-term partnerships.

3. Tech-Driven Accountability: Tech-driven accountability is essential for maintaining financial integrity and ensuring timely debt repayments. Implementing platforms like QuickBooks or SAP enables real-time tracking of financial obligations, minimizing the risk of oversight and missed payments. By leveraging automation and data analytics, businesses can enhance transparency, improve cash flow management, and build stronger trust with creditors and stakeholders.

4. Ethical Prioritization: Ethical prioritization in financial management demands that businesses cut executive bonuses and luxury expenses before failing to meet their debt obligations. In 2023, a major tech startup suffered a 40% drop in valuation after it was exposed for extravagant executive spending while defaulting on creditor payments. Diverting company funds for personal aggrandizement not only erodes trust but also triggers financial instability, legal consequences, and long-term reputational damage.

5. Dispose Your Asset Or Get 3rd party Collateral: If you are unable to meet your debt obligations, consider liquidating some of your assets to generate the necessary funds for repayment. Selling off non-essential properties, vehicles, or investments can help you settle outstanding debts and restore your financial credibility. Alternatively, securing a third-party guarantor or collateral provides lenders with assurance, increasing the likelihood of renegotiating terms or obtaining additional time to repay.

Dr. Ohio O. Ojeagbase, FICA, FIDR, Chief Private Investigator at KREENO Debt Recovery and Private Investigation Agency and CP Ayotunde Omodeinde, the Commissioner of Police of the Nigeria Police Special Fraud Unit (PSFU)

Integrity in Business —The Currency of Trust

When a business consistently demonstrates integrity in managing debts, it builds a strong reputation for reliability and trustworthiness among creditors. This credibility fosters better relationships, increasing the likelihood of flexible repayment terms and financial support during tough times. “As businesses successfully repay loans and maintain ethical financial practices with theior creditors, their integrity-in-business score rises, unlocking greater access to funding opportunities from financiers eager to support responsible enterprises.” Dr. Ohio O. Ojeagbase FICA, FIDR

“Your word is your bond. Protect it fiercely. And if you as a clergy cannot keep you word no matter the challenges in the marketplace and manage your creditors professionally as a debtor then you have no business being in business otherwise you face the music.”

... Dr Kreeno

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?