Access Holdings Ensures Governance Compliance as Roosevelt Ogbonna Steps Down from Board, Remains Access Bank MD/CEO

Access Holdings Plc announces compliance with Nigeria’s governance code as Roosevelt Ogbonna resigns from the HoldCo Board whilst continuing as Managing Director/CEO of Access Bank.

Access Holdings Director Roosevelt Ogbonna Resigns From Board, Remains Access Bank MD

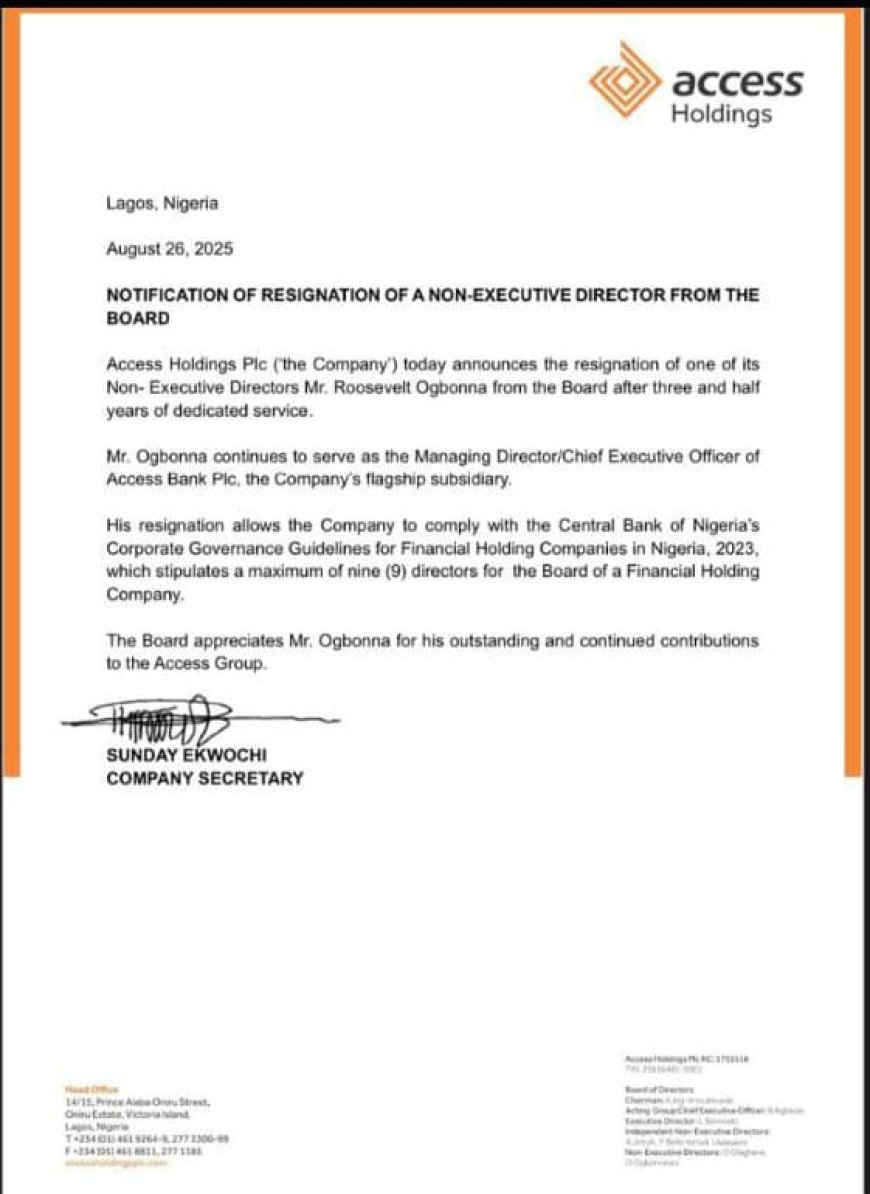

Access Holdings Plc (‘the Company’) today announces the resignation of one of its Non- Executive Directors Mr. Roosevelt Ogbonna from the Board after three and half years of dedicated service.

Mr. Ogbonna continues to serve as the Managing Director/Chief Executive Officer of Access Bank Plc, the Company’s flagship subsidiary.

His resignation allows the Company to comply with the Central Bank of Nigeria’s Corporate Governance Guidelines for Financial Holding Companies in Nigeria, 2023, which stipulates a maximum of nine (9) directors for the Board of a Financial Holding Company.

The Board appreciates Mr. Ogbonna for his outstanding and continued contributions to the Access Group.

SUNDAY EKWOCHI

COMPANY SECRETARY

About Mr. Roosevelt Ogbonna

Roosevelt Ogbonna assumed office as the Managing Director and Chief Executive Officer of Access Bank in May 2022. Before his current role, he served as the Bank’s Deputy Managing Director from 2017 and had earlier been appointed as an Executive Director in 2013. His career in banking spans more than 20 years, beginning in 2002 when he joined Access Bank after a successful stint at Guaranty Trust Bank.

Mr. Ogbonna combines strong academic achievements with extensive professional expertise. He is a Fellow of both the Institute of Chartered Accountants of Nigeria (FCA) and the Chartered Institute of Bankers of Nigeria (FCIB). He is also a CFA charterholder and an alumnus of several globally recognized institutions, including Harvard Kennedy School of Government’s Senior Executive Fellow programme and Harvard Business School.

His academic portfolio is diverse and distinguished: a Master’s in Business Administration from IMD Business School, Switzerland; a Master of Laws (LL.M) in International Corporate and Commercial Law from King’s College, London; an Executive MBA from the Cheung Kong Graduate School of Business; and a Bachelor’s degree in Banking and Finance from the University of Nigeria, Nsukka. In 2015, he was named among the Institute of International Finance (IIF) Future Global Leaders, further underscoring his international recognition.

Beyond academia, Mr. Ogbonna has completed various executive management programmes across top-tier global institutions, covering multiple aspects of banking, leadership, and corporate governance.

He brings considerable boardroom experience, serving as a Non-Executive Director on Access Bank’s subsidiaries in the United Kingdom and South Africa. In addition, he represents the Bank on the boards of African Finance Corporation and the Central Securities Clearing System (CSCS) Plc.

Kindly share this story:

Contact: report@probitasreport.com

Stay informed and ahead of the curve! Follow The ProbitasReport Online News Report on WhatsApp for real-time updates, breaking news, and exclusive content especially when it comes to integrity in business and financial fraud reporting. Don't miss any headline – and follow ProbitasReport on social media platforms @probitasreport

[©2025 ProbitasReport - All Rights Reserved. Reproduction or redistribution requires explicit permission.]

What's Your Reaction?